The crude oil market is witnessing a notable surge, with a barrel of Brent escalating to 87.70 USD.

This uptick in commodity prices comes amidst an intensifying conflict between Arabian and Israeli forces. The current armed clashes arise from a longstanding, simmering dispute that periodically intensifies. Should the conflict persist, prices for energy carriers may venture even higher.

In the forthcoming week, the market anticipates new reports from the International Energy Agency (IEA), the Organization of the Petroleum Exporting Countries (OPEC), and the US Department of Energy, which will shed light on the global oil supply and demand dynamics.

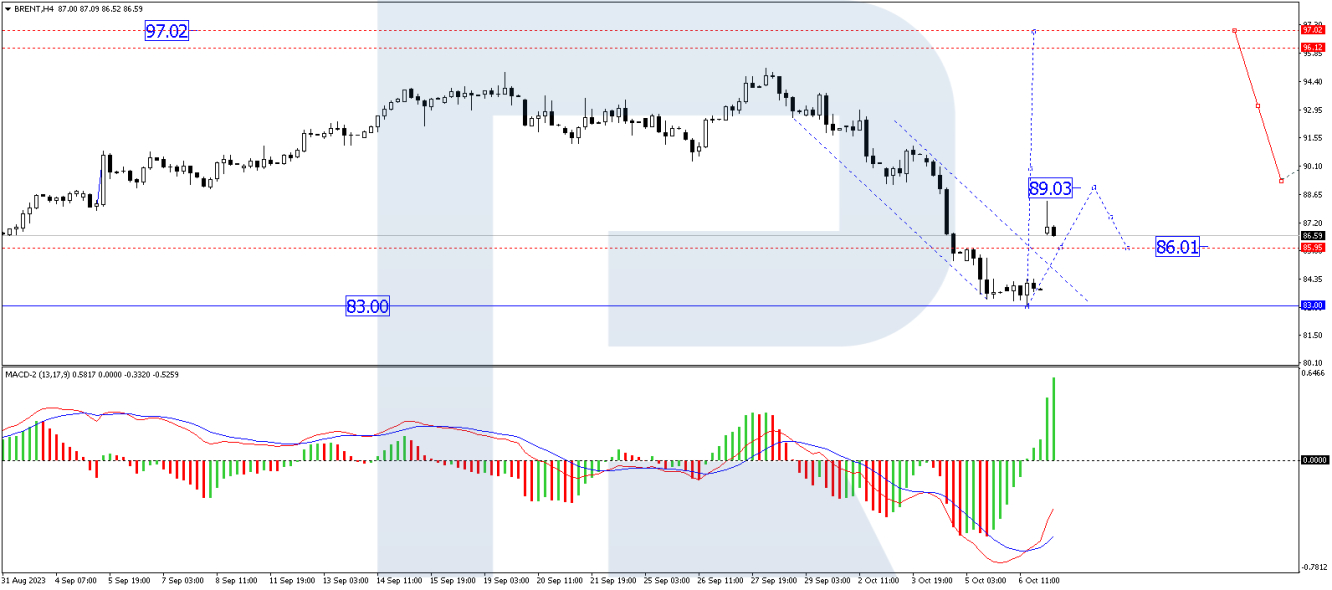

Brent Oil Technical Analysis

On the Brent H4 chart, a corrective movement to 83.00 has been observed. The market is currently forming a growth impulse toward 89.00. Upon reaching this level, a correction down to 86.00 may ensue. Subsequent to that, another wave of growth to 89.00 is anticipated. Should this level be breached upwards, there is the potential for a climb to 94.00, potentially even advancing to 97.00. The Moving Average Convergence Divergence (MACD) provides technical confirmation for this scenario, with its signal line oriented sharply upwards, and expectations that the indicator will explore new highs.

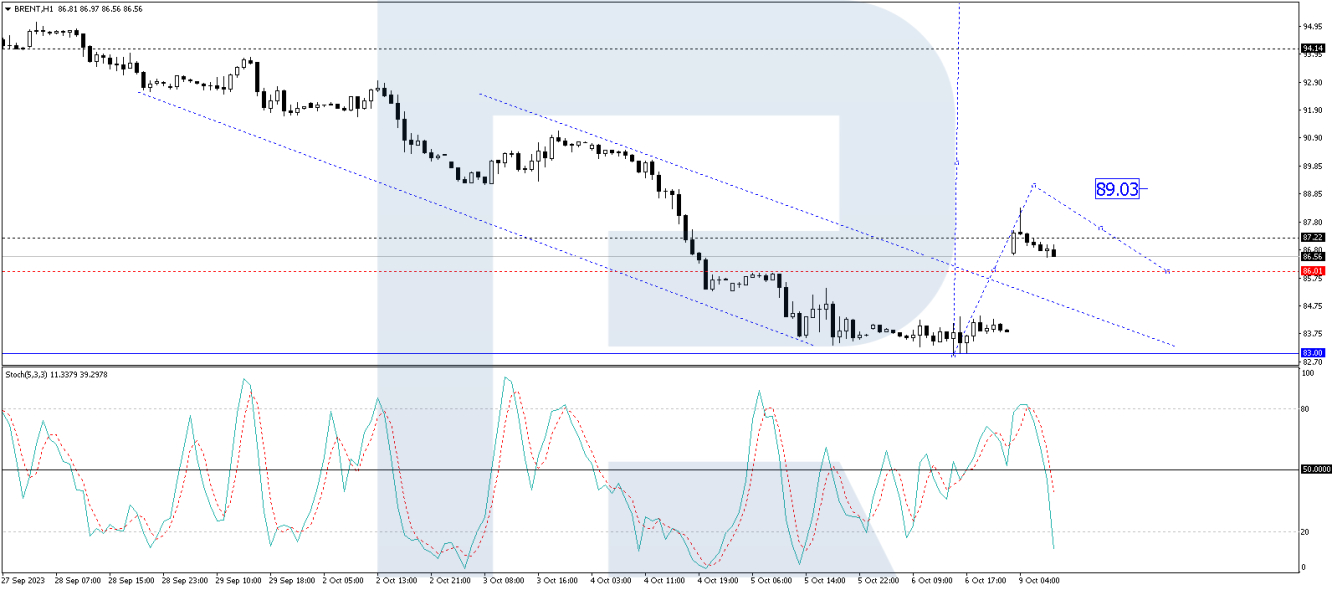

On the Brent H1 chart, a correction to 83.00 has concluded, and today’s market activity has produced a growth impulse to 88.33. A downward motion to 86.00 is anticipated, to be followed by an ascent to 89.00, which is identified as the initial target. The Stochastic oscillator provides technical validation for this scenario, as its signal line is directed sharply downwards toward the 20 mark. Subsequently, it may surge to 50, and should this level also be breached upwards, the potential for an ascent to 80 might be unlocked.

Conclusion

The escalating Arabian-Israeli conflict is casting its shadow over the crude oil market, propelling prices upwards amidst the turmoil. The market will be attentively observing upcoming reports from major energy organizations and aligning strategies with unfolding geopolitical and economic events. Technical indicators suggest possible further upticks in price, but as always, traders must navigate with caution amidst such volatility and uncertainty.

***

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.