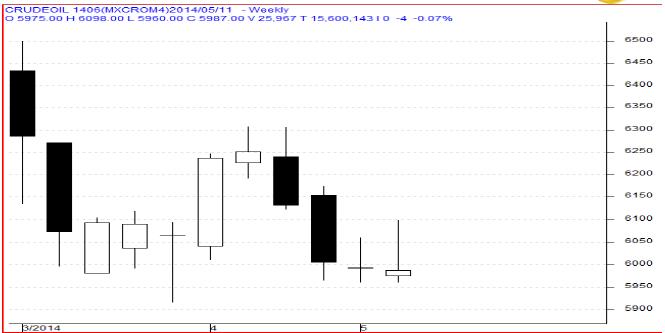

MCX Crude oil June as seen in the weekly chart above has opened the week at 5,975 levels and during this week price made a low of 5,960 levels. During this week prices bounced from the weekly lower levels towards the weekly high of 6,098 levels. At the end of the week as expected prices could not able to sustain on higher levels and corrected back towards 5,965 levels. During this week price are able to close below the previous week’s closing of 5,991 levels and finally closed 0.07% lower at 5,987 levels. As per the candlestick pattern it formed “Inverted Hammer Pattern” on support levels which represent a trend reversal.

For the next week we expect Crude oil prices to find support in the range of 5,920 – 5,900 levels. Trading consistently below 5,900 levels would lead towards the strong support at 5,780 levels.

Resistance is now observed in the range of 6,050-6,100 levels. Trading consistently above 6,100 levels would lead the rally towards the strong resistance at 6,200 levels, and then finally towards the major resistance at 6,300 levels.

MCX / NYMEX Crude Oil Trading levels for the week

Trend: Sideways

S1 – 5,900 / $ 100.60 R1 – 6,100 / $ 104

S2 – 5,780 / $ 98.60 R2 – 6,200/ $ 105.80

Weekly Recommendation: Buy MCX Crude Oil June between 5900 – 5920, SL - 5780, Target – 6100 / 6150.