- Physical market indicators of the oil market such as term structure and crude inventories are supportive of this move higher in oil prices, with the market being in a better position to start of 2024 than 2023.

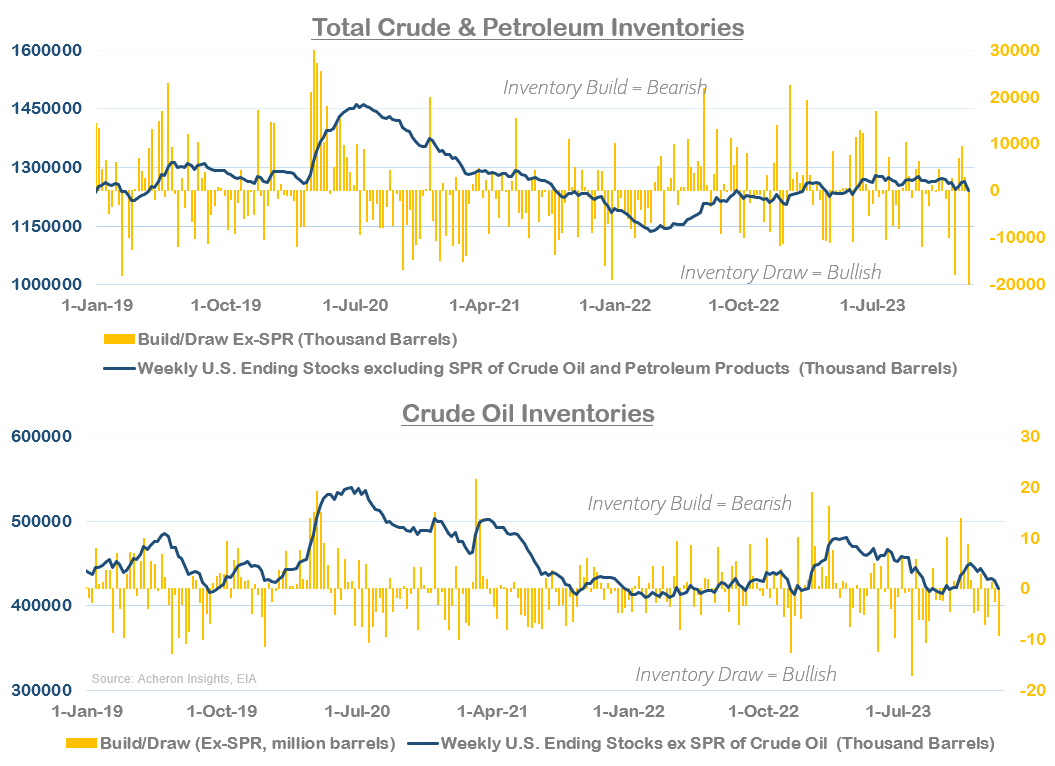

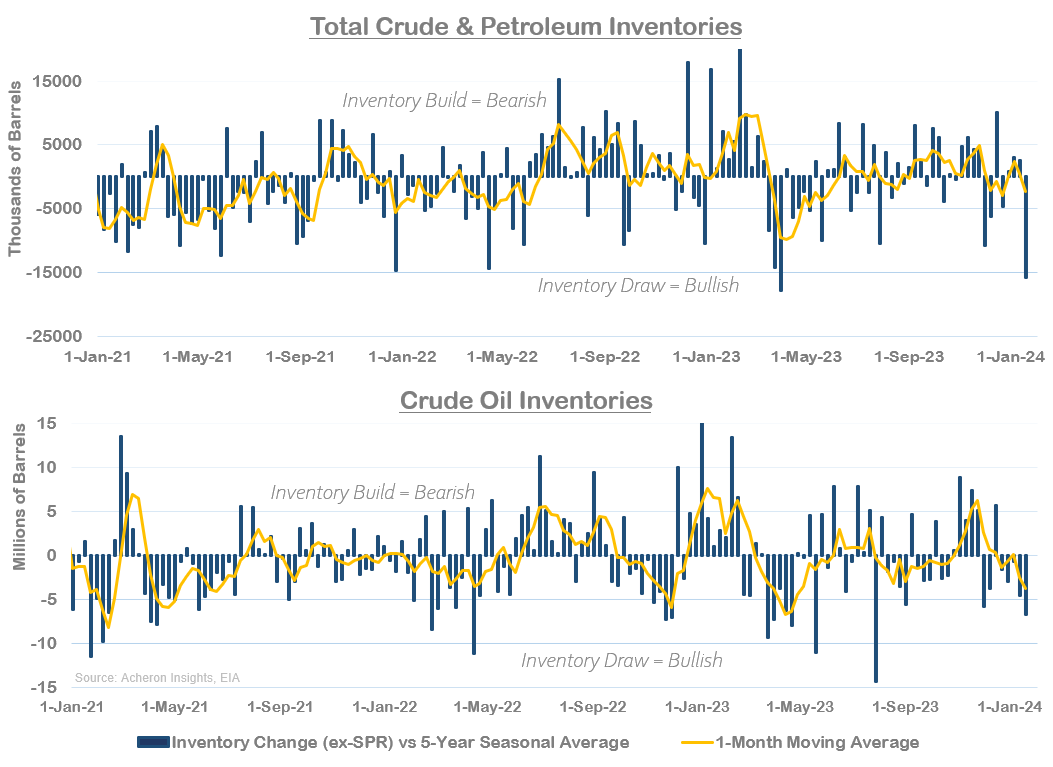

- We have seen persistent inventory drawdowns to start the year, leaving crude inventories at a much lower than level than at this stage last year (though the same cannot be said of overall petroleum inventories).

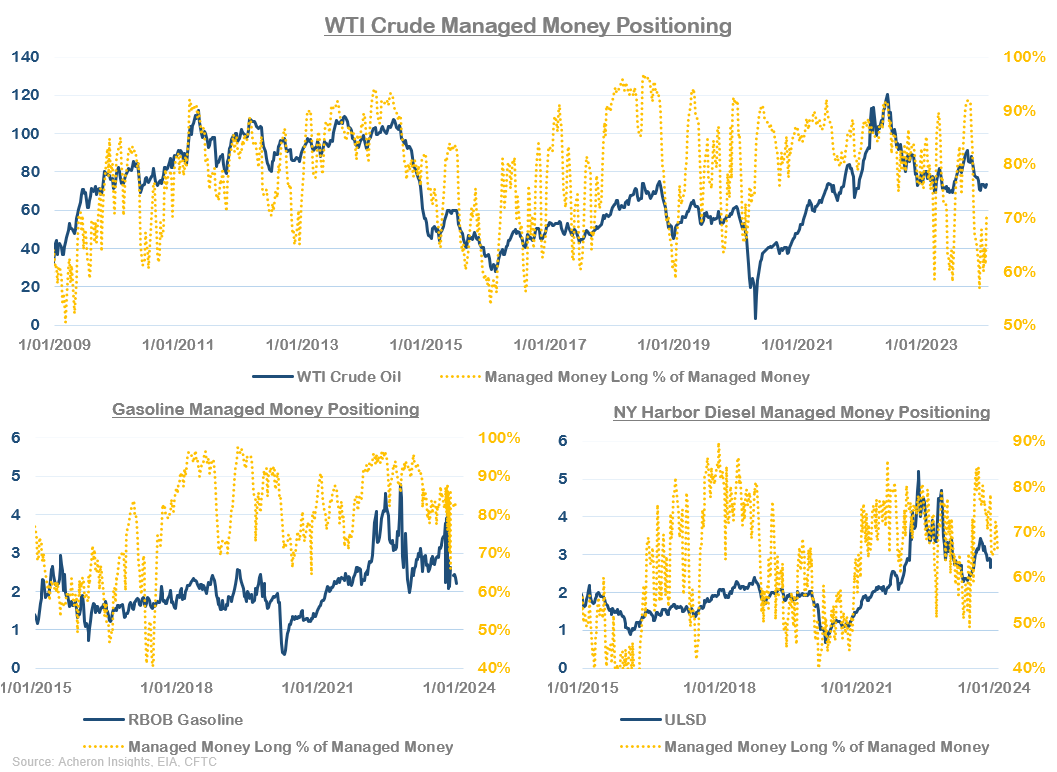

- Speculators are still positioned bearishly, with plenty of scope for a continued short-squeeze higher. How stringent OPEC+ is in enforcing production cuts through Q1 will go a long way in determining how long this rally can continue.

- However, given the slower demand growth likely to be seen during 2024, continued strength in non-OPEC+ supply growth and higher overall petroleum inventory levels, triple-digit oil remains unlikely any time soon.

Oil on the Move

Back in December as the WTI crude oil price fell below $70, I wrote a piece suggesting the sell-off was overdone and an attractive buying opportunity in oil and energy equities was on the cards. In the weeks since this call has proved prescient as WTI has since rallied into the high $70s on the back of short covering, big inventory draws and improving fundamentals.

The question now is whether this move higher is coming to an end or if oil prices can continue their march higher? Fortunately, there remains evidence to suggest it could be the latter, but don’t expect triple-digit prices anytime soon. For now, a cautiously bullish stance toward the oil market seems about right.

Improving Fundamentals

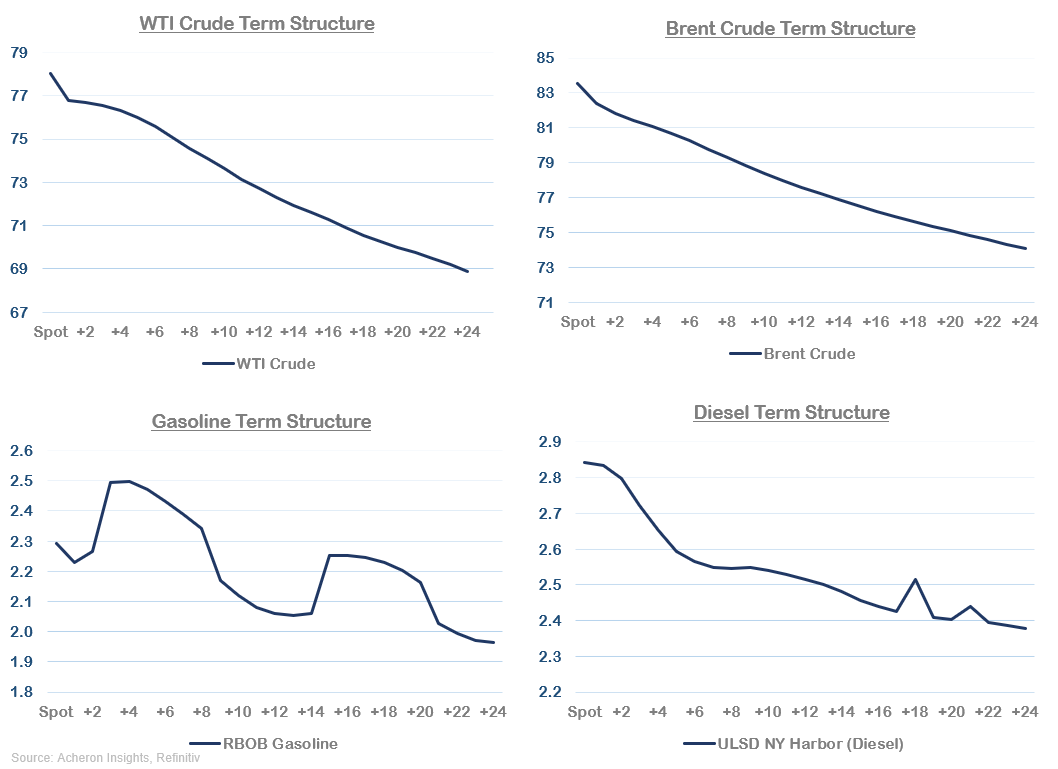

What has been most notable during this recent move higher are the improving fundamentals. First and foremost are the futures term structure for crude and the primary refined products in gasoline and diesel, which have returned to a state of backwardation across the board after moving into contango as oil prices collapsed during Q4.

More than anything, when the futures curve is in backwardation and prompt/spot prices exceed those of longer-dated contracts, it suggests the market is tight as the demand for immediate delivery exceeds that of delayed delivery. That is backwardation is being confirmed by similar measures in Brent CFDs and DFLs is positive and seems to confirm the oil market as of Q1 is much tighter than what we saw during Q4 of last year.

So long as backwardation remains, prices ought to be supported. And, for backwardation to remain, we need to see continued draws in inventories. Fortunately, through the first month of 2024 we have seen exactly that. Persistent crude oil inventory draws have taken place throughout January such that overall inventory levels are again nearing the 400 million barrel area (second chart below).

And, while inventory draws have been less consistent when viewing total petroleum inventories (which includes refined products such as gasoline and distillates, first chart above), this is still bullish on the whole.

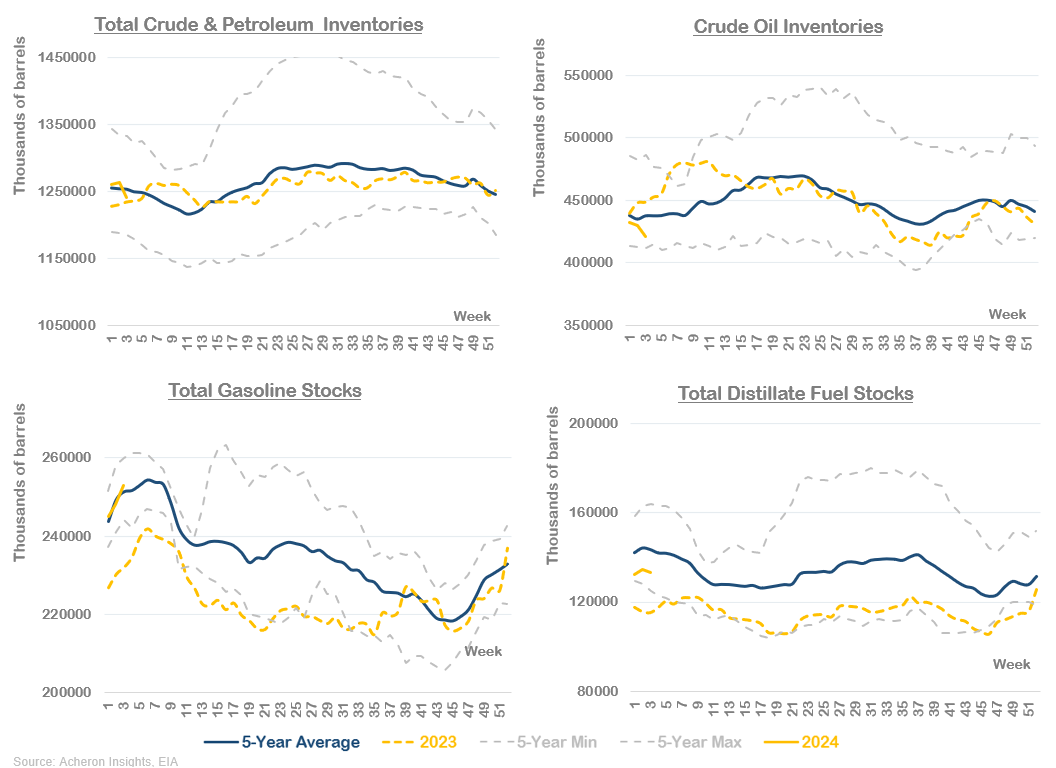

In relation to gasoline and distillates, inventory builds during the first few months of the year are the norm (particularly for gasoline) as vehicle traffic generally falls during the coldest weeks of the year. These past few weeks have seen particularly cold weather across North America, which has hampered gasoline demand.

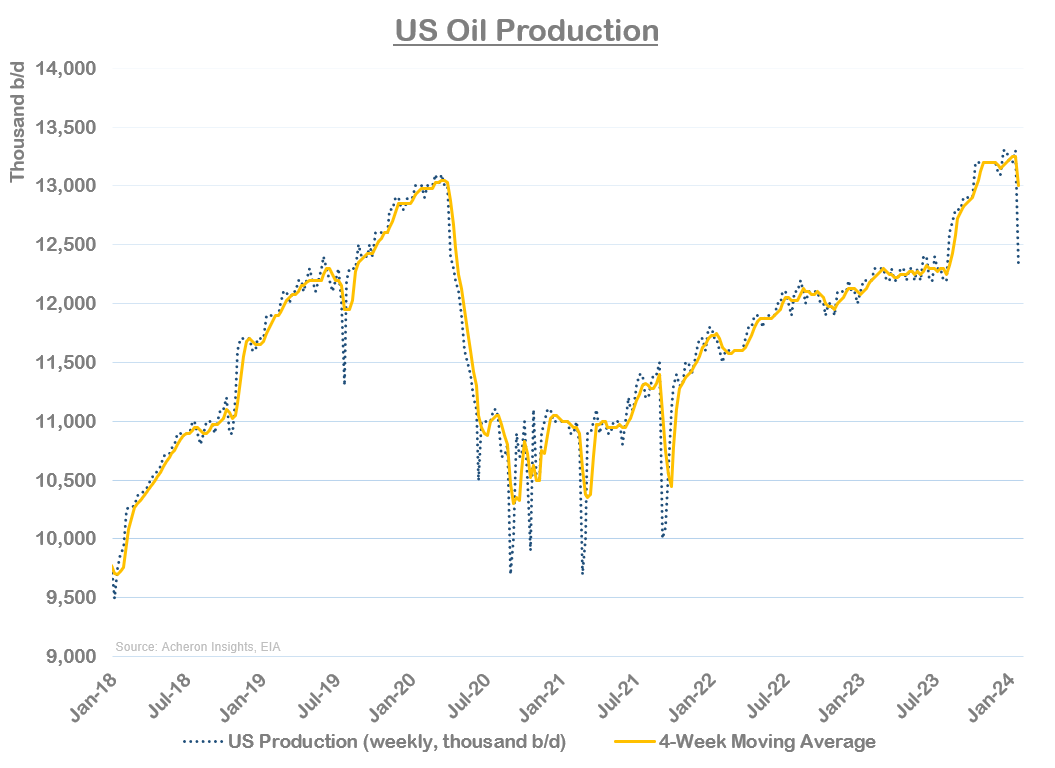

Of course, this cold weather has been partly responsible for the large draws in crude we have this so far this year as US production has taken a significant hit and one that will be temporary as North American weather normalizes. How bearish this turns out to be depends on how quickly production recovers versus how quickly gasoline and diesel demand returns once the cold weather abates.

Regardless, so far in 2024 we have seen significant counter seasonal draws in crude, with inventories now around 27 million barrels below where they were this time last year. And, although distillate inventories have recovered from their dismal balances that were present at the start of 2023, they too remain well below seasonal averages.

While these below seasonal draws are bullish, as is the inventory picture in crude and diesel, high gasoline inventories in addition to robust overall crude and petroleum inventories will limit upside price potential for oil and is one reason why prices will probably be rangebound for much of the year. The inventory picture for crude oil is more bullish than at this stage last year, but overall is not enough to see prices rally to triple digits in my opinion.

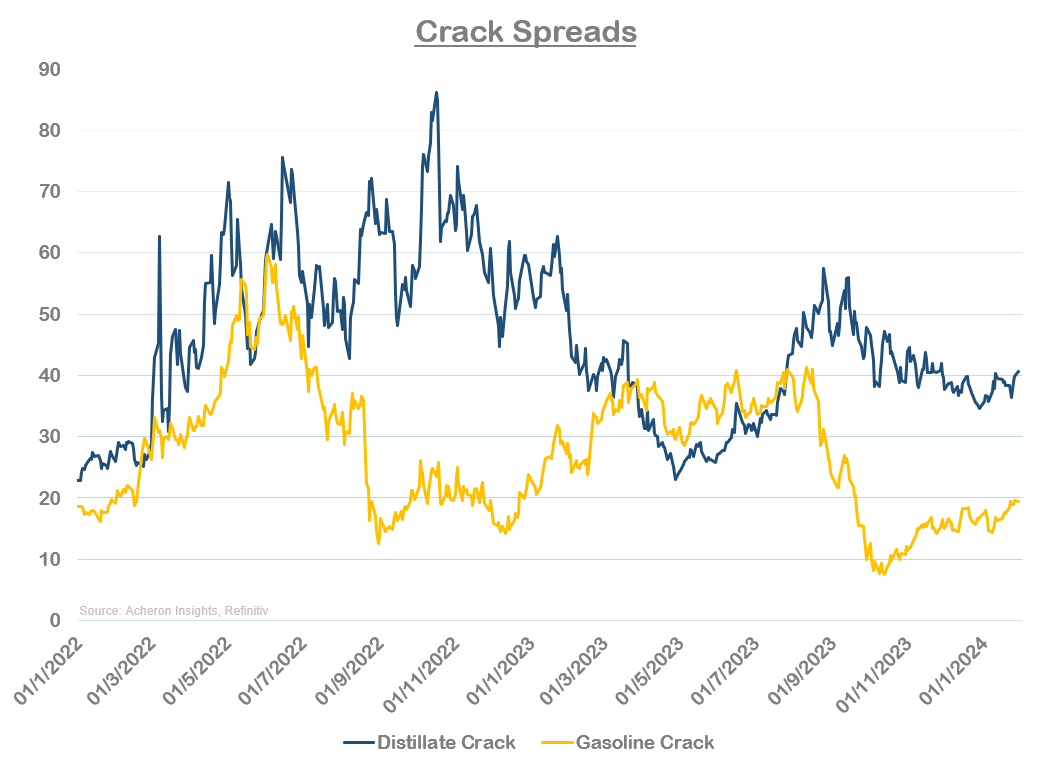

However, that doesn’t mean inventory draws below seasonal averages can’t continue. Importantly, refinery margins (crack spreads) are improving which will incentivize refineries to increase throughput and thus increase crude oil demand. Likewise, a backwardated term structure will continue to incentivize inventory draws as opposed to inventory builds. That gasoline cracks continue to move higher along with still elevated diesel cracks is undoubtedly positive (a trend being confirmed via both Singapore and European gasoil and gasoline cracks), while the fact that gasoline cracks are rising while gasoline inventories are starting the year at much higher levels than 2023 is also comforting.

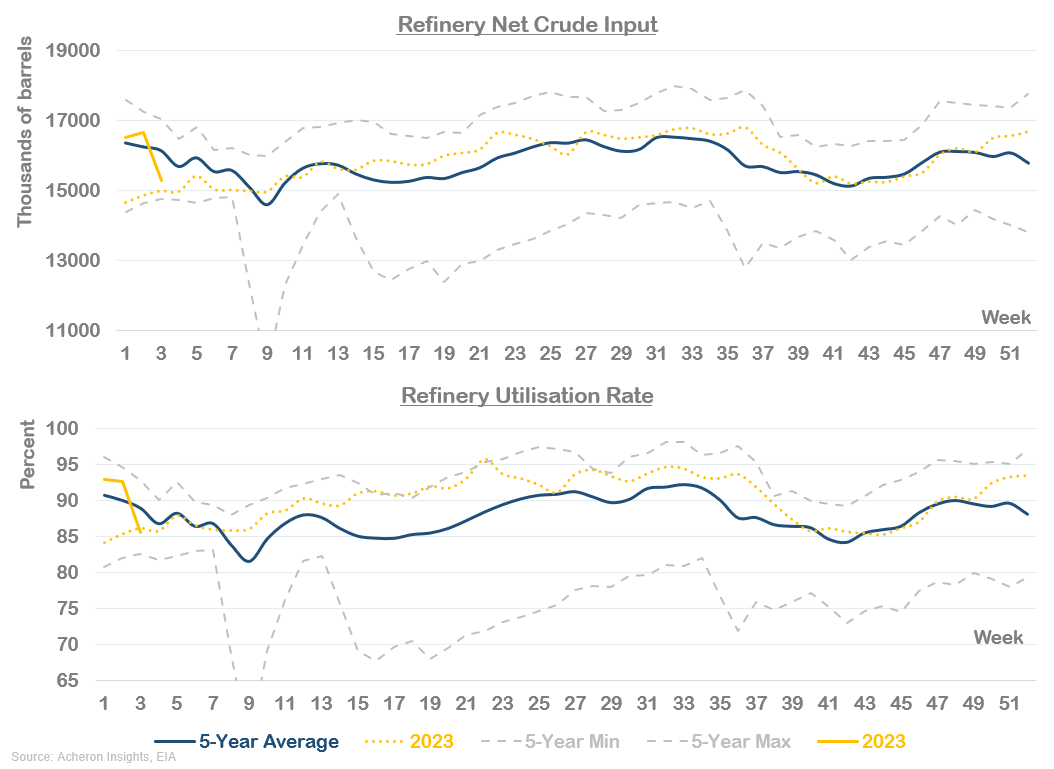

If we see continued crude draws and an increase in gasoline/diesel draws as the colder weather abates, coupled with increased refinery demand from robust crack spreads this would be highly supportive of prices, particularly as refinery crude input and utilization rates have dropped amid cold weather induced disruptions and seasonal maintenance.

What also has me continuing to lean bullish is speculative positioning. Managed money (hedge funds and CTAs) were positioned in crude oil as bearish as they have ever been in December. And, as we can see below, even though a liquidation of shorts has taken place over the past few weeks, there remains plenty of scope for upside buying by managed money that could fuel a rally into the high $80s and even low $90s should the fundamentals hold steady over the coming months. Such bearish extremes in managed money are perhaps the best predictor of future price action and continue to suggest price asymmetry is skewed to the upside.

In addition, now that the futures market has returned to a state of backwardation will incentivize speculators to buy back shorts as the cost of holding such positions increases dramatically due to the negative roll yield associated with a term structure in backwardation.

But, having said that, similar to the current state of inventories, because positioning in gasoline and diesel futures is far less bullish, this remains another reason why I don’t see a rally much higher than $90 to be on the cards anytime soon.

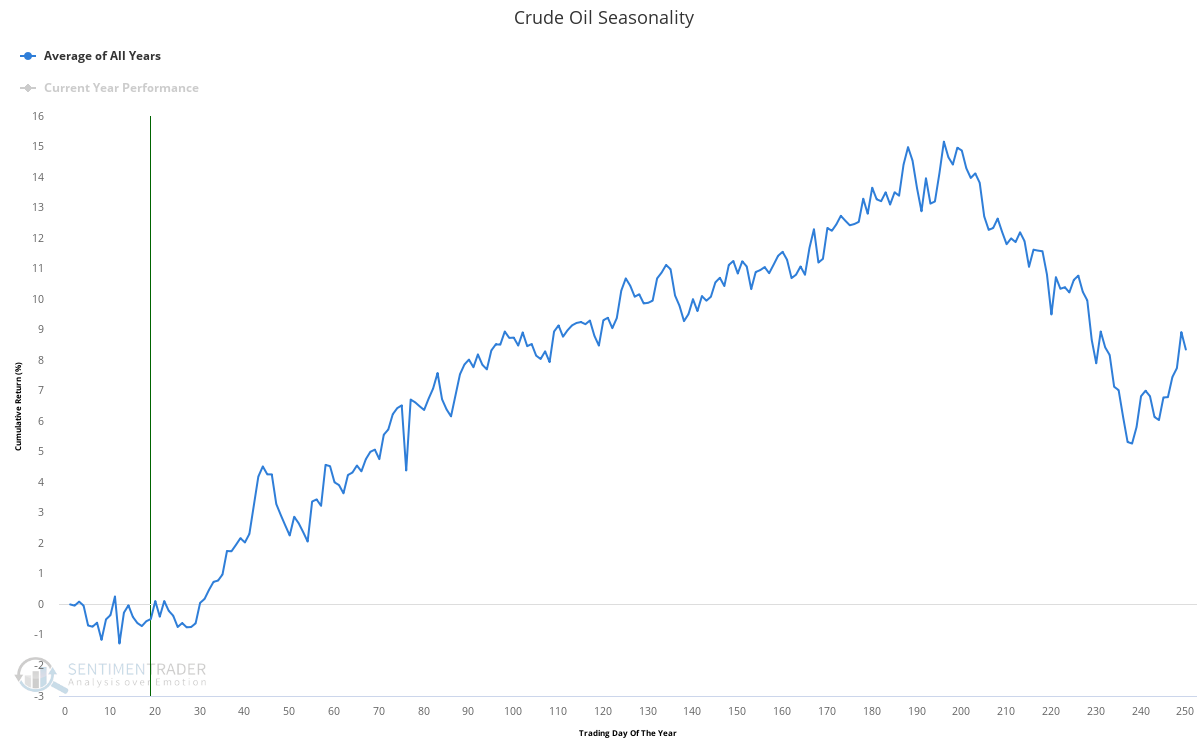

Again, that doesn’t mean crude oil prices won’t rally further from here. Indeed, from a seasonality perspective, we are about to enter one of the most favorable periods of the year.

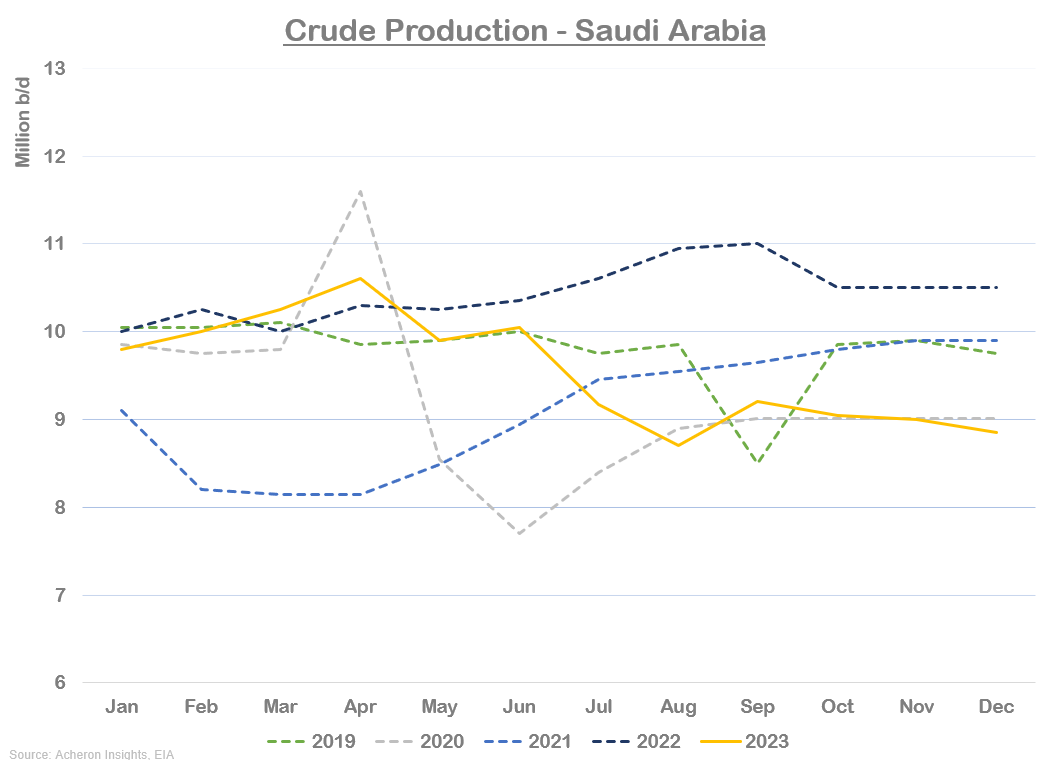

One factor that will go a long way to determining whether this rally can continue is OPEC+ production and how stringent Saudi Arabia and the cartel are in implementing their production cuts throughout 2024. Though it may only be for a short time, I suspect OPEC+ compliance will be enough to buoy prices as 2023 production cuts are carried into 2024. Saudi Arabia is set to enter 2024 producing around one million b/d less than they were at the beginning of 2023.

While my overall take on the oil market remains bullish in the short-term, I do believe oil prices will probably be somewhat rangebound throughout 2024, and I certainly do not think 2024 is the year of triple-digit oil. For now, given that total petroleum inventories are at relatively robust levels and non-OPEC production growth should continue into 2024 (though as a slower pace than 2023), the upside is probably capped for the time being, barring any major geopolitical escalation.

As such, while things look good for now and prices should continue to be supported through Q1, look to take profits in oil and energy-related positions as we see managed money positioning reach levels of extreme bullishness, along with a deterioration in physical market indicators.