Commodity prices have been growing for seven weeks in a row. On Monday, 14 August, the price of a Brent barrel is hovering near 85.78 USD.

This local correction is not surprising – occasionally, investors return to minor sales. The fundamental background remains favourable for buyers who find a foothold in the supply shortage in the second half of 2023.

Meanwhile, global crude oil demand calculated by the IEA set a record of 103 million barrels daily in June. In August, it might reach a new peak.

Technical analysis of Brent:

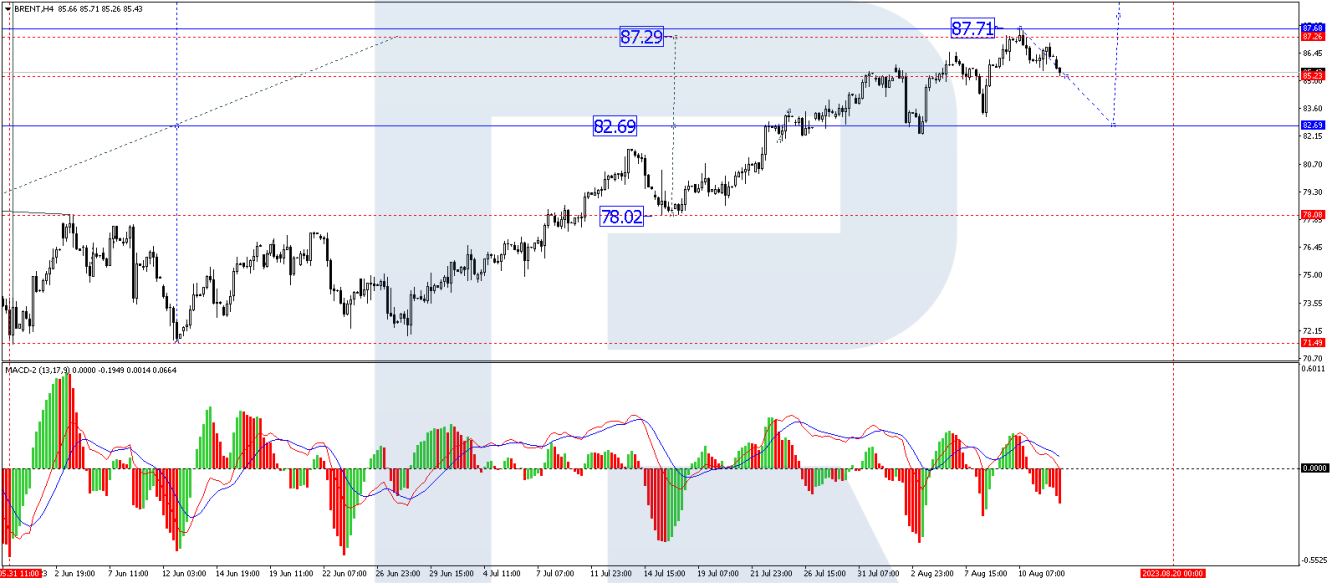

On the H4 Brent chart, the price has reached a local target of an ascending wave at 87.71. At the moment, a consolidation range is forming under this level. Breaking it downwards, the price could perform a correction link to 87.20. Next, a new wave of growth to 93.80 might begin, from where the trend could continue to 103.93. Technically, this scenario is confirmed by the MACD, whose signal line has left the histogram area and aims strictly downwards.

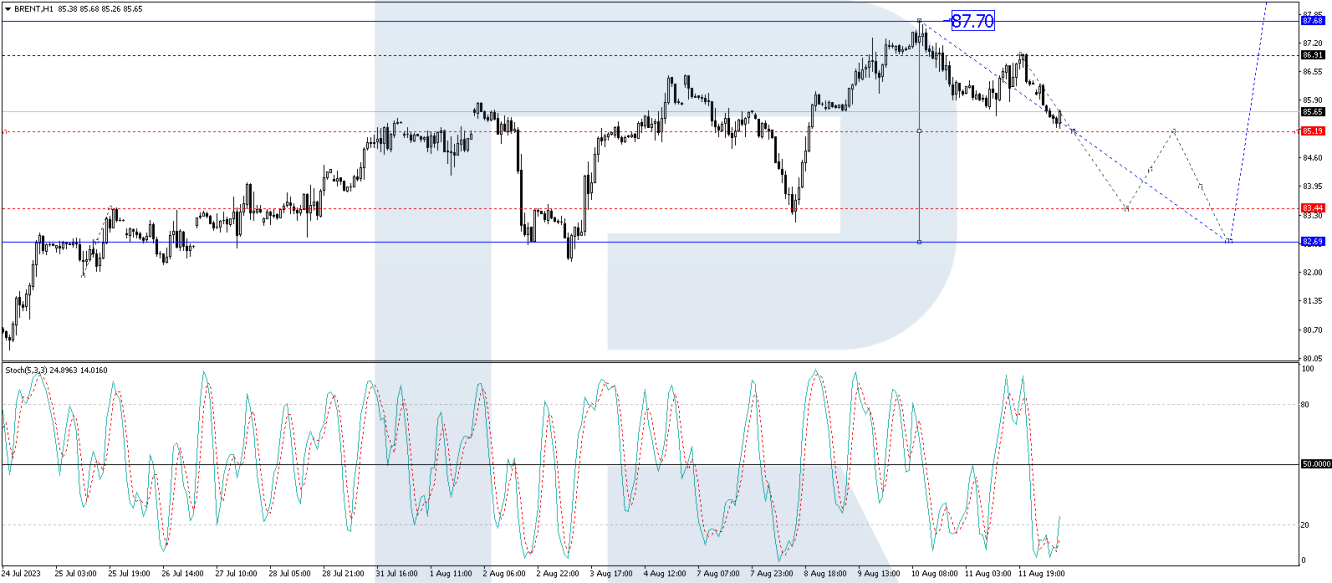

On the H1 Brent chart, a structure of a declining impulse to 85.55 and its correction to 86.90 formed. Today, the market has completed a new link of decline to 85.30. At the moment, a consolidation range is being formed above this level. With an escape from the range upwards, a growth link to 86.00 is not excluded, followed by a decline to 83.44, from where the correction might continue to 82.70. Technically, this scenario is confirmed by the Stochastic oscillator: its signal line is under 20, preparing for further growth to 50.

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Crude Oil Rallies for 7-Weeks in a Row: What's Next?

Published 08/14/2023, 09:40 AM

Updated 02/15/2024, 03:13 AM

Crude Oil Rallies for 7-Weeks in a Row: What's Next?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.