Key Points:

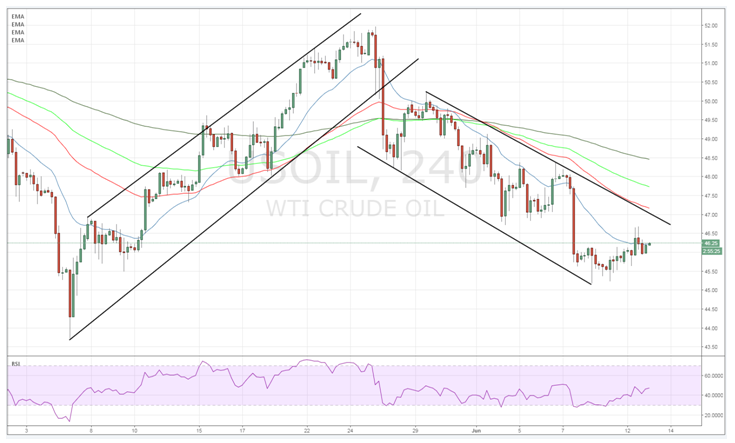

- Crude oil trending within a relatively strong bearish channel.

- Price action has discovered some support and RSI is now trending higher.

- Watch for a breakout of the descending channel in the week ahead.

Global crude oil prices have seen plenty of volatility over the past month as the commodity has faced a variety of fundamental and technical pressures. In particular, an ongoing schism between Qatar and Saudi Arabia kicked off mounting speculation that the OPEC production cut agreement could be in trouble following sanction levying. Subsequently, WTI prices have dived of late with the oil benchmark having recently reached a low at $45.19 before rising to trade around its current level at $46.25 a barrel. However, it remains to be seen if crude prices can maintain some buoyancy in the face of a strongly descending channel.

Taking a look at the commodity's current technical factors shows the decision that the market is presently facing. WTI’s price action has been relatively strongly depressed over the past few weeks and has been, subsequently, trending lower within a strongly bearish channel. However, the commodity appears to have bounced back from a recent low and the RSI Oscillator is now rising away from oversold levels.

Regardless, crude oil is likely facing an uphill battle given the strength of the descending channel and the fundamental bearishness that is swirling around the commodity. However, on a brighter note, the recent low at $45.19 occurred within a key reversal area and price action is now trending towards the upper channel constraint. Subsequently, if crude prices can break above the $46.75 mark we are likely to see some gains back towards the $48.00 handle.

In fact, there are already some fundamentally bullish moves occurring with the latest U.S. Inventory figures showing declines and news that Sinopec (amongst other nations) is considering output drops to curb the current glut. In addition, lower Saudi exports are likely to have an impact on global markets in the coming week which adds to the sense that we may see a fundamental rise in prices.

Ultimately, there is still plenty of selling present and an ongoing bearish appetite for the commodity. However, it appears we might have currently plumbed the short term lows and the most likely scenario is now a move to the upside and towards $48.00 a barrel in the coming days. Therefore, monitor the WTI prices closely for a break above the descending channel to signal the start of the move.