Crude oil for most active February expiry at the NYMEX finished on a weaker note, though managed to take a small pull-back from the lows of the day on Thursday. By the end of the trading session WTI oil was lower by 0.75% to $91.65 per barrel wherein it hit a low of around $91.25 per barrel during the late evening trade. In the Indian markets however, we saw crude oil prices for most active January expiry at MCX finished with a big loss of around 1.4% to Rs 5705 per barrel, as our prices took negative cues out of the Rupee and also International oil prices took some pullback post our market closure.

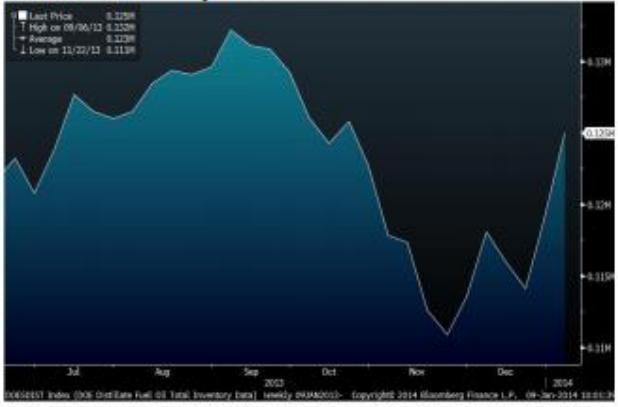

There are no major cues as per the oil markets are concerned in the US. The selling pressure over the last two trading session was backed by highly weaker than expected US weekly inventory report. The major negative surprise out of the report was the strong increase in stockpiles of distillate fuel which includes diesel and heating oil and sees higher demand in the winter season in the US. Distillate stocks for week ended January 3rd rose by 5.83 million barrels. Separately the report added US crude production rose 24,000 barrels a day to 8.15 MBPD, the most since September 1988.

While US based oil fell significantly in last two days, Brent was a better performer amidst some cues like the Buzzard oil field in the North Sea was halted and gunmen blew up a pipeline in northern Iraq. The spread between the two major global benchmarks inched higher to $14.75 per barrel while during Intraday trade it also hit a high near $15.40 per barrel.