All Eyes Are On The OPEC Meeting Tomorrow In Vienna, Austria.

Crude oil surged on Friday as investors turn their focus to the highly-anticipated meeting of oil producers this weekend, amid fueled expectations for a global production deal will be yielded from this OPEC (Organization of the Petroleum Exporting Countries) conference in Vienna.

In particular, oil prices strengthened as non-OPEC countries are monitored to agree to curb oil production to reduce a global oversupply. Additionally, Saudi Arabia has been reported to have informed its consumers this week of cuts to their January crude oil inventories to submit to the latest agreement in OPEC.

OPEC will meet non-OPEC producing countries in Vienna on Dec. 10, in hopes non-OPEC will commit to curbing 600,000 barrels per day after its own members granted to cut 1.2 million bpd in the previous week.

OPEC sources said nine non-OPEC countries were set to join the meeting, namely: Azerbaijan, Kazakhstan, Oman, Mexico, Russia, Sudan, South Sudan, Bahrain and Malaysia.

Only Russia and Oman have pledged cuts coming from non-OPEC oil producers. Contrarily, Kazakhstan intends to increase output in 2017 as it launches the long-delayed Kashagan project.

Brent Crude

The commodity has been mostly lifted this week, although worries lingered over whether OPEC’s planned output cut will be enough to lower the global supply glut. As of writing, US crude futures for January delivery inched up 1.04% or 54 cents to $51.39 a barrel.

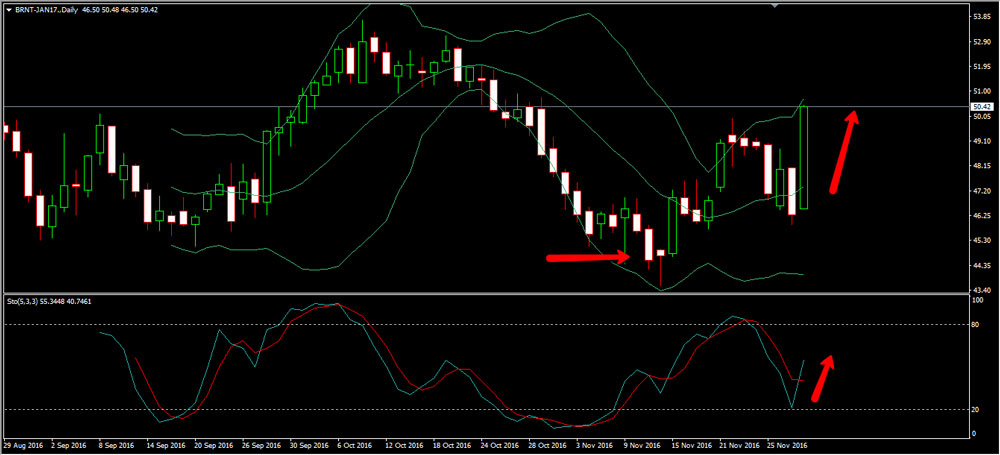

In London, the February Brent crude contract climbed 0.65% or 39 cents to trade at $54.27 per barrel on the ICE Futures Exchange. On the chart below, Brent has hit a one-month high with this growing anticipation for an output cut agreement. It reached multi-month lows on November 11 as OPEC pointed to an even bigger oil surplus in 2017 as inventory increased at that time.

However, with the Vienna meeting drawing near and ignited hopes for a production cut agreed upon oil producers, oil prices are on a rally.

Saudi Arabia

Saudi Arabia has reportedly told its US and European customers that it will decrease oil deliveries from January as Russia indicated that a commitment from non-OPEC producers to join OPEC's plan to curb output is a little rocky.

“We told our customers of the allocations and the compliance with allocations (for the cuts) for Saudi Arabia is 100 percent,” the source familiar with the matter said. He said cuts to Asian refiners would be lower than those to Europe, the United States and to major oil companies.

“We are cutting more in the U.S. because the inventories ... are very high,” the source added.