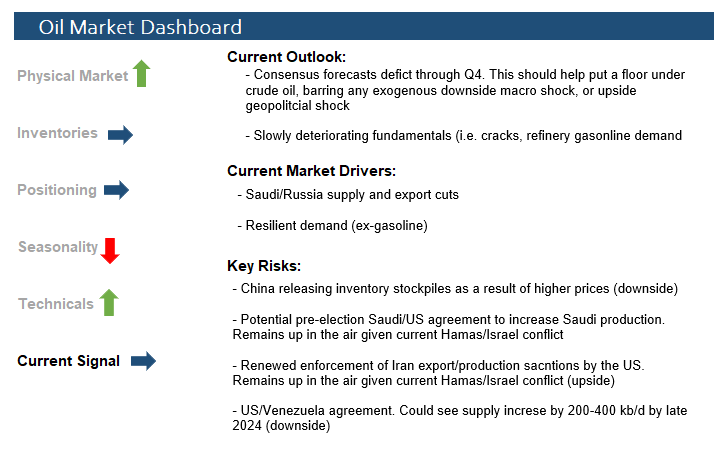

- The indicators of the physical market overall remain tight, with the only concern being an oversupply of gasoline.

- We seem to be transitioning for a period of sustained inventory drawdowns to a more balanced inventory picture, perhaps reflecting the slowly deteriorating fundamental outlook for oil.

- Speculative positioning is looking stretched, meaning a primary tailwind for higher prices looks to have run its course.

- For now, barring any geopolitical escalations, the outlook for oil prices looks to be neutral to slightly bullish, with $100 crude oil probably the ceiling for now.

- Firstly, should the Israel-Hamas conflict remain contained, then the impact on oil supply disruptions are likely to be minimal at best.

- -Should the conflict evolve and Hezbollah, Iran or other players become officially involved, then supply disruptions look much more likely, particularly if the US cracks down on Iranian oil sanctions. These have been relatively lax of late, with Iran being one of the primary marginal suppliers of oil throughout 2023.

- While the risks of any official Arab oil embargo are small given the failure of those in the past, unofficial attacks on oil infrastructure/pipelines are a possibility.

- Another area of concern is in regard to the potential Saudi-US agreement for arms/protection in exchange for increased Saudi oil production. This looks to be off the table for now, which probably means we should expect the Saudi production cuts to be in place longer than initially expected (and is probably bullish for oil overall). But with the US election next year, the Biden administration will continue to be very much incentivized to get some kind of deal done.

The Physical Market Remains Relatively Strong

For the most part, indicators of the physical market for crude oil remain relatively bullish - as they have been for much of this year.

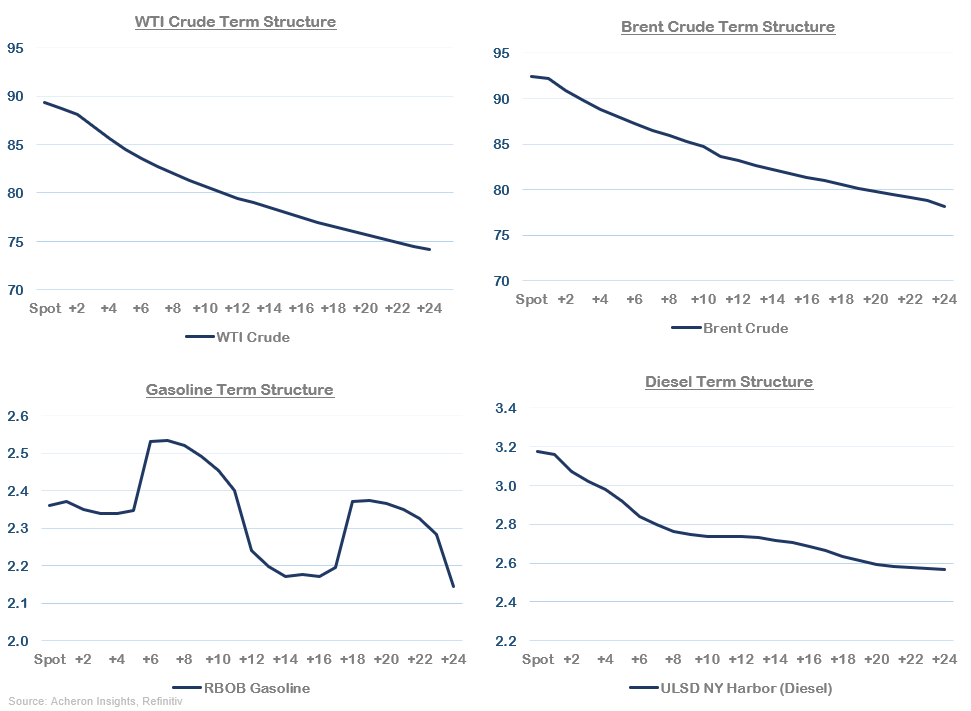

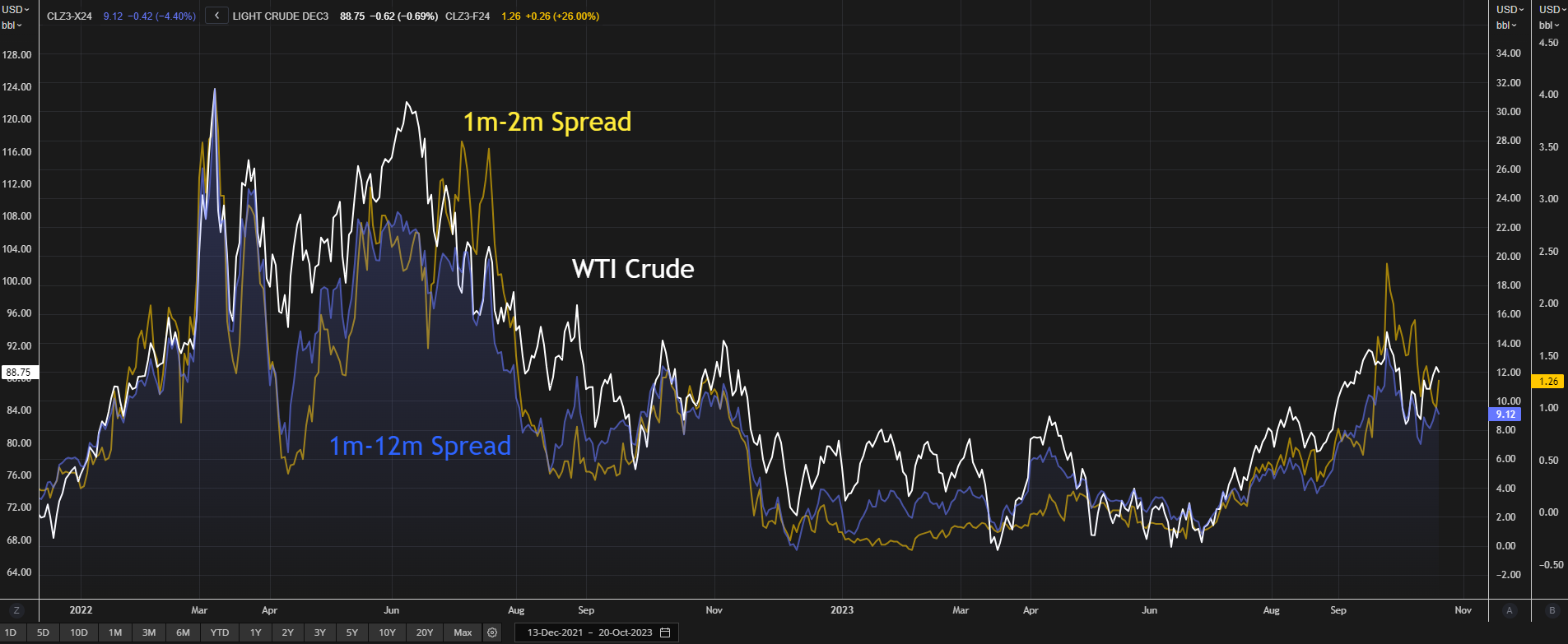

On the term structure front, both WTI and Brent remain firmly in backwardation across the entirety of the futures curve. This signifies the market is tight and there is a premium for immediate storage/consumption, despite the additional costs associated with said delivery.

The same can be said of diesel futures. Through a combination of reduced Russian diesel exports, reduced production of Saudi heavy/sour crudes (which are generally easier to refine into diesel as opposed to gasoline) and a number of other factors, the diesel market remains incredibly tight and is certainly something energy bulls will want to see in addition to crude oil backwardation.

Meanwhile, WTI calendar spreads (represented below via the one-month less two-month prompt futures spread and one-month less 12-month spread) continue to confirm the positive price action for oil.

Source: Refinitiv

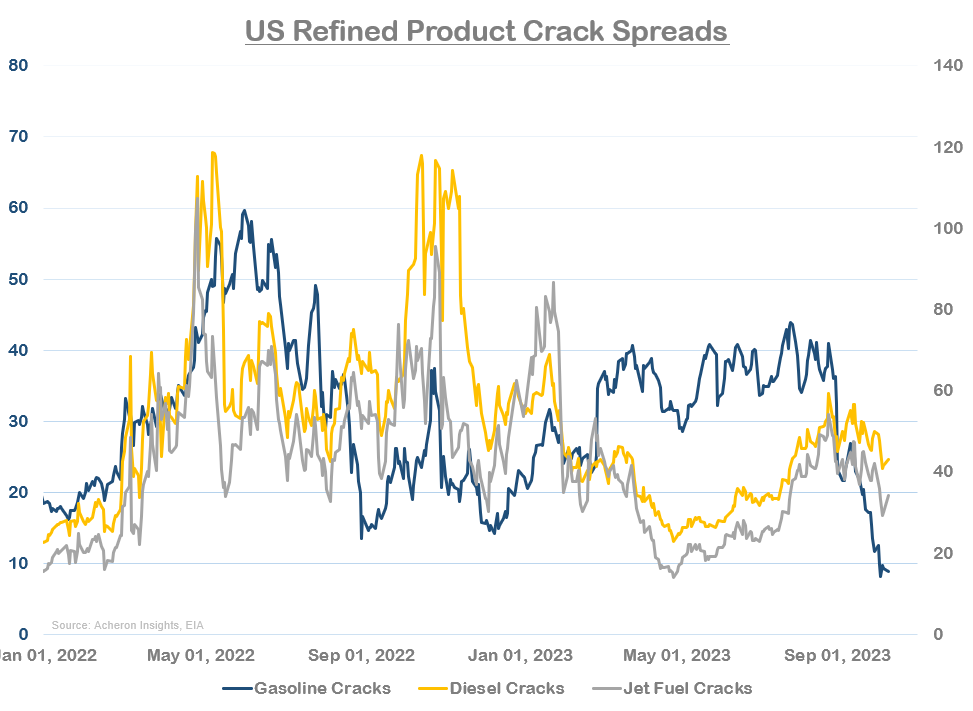

The gasoline market on the other hand looks much weaker than that of diesel or crude oil as a whole. The EIA’s (historically noisy) estimates of gasoline demand suggest demand has been waning, but whether this is a result of an oversupply or falling demand remains to be seen. Regardless, the market for gasoline is clearly far less favorable at present.

We can assess this by examining both the RBOB gasoline futures term structure above, as well as looking at refined product crack spreads. As we can see below, gasoline crack spreads have moved materially lower over recent weeks, while diesel and jet fuel cracks have held firm.

Clearly, the market for refined crude oil products is becoming increasingly bifurcated, a dynamic which suggests to me the tight market for crude oil is more so being driven by the supply side rather than the demand side.

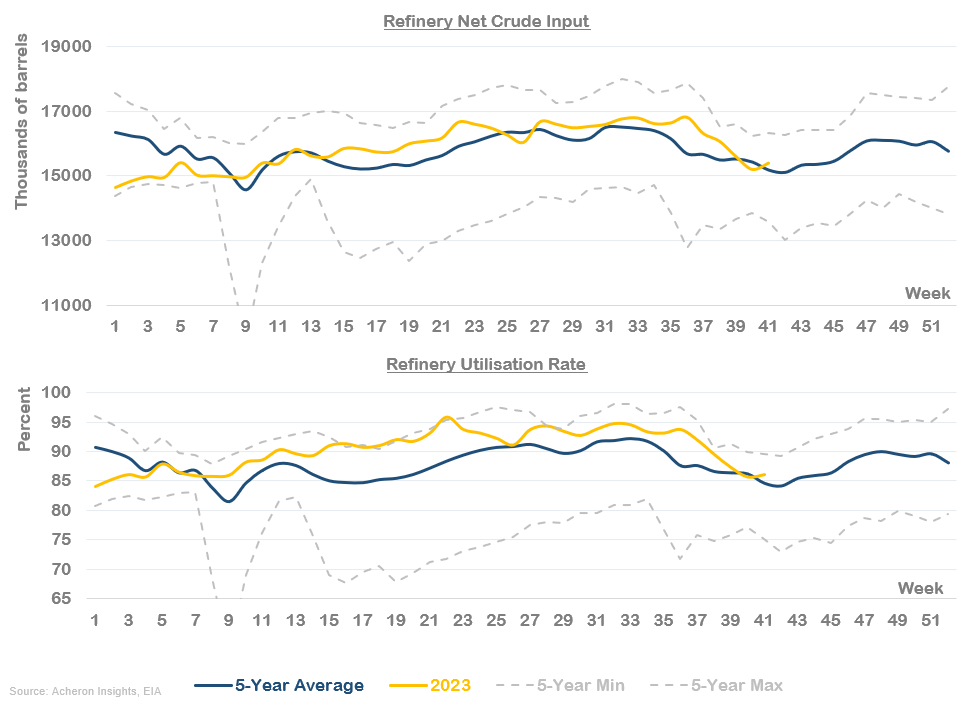

Such dynamics are beginning to show up within refinery demand, whose throughput and utilization rates have largely trended back toward their seasonal averages. Refiners are in a bit of a tricky spot at present, having to decide whether to continue to refine at above seasonal rates to capture the higher diesel and jet fuel margins on offer and thus continue to oversupply the market with gasoline, or to reduce runs, thus reducing the amount of crude they consume. This is why crack spreads provide such valuable insight into the state of the oil market. After all, refiners are ultimately on of the primary buyers of crude oil.

Thus, all else equal, unless we see gasoline demand pick-up and thus gasoline cracks firm, it will be very difficult to see oil move much beyond the $95-$100 area in the near future, particularly when European and Singapore gasoline cracks are also moving lower.

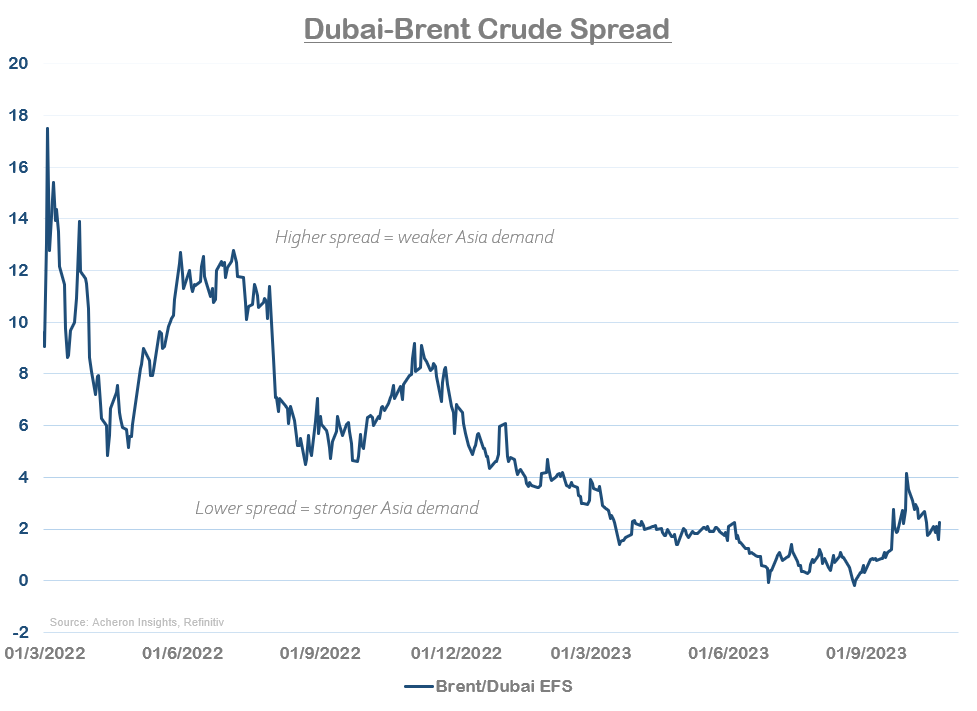

Though, as we have seen, outside of gasoline the physical market remains strong and bullish overall for oil. Other key differentials are confirming this dynamic, with the Dubai-Brent spread (a proxy for Asia/China oil demand) continuing to trend lower overall and near parity.

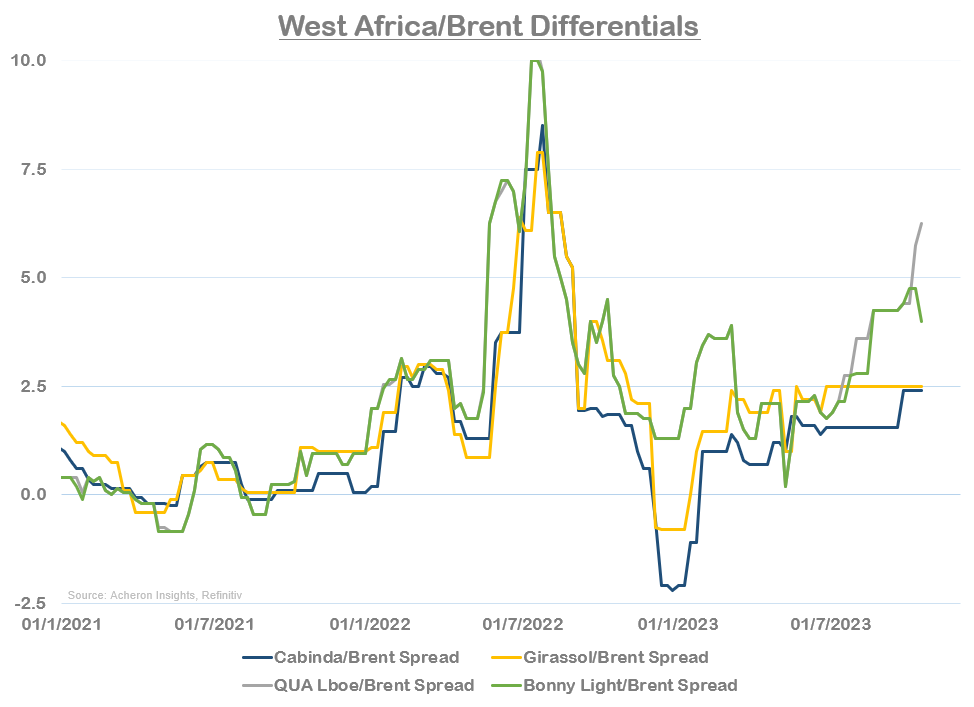

While the various Africa-Brent crude oil differentials also remain strong. This is an important relationship to track as West African crudes tend to be the first to sell-off.

Inventories Shifting to Neutral

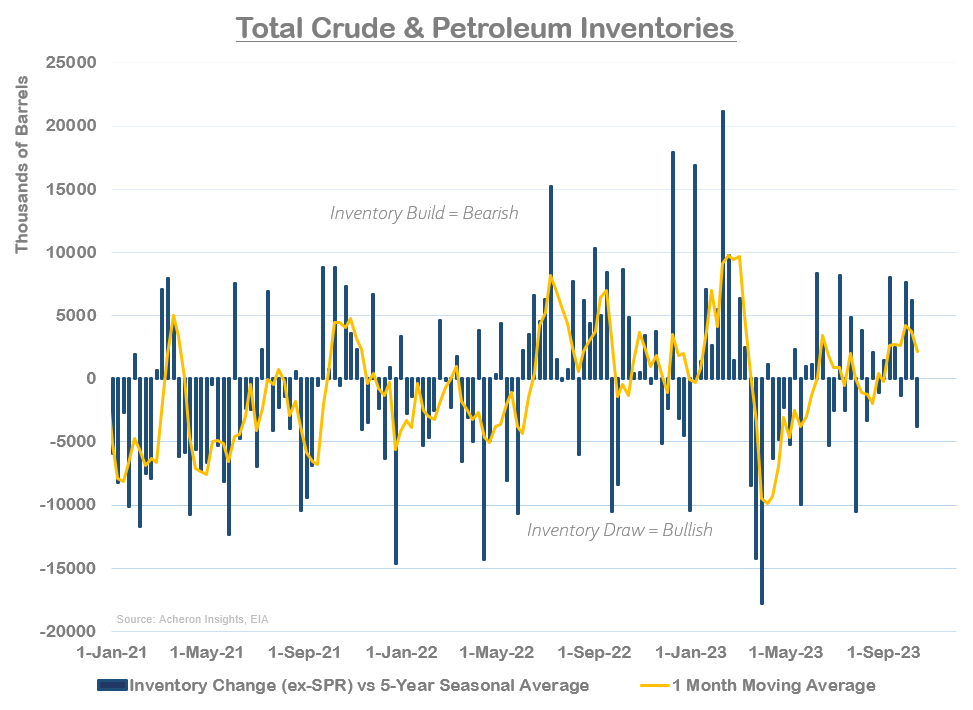

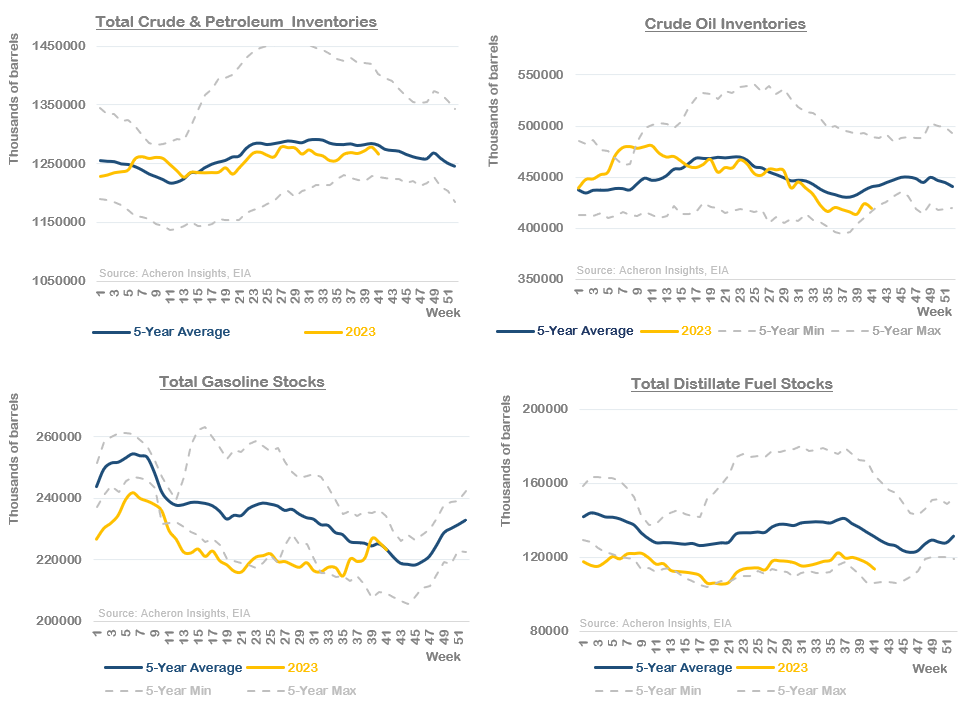

While the physical market overall looks to still be rather tight, we are not seeing this translate into inventory draws to the same degree that we saw from August through September. Indeed, if we look at weekly changes in total crude and petroleum product inventories relative to their seasonal averages, the picture has now turned unfavourable as we are seeing far more builds than draws.

In terms of commercial inventory levels overall, total crude and petroleum stocks are more or less in-line with seasonal averages. Crude oil stocks on the other hand remain below seasonal averages, as do diesel stocks. The recent build in gasoline stocks is again reflective of the bifurcation between the crude market and the various refined products we are seeing at present. For me to once again become uber bullish (though I remain cautiously bullish), persistent inventory drawdowns across the board would need to become the norm.

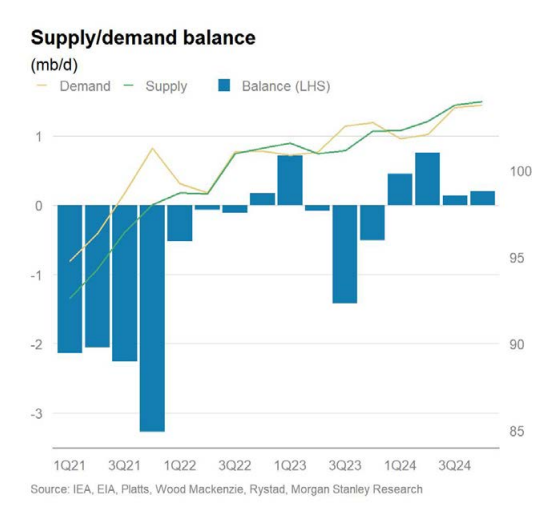

The Market Should Remain in Deficit Through Q4

In terms of the outlook for supply and demand, consensus forecasts continue to suggest we are likely to see the Q3 deficit continue through Q4, though to a lesser extent, prior to the market returning to surplus at some stage during Q1 of 2024. Although such forecasts are full of assumptions and thus fraught with error, it is worth noting what the EIA, IEA, OPEC and others are expecting in terms of production and consumption. For now, consensus is expecting a 0.5-1 mb/d deficit to close out the year, which if true, will show up in persistent inventory drawdowns as well as the key indicators of the physical market, which to me are far more reliable indicators of the outlook for oil.

Source: Morgan Stanley

Speculative Positioning Should Cap Upside Gains

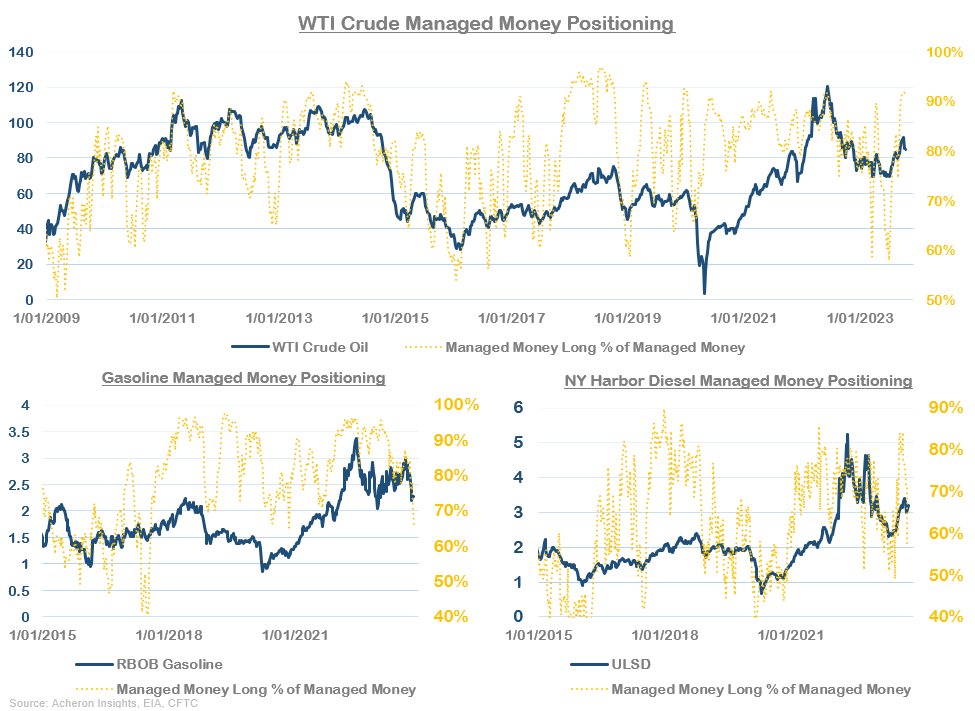

When it comes to positioning, this is unfortunately where things take a bearish turn.

All good bull markets in energy are driven by low levels of speculative positioning (i.e. hedge funds and CTA’s) who are then forced to cover shorts and drive prices higher on the back of favourable fundamentals. This is exactly what has occurred since speculators were caught heavily underweight crude oil around mid-year, thus providing the fuel for much of the subsequent rally from $70 to $95 crude.

Now, despite a significant level of unwinding of speculative longs in RBOB gasoline and ultras low sulfur diesel (ULSD) futures, hedge funds and CTA’s remain heavily long WTI futures, a dynamic which will prove a material headwind for oil. This is not to say speculative positioning cannot become even more extended, but the fundamentals needs to be significantly bullish for them to do so.

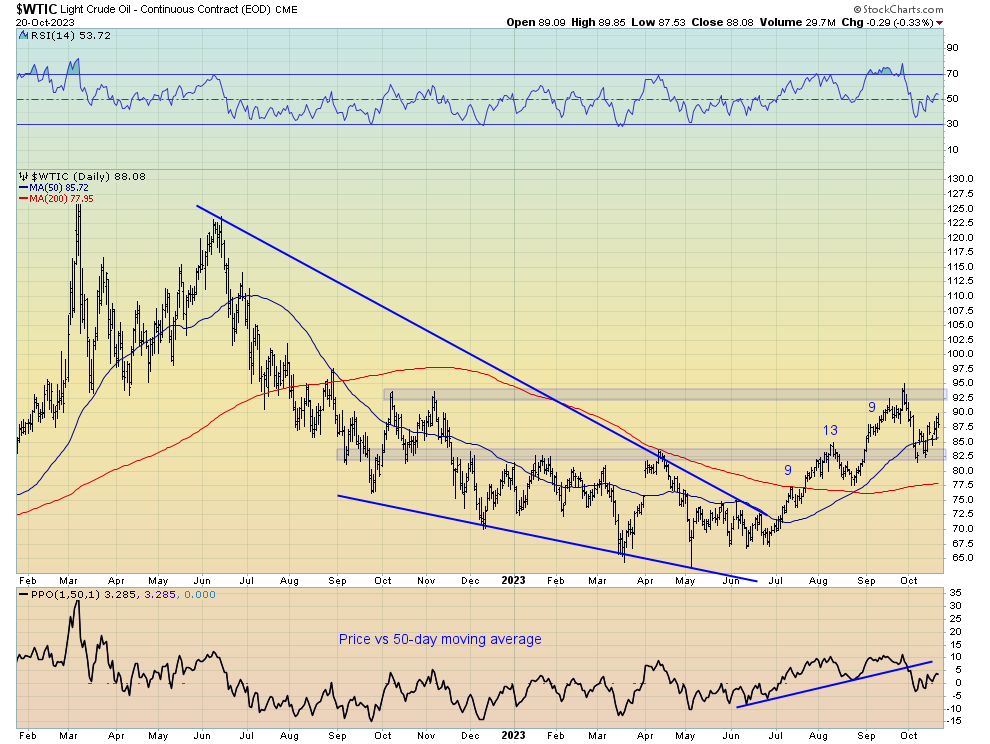

The Technical Picture

From a technical perspective, however, it is difficult to argue that recent price action remains favourable for bulls. We continue to see a trend of higher highs and higher lows, with the $90-$92 level now acting as key resistance. Should we fail once again to break through this level, then I suspect this is the market telling us how high the ceiling is for oil prices for the time being. But, as it stands, price action remains constructive and a break above $92 for WTI should usher in $100 crude in short order

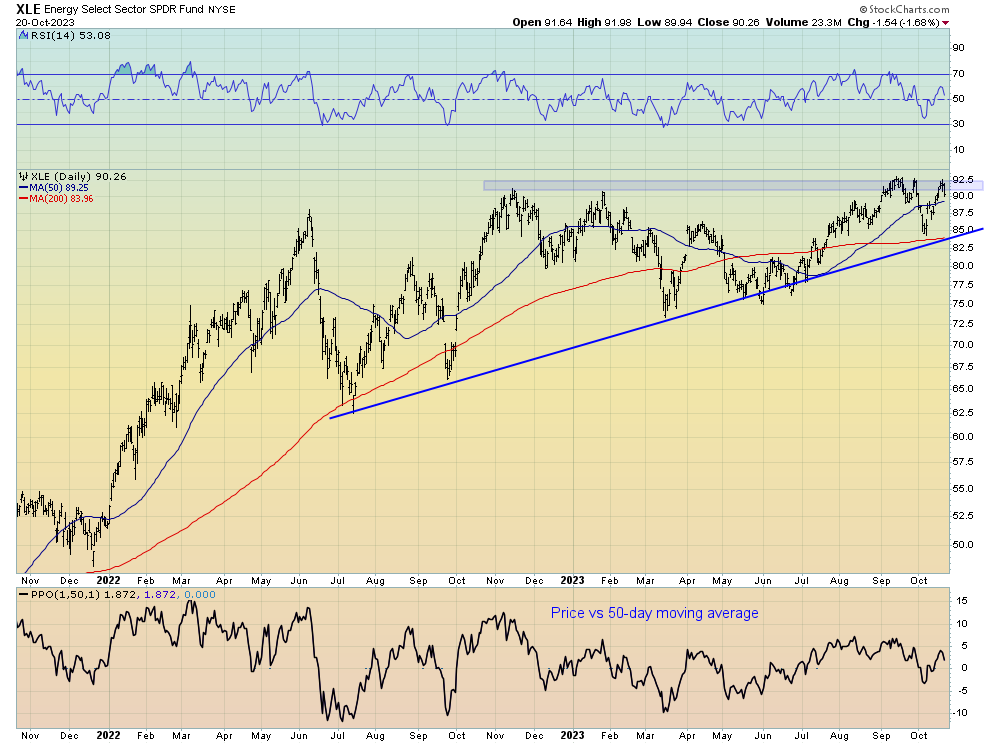

The same can be said of the energy equities, with the XLE (NYSE:XLE) ETF continuing its relative strength and very much looking like it wants to break out above the $93 level which has acted as key resistance for over 12 months now. Again, a decisive break to the upside would be telling in relation to the future movements in the energy space.

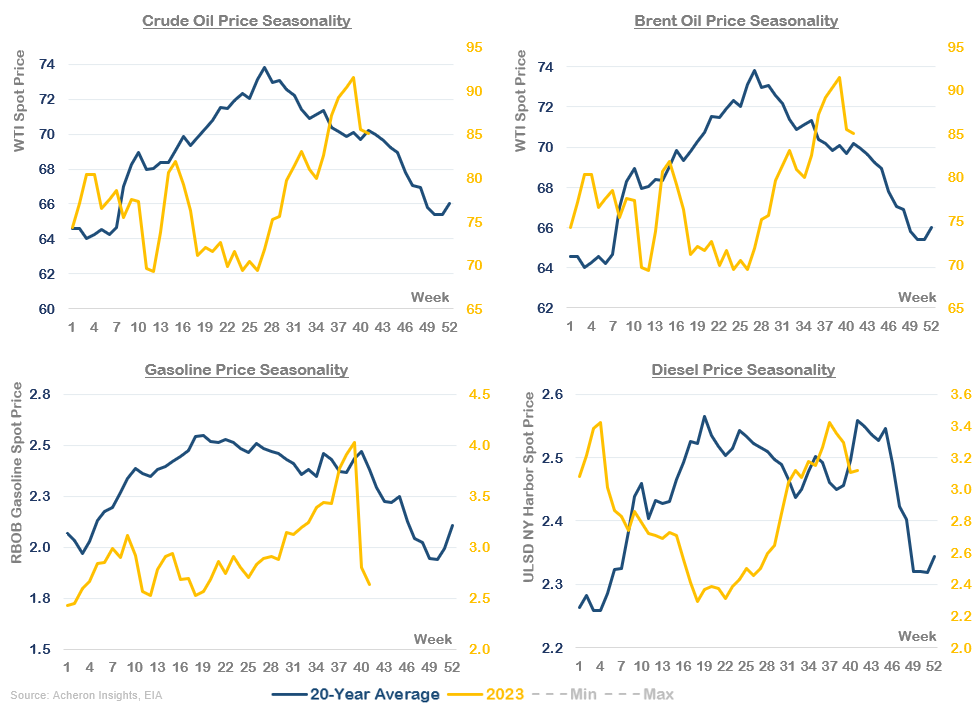

On the other hand, it is also worth noting we are now entering the worst seasonal period for oil prices in the final few months for the year. The northern hemisphere’s summer driving season is behind us, although it must be said seasonal swings in demand have had very little impact on price movements this year, as supply shortages have been the primary market driver.

A Few Words on the Geopolitical Landscape

Following the renewal of the Israel-Hamas conflict earlier this month, geopolitical risks for the oil market are again front and center for investors. As it stands, the geopolitical landscape and its implications for energy markets are very broad, ranging from immaterial to disastrous.

Of course, what it happening in the Middle East is sad on both sides, and while I will refrain from making any geopolitical predictions as they are nearly impossible to do so with accuracy, it is worth highlighting a few possible outcomes and their implications for energy markets.

As it stands, the ~$2-$3 geopolitical premium that looks to have been priced in is probably about right.

Summary

In summary, I remain cautiously bullish about oil, though my belief that oil will struggle to crack into the triple digits (barring geopolitical escalations) remain. The indicators of the physical market overall remain tight, with the only concern being an oversupply of gasoline.

Unless we see indicators of the gasoline market improve in the coming weeks and a return of sustained inventory drawdowns across the board, I will continue to take profits when and where appropriate, particularly as speculative positioning is looking very stretched.