- WTI crude oil falls below $70 a barrel.

- This comes amid rising fears of slowing growth in China and the US following underwhelming data.

- With OPEC+ planning to ease production restrictions, the prices could continue to tumble.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

Oil prices plunged yesterday, pushing WTI below $70 per barrel with this year's low now within reach.

Several factors are fueling this downward trend that started back in July. Concerns about economic growth in the U.S. and China are playing a big role.

Plus, OPEC+ is planning to increase oil production next month, which could add to the supply and put further pressure on prices.

Investors are also keeping an eye on political and geopolitical developments. Libya is making headlines, and the ongoing crisis in the Middle East is disrupting production.

US, China Potential Slowdown Worries Weigh on Sentiment

As the world’s largest oil importer, China’s economic signals heavily impact oil prices.

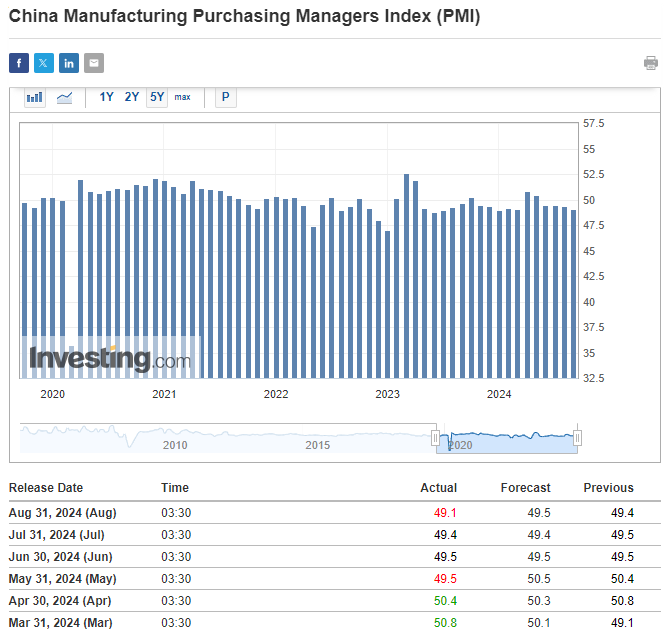

Recent PMI data from China, which fell short of expectations and remained below the 50-point threshold, contribute to a bearish outlook for the coming quarters.

If this weak data translates into lower GDP growth, the country’s 5% economic growth target may be at risk.

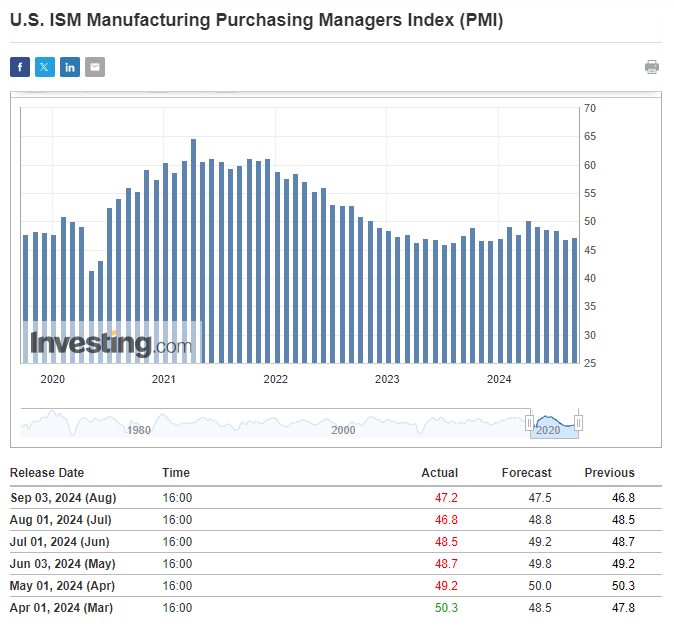

Meanwhile, uncertainty surrounds the US economy as the ISM manufacturing index has underperformed expectations for the fifth consecutive month.

Coupled with a noticeable decline in the labor market’s strength, this raises concerns about the likelihood of a soft landing.

Given these factors, oil prices may continue to head lower, reflecting growing pessimism about the economic outlook in the world’s two largest economies.

Market Pricing in Increasing Supply Ahead

OPEC+, which controls about 40% of global oil production, traditionally wields significant influence over the oil market.

The organization plans to ease production restrictions by 180,000 barrels per day starting in October.

However, not all member countries are adhering to these limits. Notably, Iraq is exceeding its quota by 320,000 barrels per day, much of it coming from the semi-autonomous Kurdistan region.

In Libya, internal political conflict has drastically cut oil production from 1 million to 450,000 barrels per day.

While there are signs of potential de-escalation, no definitive resolution has been reached yet. The more likely scenario appears to be a temporary disruption, with production gradually returning to previous levels.

WTI Crude Oil: Key Support Levels to Watch

WTI crude oil prices are maintaining their strong downward momentum, potentially setting new lows for the year.

However, this doesn't necessarily signal the end of selling opportunities. The next crucial support levels to watch are in the $64-$67 per barrel range.

Given the potential strength of these support levels, we might see a short-term rebound. Nonetheless, the prevailing supply pressure remains significant.

If prices break through the $64-$67 zone, a move toward $60 per barrel could become increasingly likely.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.