Oil shows double-digit growth rates in the morning, reaching $26.90 (+10.5%) per barrel of Brent in the spot market. The U.S. WTI reached $19.6 earlier today, adding over 50% against Tuesday’s lows when it was down to $13. Several factors support the recovery of prices – from growing investor optimism to signs of the balance recovery beginning. In the case of the United States, we see signs of progress towards the balance both on the supply and demand sides.

Firstly, the change of sentiment on the Oil took place against the stabilization of the world financial markets. The news about the success of testing the Remdesivir became a fresh driver. Besides, countries report about the gradual easing of restrictions and hope that demand will start to recover further.

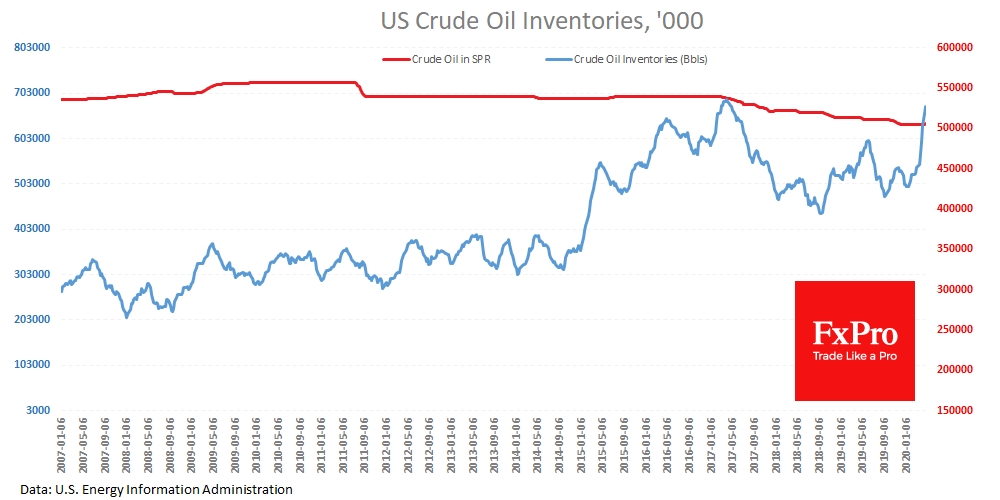

Weekly data showed an increase in commercial stocks in the U.S. by 9 million, less than expected 11.2 million, and markedly below the growth of 15 million and 19.2 million in the previous two weeks.

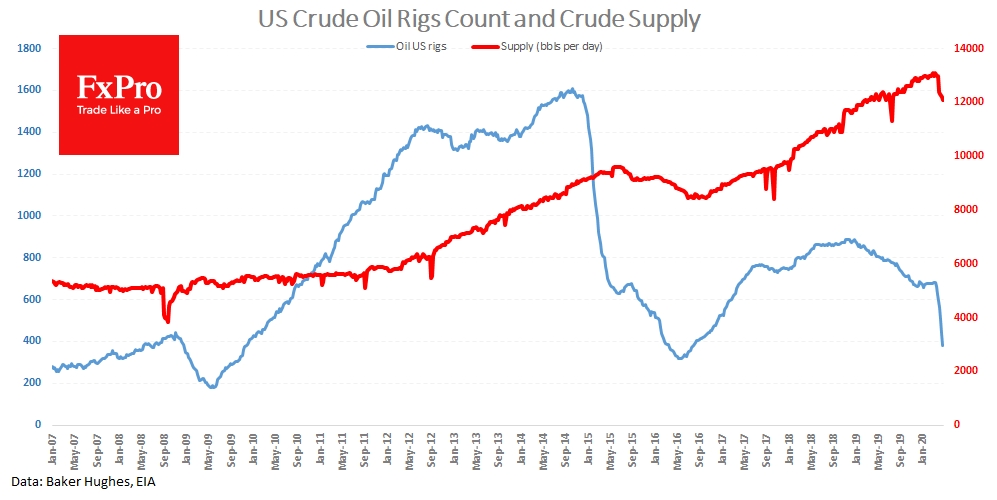

Interestingly, production has been declining very slowly. Last week’s average daily production was 12.1 mln, i.e. -0.1 mln against the previous week and -1 mln against historical peak levels in mid-March. Other weekly data from Baker Hughes show an extremely sharp decline in drilling activity. However, these figures may be 6-9 months ahead of production as an indicator of sentiment for next year.

In our view, it is worth noting an increase of 1mln barrels in U.S. strategic storage (SPR). This is a small, but very symbolic increase, because before that the volume of Oil in SPR had been gradually declining for three years.

Apart from this, OPEC countries and some other major producers announce their production cuts. Previously agreed cut by about 20% from OPEC+ comes into effect in early May. Additionally, Norway promises to reduce its production and suspend work on new projects until the end of the year.

All this is not so much a goodwill gesture and a desire to save the Oil from decline, but rather an economically logical step to secure the status quo in the share of production and at the same time to support prices.

In any case, the positive dynamics of Oil is an additional stabilizer of market sentiment, bringing back interest in buying risky assets and allowing hope that the worst moment has already passed.

The FxPro Analyst Team