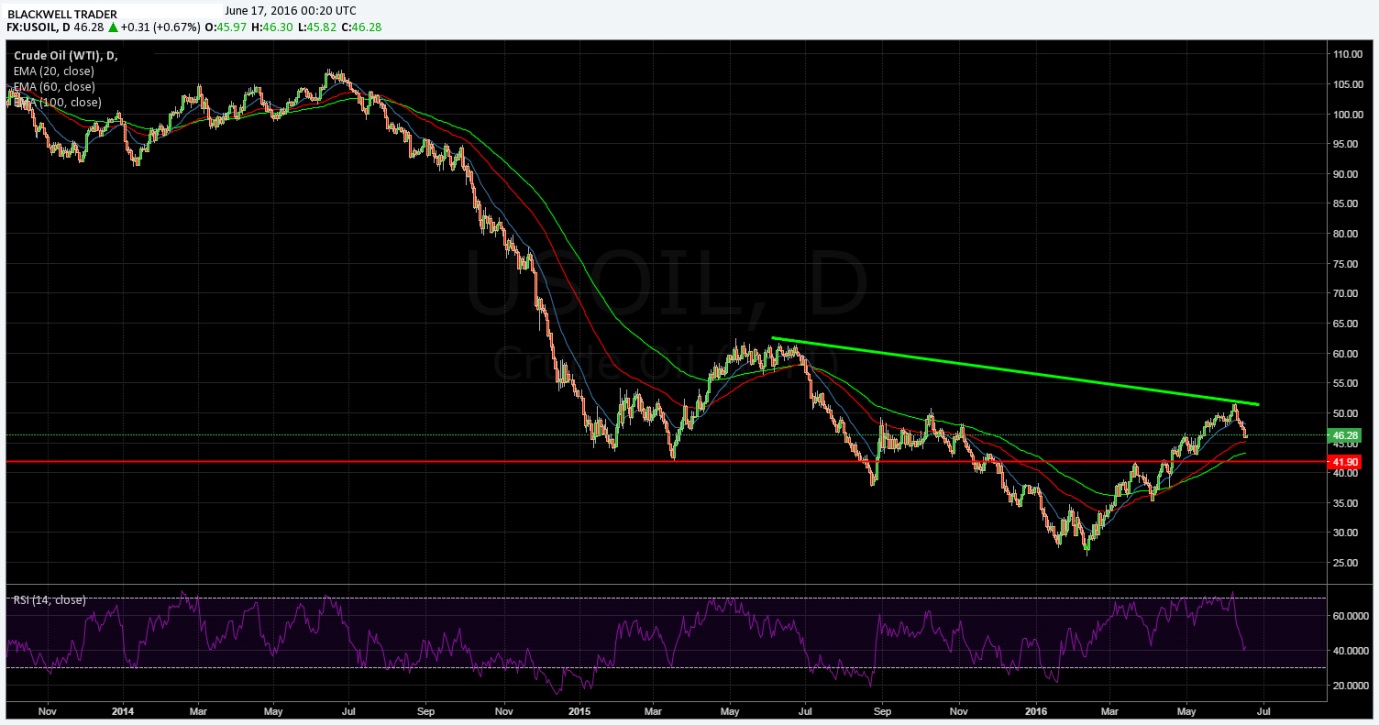

Crude oil futures continued to slump overnight as concerns over global energy demand continued to grow. Subsequently, WTI prices remained under pressure as the bears pushed the commodity down towards the $45.98 mark overnight. However, this could just be the start of a medium term slide for crude given the failing fundamentals and a US economy that appears too weak to support near term rate hikes.

Despite oil’s rally over the past month, it really isn’t a surprise that bears now largely appear back in control of the market. Following a modest draw of 900k barrels, according to the EIA, the commodity managed to pare back some of its losses but the bearish trend largely remained in play. Although the headline crude inventory figure was less bullish than expected, it still played a large part in stemming some of the losses.

However, structural imbalances within crude oil markets still remain and are likely to continue to dominate oil’s long-run outlook. Primarily, there is an abject lack of demand for the commodity with productive efficiency skyrocketing whilst consumer use languishes. Adding to the bearish view is the US Federal Reserve’s latest round of dovishness which saw the central bank continuing to delay any form of hike to the Federal Funds Rate (FFR).

Subsequently, the Fed’s current policy of “wait and see” seems to imply that the US economy is not yet robust enough to survive monetary tightening. This fact is also relatively borne out by the recent poor US Jobs print as well as sliding business inventories. It is therefore no surprise that this slowing of economic activity is seen within crude oil markets.

Ultimately, oil could potentially be facing a tough finish to 2016, as global economic growth appears to be moderating. Given the relative glut of crude oil stocks remaining upon the market, it is unlikely that the commodity will be seeking to rally sharply back above the $50.00 a barrel mark anytime soon.

The bottom line is that the current market fundamentals favour the bearish contention and are likely to remain so in the medium term.