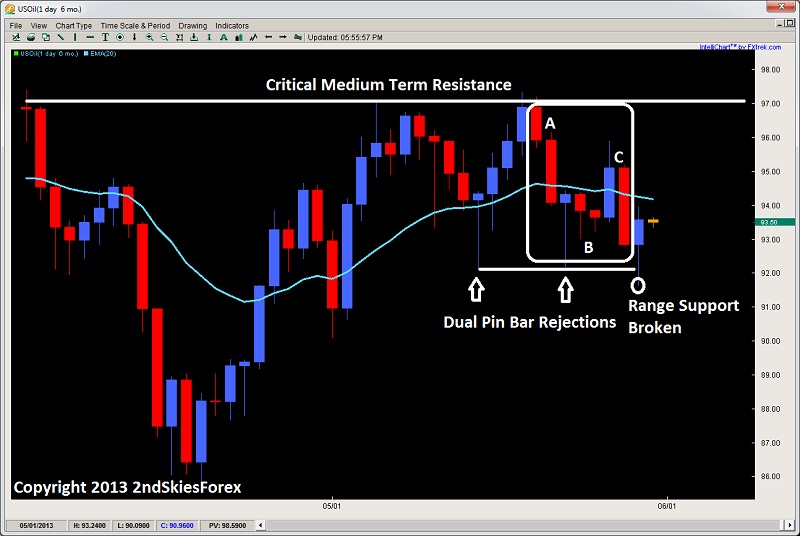

In my weekly market commentary, I discussed the crude oil pin bar that had formed at the range support. Although it looked identical to the last pin bar at the same level which profited, I was highly skeptical it would follow through as the setups, price action and context were not as supportive this time around.

Looking at the chart below, this ended up being correct as this last pin bar failed to produce any follow through. Anyone trading the 50% pin bar entry technique got crushed in the process. This is why we don’t just trade pin bars blindly. We are not pattern traders - we trade price action in context, and when you learn to read the context of the price action – you begin to spot why pin bars will win or fail ahead of time (as in this case). The impulsive selling at A showed greater force from the bears this time, hinting bulls will have more to contend with on the next bounce.

The result was after two days of stalling at the 61.8% retracement of the pin bar at B which were two inside bars back to back (an ii pattern), it had one bull close in four, with massive selling (bar C) after the first bull close. Thursday followed up with more selling, taking out the pin bar and range support lows, tripping stops sub 92.00.

Considering the range has been broken, bears will have to wait till the 97.00 range highs before shorting, or look to sell just shy of 96.00 targeting the 92.20 lows. Bulls now will have to wait for a deeper pullback towards 89.45 before considering longs.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Crude Oil Pin Bar And Range Support Fails

Published 05/30/2013, 03:12 AM

Updated 05/14/2017, 06:45 AM

Crude Oil Pin Bar And Range Support Fails

Crude Oil – 50% Pin Bar Entry Fails – More Downside?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.