This week’s Crude Oil inventory figures showed a large draw on reserves which would usually give the Oil bulls cause for celebration. So why was Oil sold down to a fresh 7-year low?

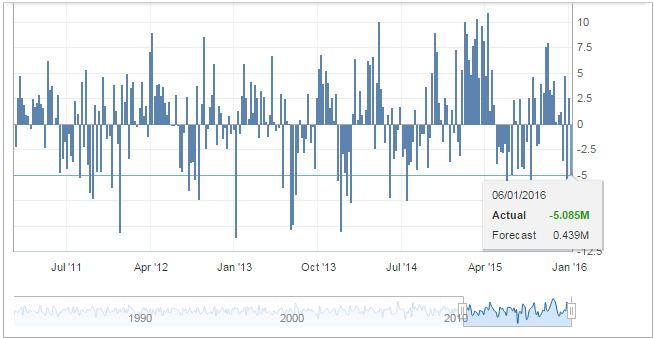

The weekly Energy Information Agency (EIA) Inventory data showed a large draw of -5.08m barrels of Crude from the brimming stockpiles. The oversupply in the Oil market is well entrenched at present which is why Oil was trading at (or close to) 7-year lows. Oil rallied briefly on the result, lifting as high as $35.13 a barrel before the market got a chance to digest the news.

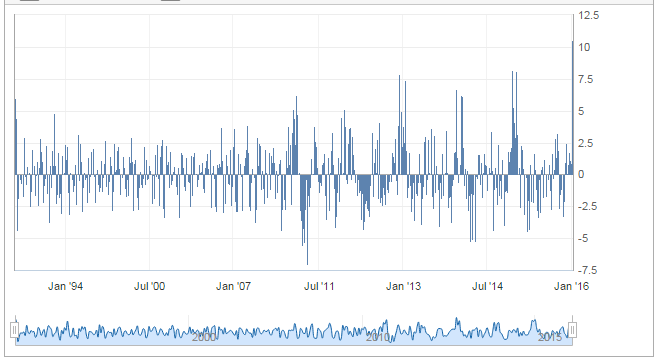

It was not long before Oil had shed over $1 per barrel, plunging down to yesterday’s low and a new 7-year low at $33.76. The devil was in the details which showed an enormous build in gasoline stockpiles, of +10.58m barrels as well as a +6.31m barrel build in distillate products. The rise in gasoline stockpiles was the largest since 1993 which says more about the demand-side than the supply-side.

The oversupply is still well and truly in place, and softer US consumer demand for gasoline products, especially over the holiday period, is cause for concern. The WTI Crude Oil stockpiles at Cushing, Oklahoma have hit an all-time high at 63.9m barrels. There are also issues on the supply-side which are contributing to the price weakness.

The tensions between Iran and Saudi Arabia could see the Oil price war shift into another gear. The tensions over Saudi Arabia’s decision to execute controversial Shia cleric Nimr al-Nimr at the weekend have caused an escalation to already-existing tensions between the two nations, and that will make any OPEC agreement on production targets all but impossible. Saudi Arabia’s allies Bahrain and Sudan have cut off diplomatic ties with Iran which will likely escalate the situation further.

Saudi Arabia’s oil minister has vowed to keep on pumping Oil, presumably in order to hurt rival producers further, but they also expect demand to pick up in 2016. This point is up for debate, especially with renewed fears over the economic health of China. As we have seen above, consumer demand in the US may be showing signs of fatigue, so it is difficult to see where the pickup in demand is going to come from.

Meanwhile, Oil touches a fresh 7-year low and is merely 60 cents away from hitting prices not seen since 2004 as it comes under pressure from both the supply-side and the demand-side with no let-up in sight.