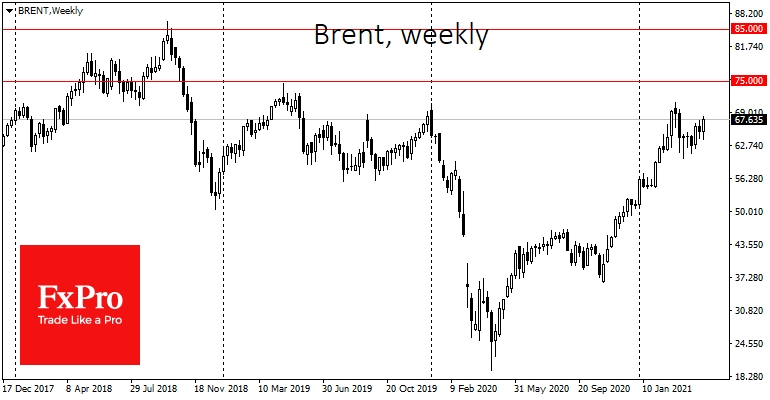

The oil price is ready for further growth, and this year it might consolidate in the area of $70-75, not ruling out bounces up to $85.

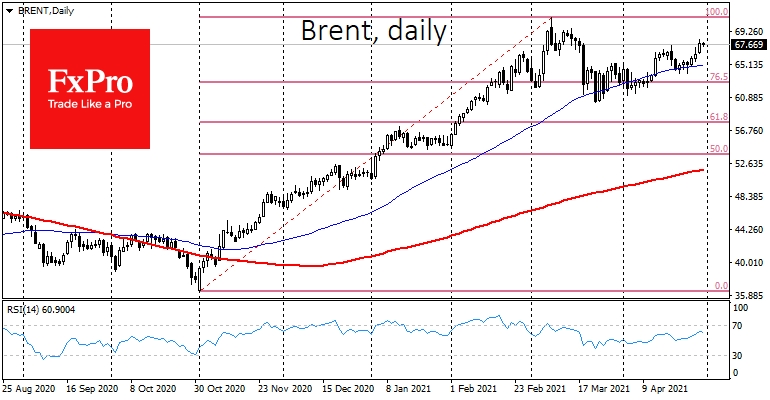

The rally in early November overheated the price by March, which turned out to be a natural correction from the peak levels of the previous month. The price corrected by 15% from the peak, where it received support. Despite the bull and bear manoeuvres, subsequent lows and highs were higher than previous ones.

The support signal was given by the 50-day simple moving average, attracting buyers and pushing the price up. The 50-day average is the medium-term trendline, which is now clearly bullish.

Earlier in April, oil's attempt to break away from the uptrend support line was halted at $67.50 per barrel of Brent, where a strong sell-off started in March. Gradually gaining strength, the price has now returned to that level, making a second attempt to break away from the moving average.

Many would agree that oil has a high chance of rising significantly. The pullback in March knocked the local overheating out of the market, clearing the path for a further rally after the correction.

For cautious traders, confirmation of further bullish momentum would be when previous highs near $70 for Brent are surpassed.

Should the bulls succeed, quotations may head towards the upper boundary of the next $70-75 range rather quickly. A strong recovery in major developed economies and continued soft monetary conditions could send the price looking for a ceiling to $85 before the end of the year, an area of 2018 highs.

Just look at recent metal and agricultural prices to see how the rally in commodity prices could become sharper and more prolonged than looks rational to most.

It is worth noting that a sharp increase in supply can stop price rallies on the risk side. Unlike metals and agriculture, the oil supply is artificially restrained. Therefore, its price has more limited upside potential than, say, copper or soybeans.

One year after the historic OPEC+ production cuts, quotas remain markedly lower, but prices are already above pre-pandemic levels. This is the result of production restriction that several participants are not comfortable with. Potential to quickly increase Crude Oil production will hold back the ascent of oil prices, preventing levels above $80 from being seen as sustainable long-term.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Crude Oil Gets Set For Another Round Of Growth

Published 04/30/2021, 03:40 AM

Updated 03/21/2024, 07:45 AM

Crude Oil Gets Set For Another Round Of Growth

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.