-

Crude oil rises to its highest price since early March

-

Resistance at the half-century mark in NYMEX crude oil futures

-

Inventory data is not bullish: Tightness in the forward curve

As of the end of last week, the continuous NYMEX WTI crude oil contract continued to rise from the ashes as it recovered by nearly $90 per barrel after falling far below zero on April 20. The seaborne Brent North Sea crude oil futures on the Intercontinental Exchange (NYSE:ICE) rose by over $36 per barrel on its continuous futures contract.The landlocked NYMEX futures fell to lows as there was nowhere to store the energy commodity as the May contract expired. Anyone holding futures contracts on April 20 without access to storage and the ability to take delivery in Cushing, Oklahoma, was forced to sell at any price. The drop in Brent caused panic among oil-producing nations worldwide, including OPEC members and Russia, as energy demand evaporated during the pandemic’s spread.

After months of a substantial price recovery, the crude oil market could face some headwinds as the prices are reaching the half-century mark, and we move towards 2021. Bullish and bearish factors pull the crude oil price in opposite directions as it continues to take the stairs to the upside. The United States Oil Fund (NYSE:USO) and the United States Brent Oil Fund (NYSE:BNO) follow the prices of the crude oil benchmarks that trade on the NYMEX and Intercontinental Exchange.

Crude Oil Rises To Highest Price Since Early March

The elevator ride from over $40 per barrel in late October to a low of below $34 on the continuous NYMEX crude oil contract on Nov. 2 turned out to be a false breakdown. Throughout November and December, crude oil got back on the staircase to the upside.

Source: CQG

As the weekly chart highlights, the oil price rallied over the past seven consecutive weeks, reaching a high of $49.28 per barrel last week, the highest level since the final week of February.

Resistance At Half-Century Mark In NYMEX Crude Oil Futures

Nearby NYMEX crude oil futures could run into some congestion and technical resistance at the $50-per-barrel level. The last time the price of the energy commodity was north of the half-century market was 10 months ago. Meanwhile, Brent futures are already above $52 per barrel.

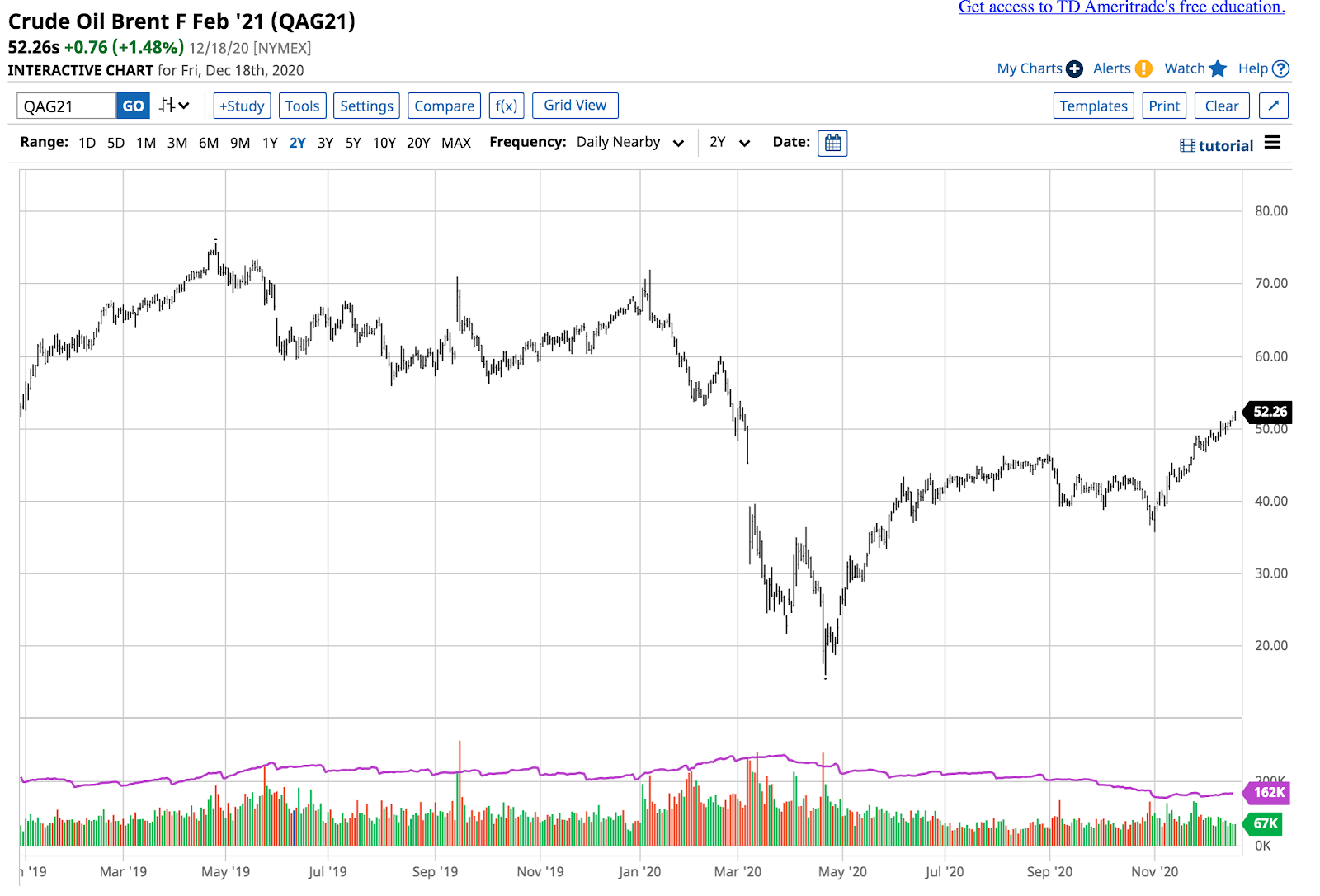

Source: Barchart

As the chart illustrates, the nearby February Brent crude oil contract closed last week at $52.26 per barrel level.

Inventory Data Not Bullish: Tightness In Forward Curve

Inventory data from the American Petroleum Institute and Energy Information Administration has not been very bullish for the crude oil market. The ongoing COVID-19 pandemic continues to weigh on the demand for the energy commodity.

Since the week ending on Oct. 2, the API and EIA reported inventory builds of 2.768 million and 7.70 million barrels of crude oil, respectively, as of the week ending on Dec. 11. Gasoline stocks rose by 9.631 and 10.70 million barrels. Both reported declines in distillate stocks of between 21.5 and 21.90 million barrels over the period. The data suggest that the petroleum and oil product markets continue to suffer from demand concerns considering declines in production in the U.S. and from OPEC+.

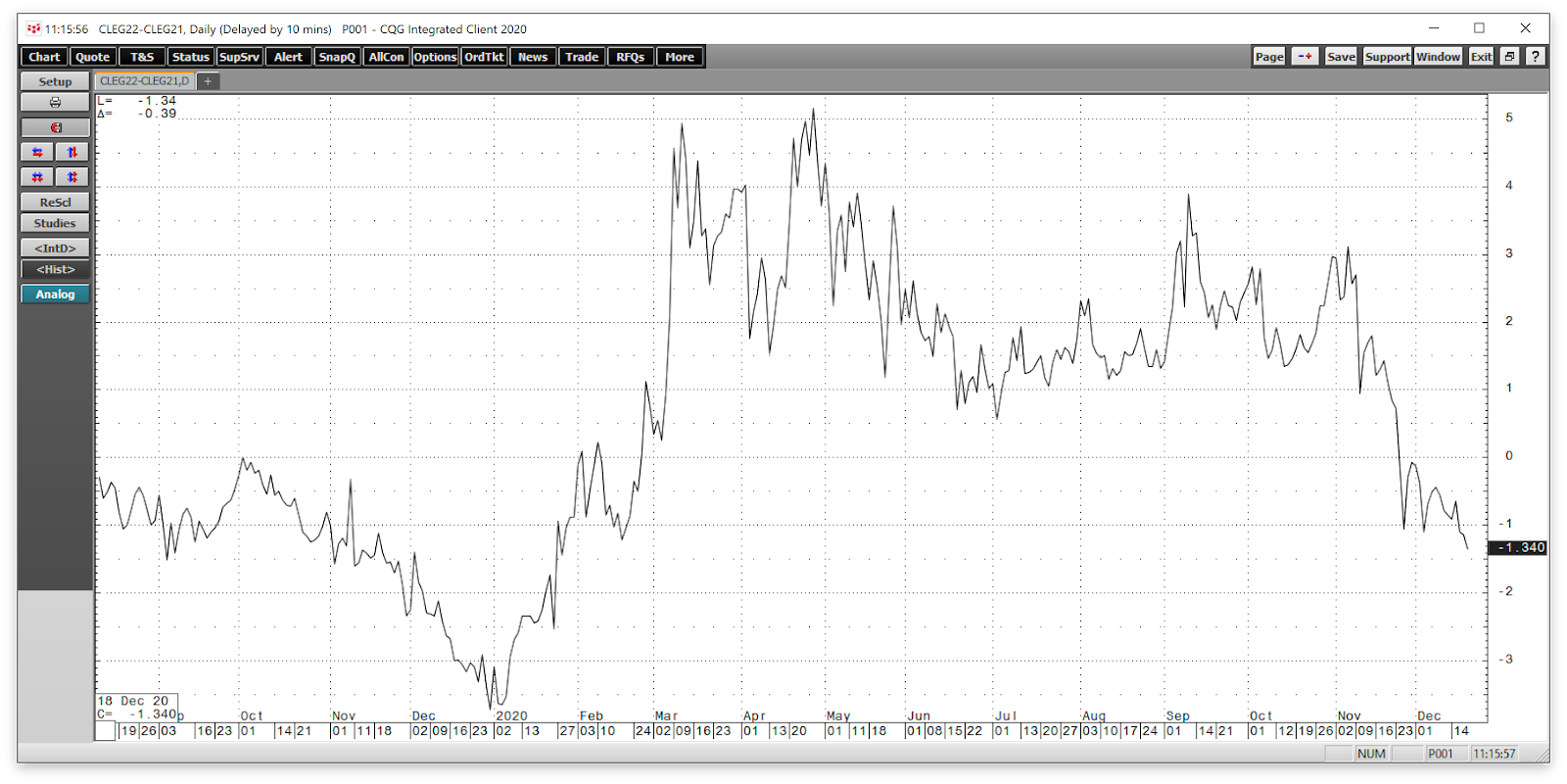

Meanwhile, tightness in the spread between NYMEX crude oil for delivery in February 2021 and February 2022 is a sign of rising supply concerns.

Source: CQG

The chart of NYMEX crude oil for delivery in February 2022 minus February 2021 shows the market’s term structure moved from a $3.11 contango in early November to a $1.34 backwardation at the end of last week. The shift in the forward curve as the price of crude oil appreciated over the past weeks signifies nearby tightness for the energy commodity. Brent crude oil futures for the same period were also trading at a $1.19 backwardation for the same period.

Aside from the rising price, the tightness could be coming from concerns over the recent assassination of Iran’s top nuclear scientist. The Middle East is home to half the world’s crude oil reserves. Political turbulence in the region tends to cause supply concerns to rise.

An End To Pandemic Bullish, And So Is Path Of U.S. Energy Policy

The demand for energy is likely to increase in the aftermath of the COVID-19 pandemic. Meanwhile, increased regulations and a shift to a greener U.S. energy policy could cause a decline in U.S. output under the incoming Biden administration. U.S. output reached a record 13.1 million barrels per day in March. We are not likely to see that level given the change in administrations on Jan. 20, 2021.

Crude oil continues to take the stairs to the upside after falling to a bottom in early November. While there are some headwinds for the oil futures market, the path of least resistance remained higher at the end of last week. Expect lots of volatility in crude oil in 2021 as the energy commodity continues to provide power to the world.