Key Points:

- Crude oil prices stall around the $53.00 handle.

- Libya and Nigeria continue to undermine OPEC agreement on cuts.

- Watch for lower oil prices in remainder of Q1, 2017.

Crude oil prices have been on a roller coaster of late as the commodity has received a significant boost from the recent OPEC production deal. Subsequently, we have seen West Texas Intermediate (WTI) prices rally to a high of $55.21 before slipping to around the $53.00 barrel mark as we near the end of the month. However, despite the recent OPEC production freeze, we could be about to see some supply side pressures as Libya looks to expand their exports.

There was significant joy amongst the oil bulls following the news that OPEC, after many months of negotiation, had finally reached a deal on production cuts. However, as is always the case with the oil cartel, the devil is typically in the details. In this case, the much vaunted agreement exempted Libya, Nigeria, and Iran, which significantly complicates assessing any subsequent impact that it could have on markets.

In particular, Nigeria has struggled to maintain appropriate levels of oil production around the delta area as militants have sought to disrupt operations. Although this has significantly depressed Nigerian production, it certainly isn’t by choice, and as conditions continue to stabilise in that region, so too will crude oil supplies.

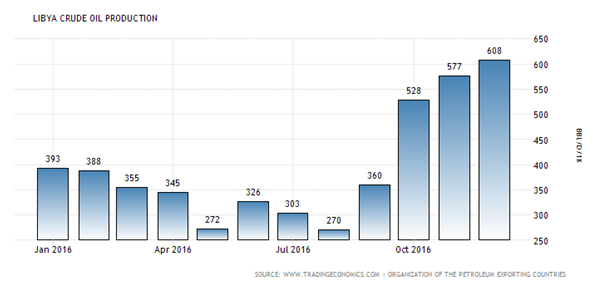

Libya also poses an interesting conundrum for global crude oil markets as stabilising production and national revenues is likely to be the initial drive of any resultant regime. In fact, according to the latest statistics, Libya has already increased their production by over 23 percent, since November, with a goal of 1.25 million bpd by the end of the year. Subsequently, there is already building supply coming out of the war torn region and further increases are likely to all but render the OPEC deal a moot point.

Ultimately, the impact of the recent OPEC production cut has likely already played itself out within global markets. There is a very real chance that we could witness oil moving back below 2016’s $50.00 trading constraint in the near term.

In fact, price action may already be heading in this direction given that there has been a definite period of moderation from the recent high. So don’t believe the OPEC hype as we might just be getting ready to see the final charge of market rebalancing in the months ahead.