Investing.com’s stocks of the week

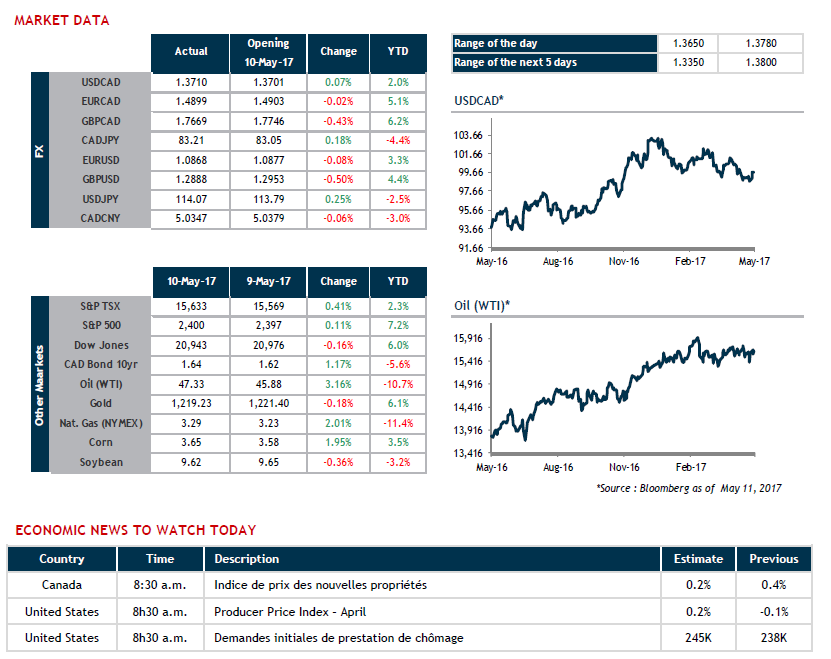

Yesterday was an excellent day for WTI crude oil prices, which continue to rise this morning further to the release of data showing a more substantial decline than anticipated in petroleum inventories in the United States. However, the impact has been muted on the Canadian dollar, which remains close to the low hit on May 5.

We will also be monitoring the situation with mortgage lender Home Capital Group, which is experiencing major difficulties. Deposits in its high-interest accounts have plummeted more than 90% in recent weeks and the situation is leading investors to fear that Canada could see a remake of the real estate meltdown that hit the United States close to a decade ago. It should also be noted that late in the day yesterday, credit rating agency Moody’s downgraded the Big Six Canadian banks. Canadian consumers’ soaring debt levels combined with the country’s overheated housing market were the main reasons stated by Moody’s.

This morning, we’ll be keeping an eye on the Canadian New Housing Price Index for March and Initial Jobless Claims in the United States.