Key Points:

- Crude Oil Breaches 200-Bar MA.

- Downside risks dominate.

- Bearish MA crossover.

Crude Oil has had a relatively rough week as prices have continued to decline steadily towards the $40.00 handle without any end in sight. The primary factor in last night’s tumble appears to be continuing worries over an oil supply glut that is persisting within world markets. In addition, the glut now appears to also be moving into gasoline and distillate supplies as producers attempt to push the raw product through the supply chain. However, technical analysis is now suggesting a deeper decline for the commodity as the bears start to swarm.

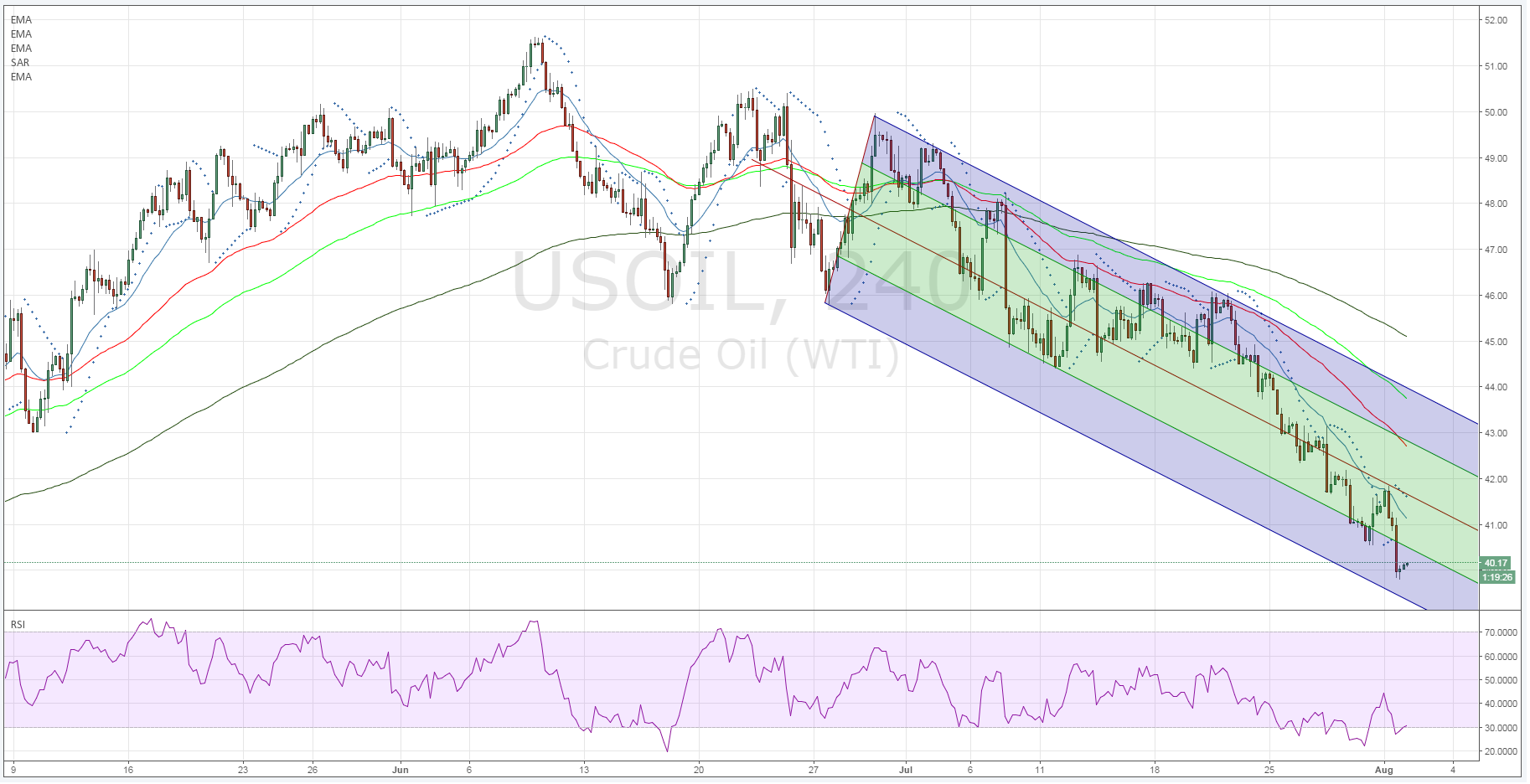

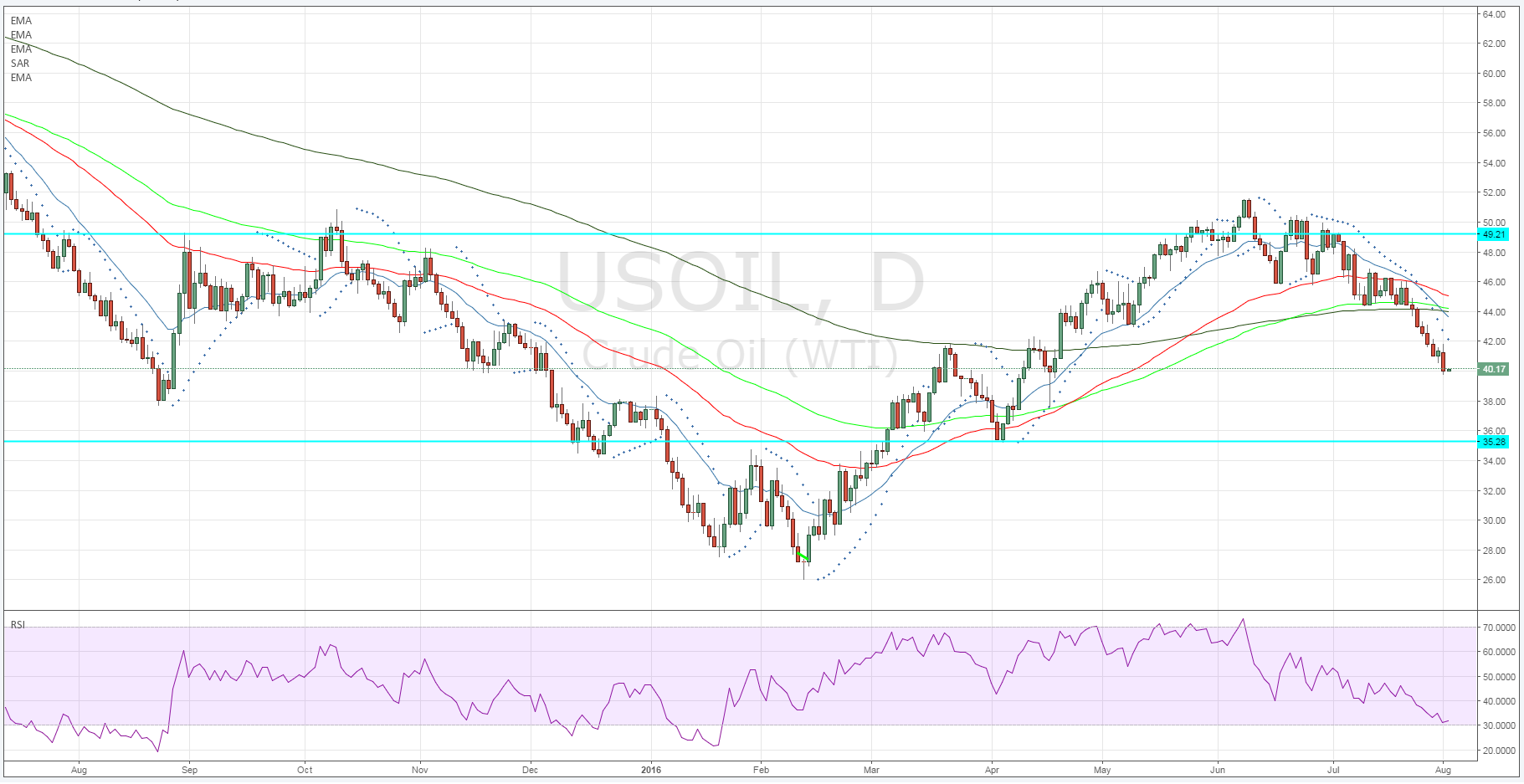

The technical indicators for crude oil are currently relatively poor but price action’s recent breach of the 200-DMA has predisposed it to a further decline in the medium term. In fact, the 20, 60, and 100 Day moving average are also relatively bearish with a crossover to the downside evident. Subsequently, there is a very clear case for substantially lower oil prices over the next few months. However, in the short term we may see a period of moderation around the key $40.00 battleground due to the fact that the RSI Oscillator is currently near to oversold levels on the daily time frame.

Figure - Crude Oil Daily Timeframe

Fundamentally, there is a very clear ongoing imbalance between demand and supply which is likely to require significantly lower prices to re-establish a viable level of output. Obviously, this can be achieved through production cuts but, given the current level of divisiveness between OPEC members, that seems an unlikely prospect. This largely leaves market forces to effect the required rebalancing, and that means lower prices and plenty of additional pain to go around. This also implies that any short term rallies will be self-defeating as supply returns to the market at the higher price points.

Ultimately, crude oil is heading in only one direction, both fundamentally and technically, and that is down. The next few weeks are likely to be relatively negative for oil and we could very well see a push towards the $38.00 handle and the $35.28 support zone in extension. In short, a return of the bears is almost a certainty at this stage so get ready for another leg lower.

Figure - Crude Oil 4-Hour Timeframe