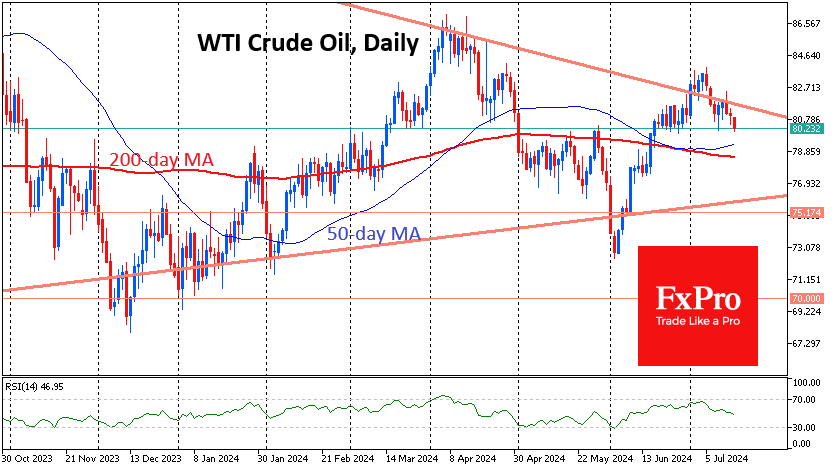

Oil is losing ground, once again threatening to fall below $80 per barrel WTI, despite a weaker dollar and strong gains in gold and equities.

We may be seeing market participants trying to stay within the established pattern, but there’s a good chance that oil is reflecting a turn in the economy to a slowdown.

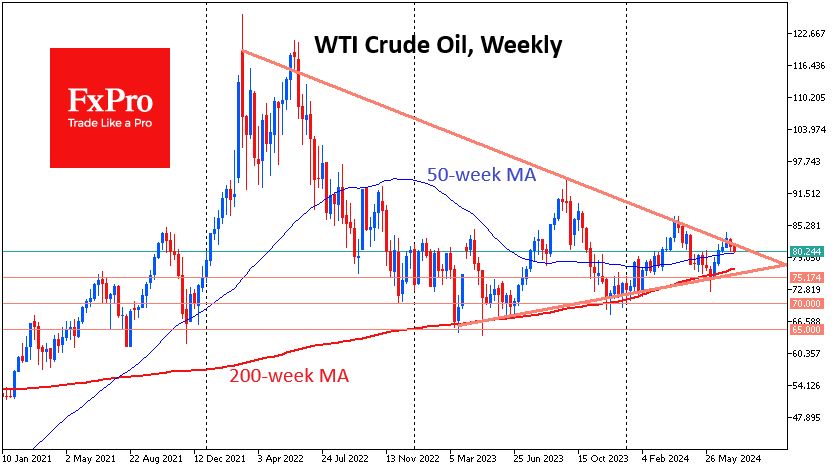

Oil is giving up ground for the second week, having reversed to the downside from $83.8. This is the development of a sequence of lower local highs since the beginning of 2022. The bulls failed to break through the resistance line despite the Fed's easing signals.

It seems that oil traders read signals of future demand problems in the signals from Powell and other FOMC members rather than anticipation of monetary easing. Oil is very sensitive to fluctuations in demand, and a 1-2% change in the supply-demand balance can change the price by tens of per cent.

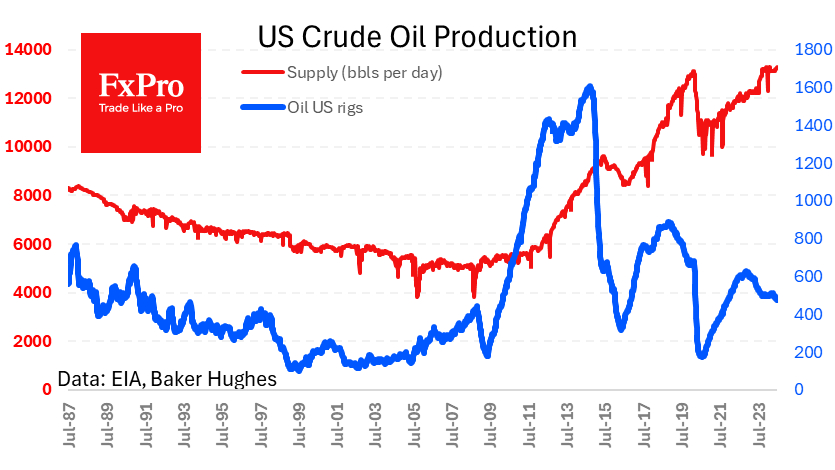

The latest Baker Hughes report saw a further decline in drilling activity, with the number of active oil rigs falling to 478 (-1 for the week), a new low since December 2021 and another reminder that current prices do not inspire investment in production expansion, only maintaining the status quo.

On the other hand, oil has failed to develop an offensive but has yet to break crucial support. Since last February, the price has been reversing to the upside after declining towards the 200-week moving average. The last attempt to break below was in early June. As a result, a sequence of higher local lows was formed.

Thus, the oil price is being squeezed into a vice. Signals of slowing US economic growth, while Europe and China are still unable to move to accelerate their growth, are not supporting demand.

Because of the economic signals, we see higher risks that the price will break out of this two-year consolidation. However, it has yet to pass a crucial test in the form of the 200-week MA (now at $77).

All along, OPEC+ has come to the oil rescue by cutting production. Whether that will be the case this time is the big question.