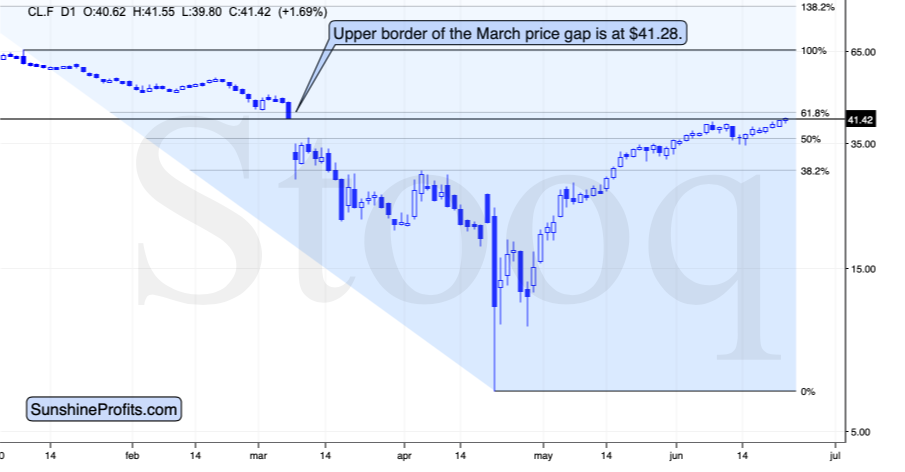

Crude oil continues to rally and is now testing the upper border of the March price gap on the daily charts. However, given the increase in cases of COVID-19, both in the US and globally, it seems crude might not have the strength to keep pushing higher for much longer.

The upper border of the March price gap is one of the most important near-term resistance levels. There’s also the 61.8% Fibonacci retracement, but since it’s based on the April low that is relatively unclear (different series of futures contracts were trading at very different price levels, some were even in negative territory), this Fib level might not be as reliable as the price gap.

This means that the resistance being tested right now is of critical importance. Just several months ago, crude oil was one of the weakest markets out there, and its rebound was one of the strongest. The reversal in the price of crude, and a decisive decline, could be tip the scales for all markets.

Consequently, while a trigger is not necessary for the market to move in a given direction, getting one could speed things up. And it seems that crude oil’s reversal could be the trigger, along with a recovery in the dollar index.

When based on the daily closing prices, esistance created by the upper border of the March price gap is at $41.28, and at the time of writing, crude oil is trading 14 cents above this level. This by no means implies that resistance has been broken. If we see a daily close above $41.28, it could have bullish implications, but it doesn’t have them right now.

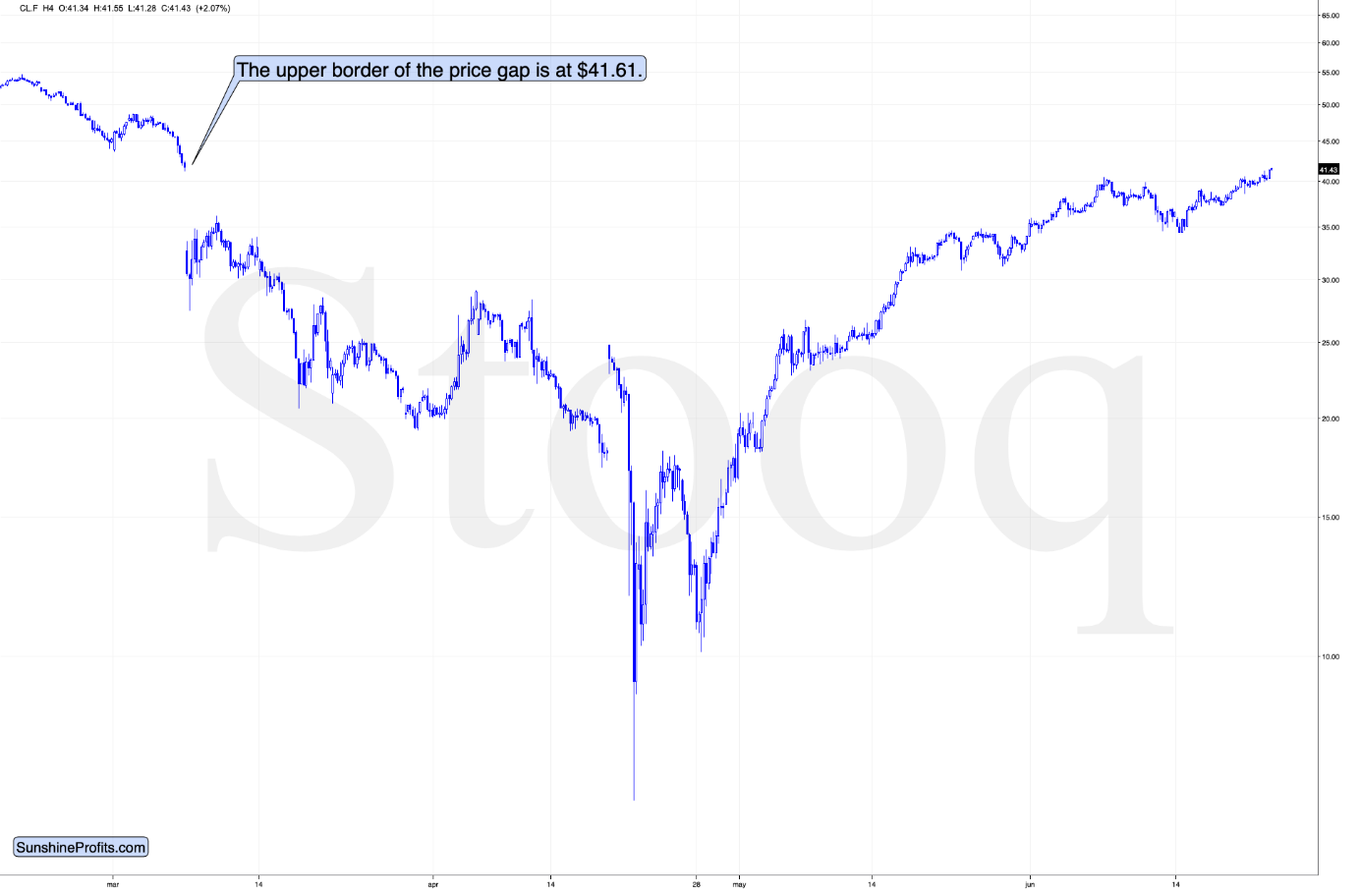

The four-hour chart for oil offers a different picture.

In this case, the upper border of the huge March price gap is at $41.61, which means that crude oil is actually slightly below, not above, it. The intraday high (so far) was $41.55, which means that this resistance was not touched on an intraday basis.

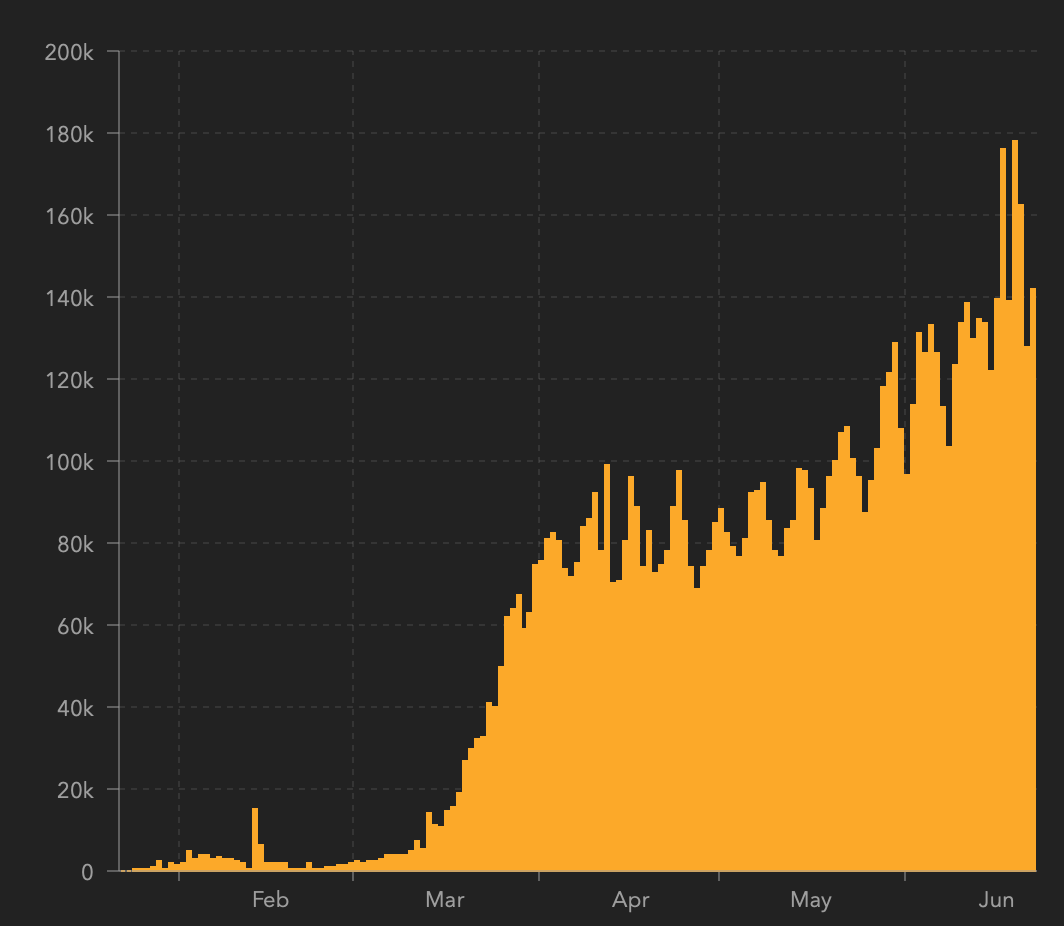

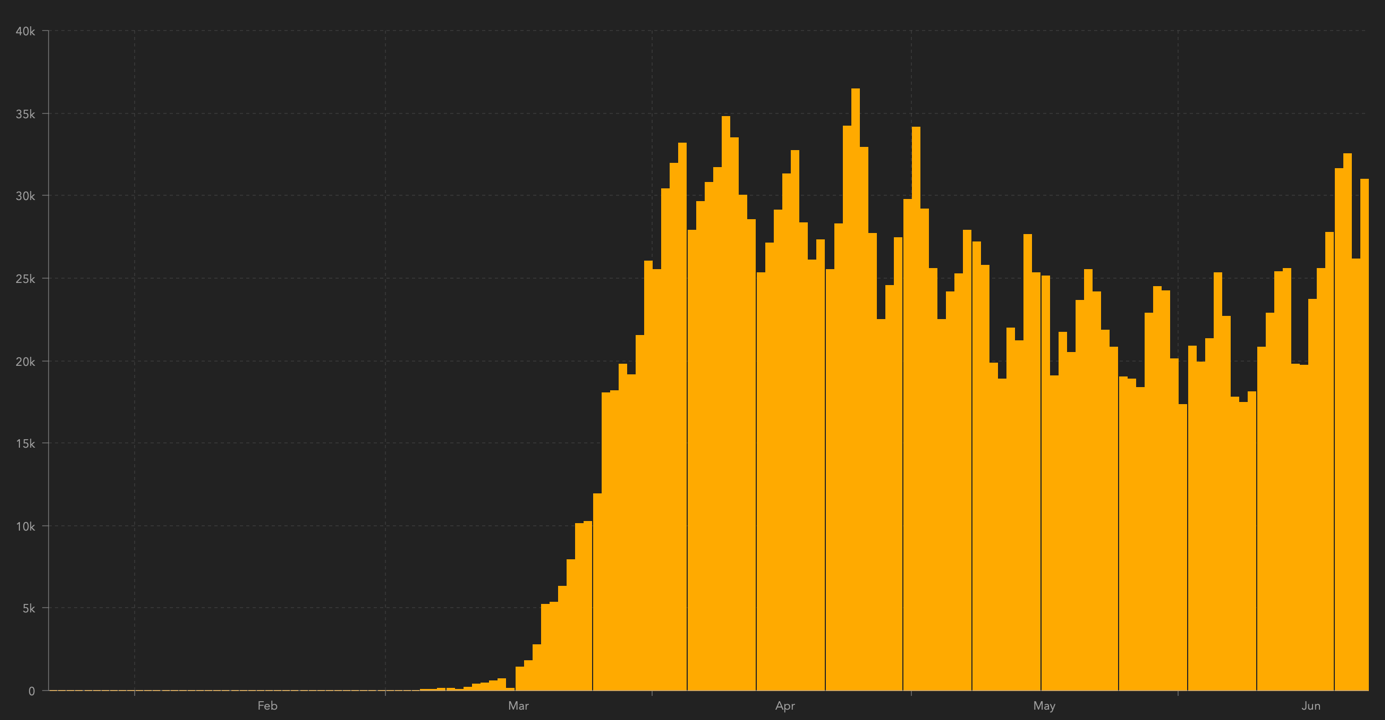

Beware coronavirus

The first chart below shows new daily global cases and the second chart shows new daily US coronavirus cases. While it’s been obvious that the cases are in a steady uptrend globally, the upsurge in the US cases and the potential for a second wave of the virus is a relatively new development. It’s not hidden, but it’s not being emphasized as much as smaller numbers were emphasized in March. But it’s going to change once the new daily cases move to new highs, as that’s a highly catchy topic and people won’t be able to ignore it.

Will crude oil be able to continue to show strength and rally further, even though it plunged on similar news in March? We view the former as unlikely.