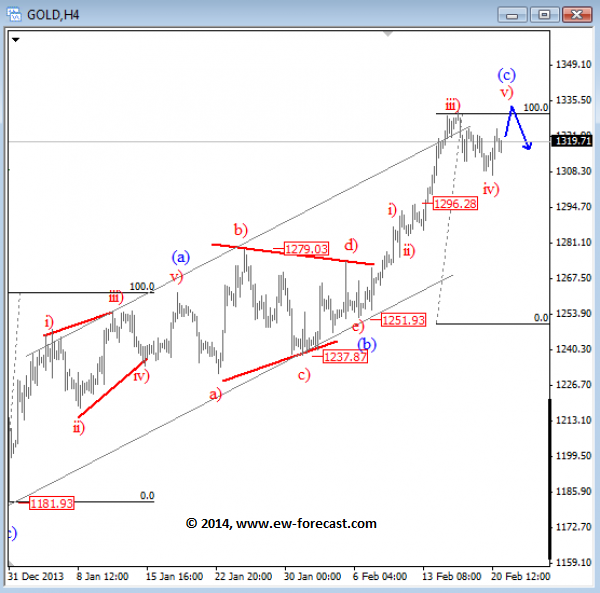

Gold has moved well above 1300 mark, and is forming an extended leg from 1251, triangle low. Notice that we have adjusted the wave count, but we see a corrective advance from 1181 now at 1330 resistance. We are observing more simple count now this time; a zigzag with a triangle placed in wave (b). We also know that wave (b) pattern CANNOT be labeled as wave two, because triangles never occur in wave two position. So, because of that situation we are even more confident that rally is a contra-trend and that gains will be limited. A decline beneath 1290 area could be an important sign for a confirmed top.

Gold 4 Hour Analysis

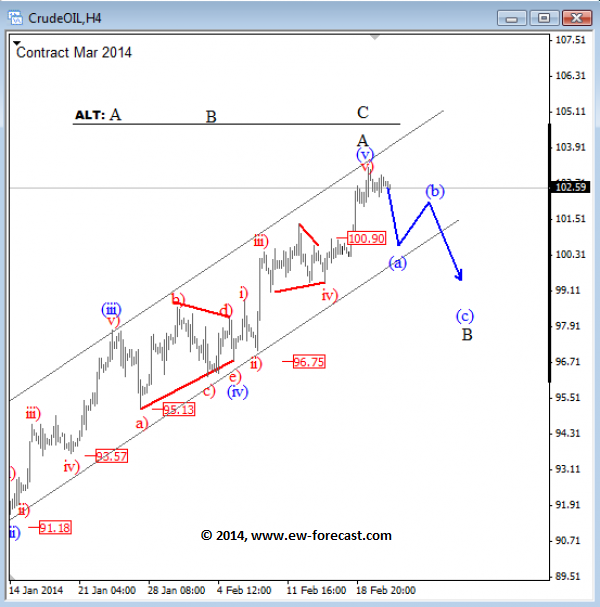

Crude Oil extended gains above 102 in the past 24 hours, which makes the move from 96.75 an extended one. We still see that leg as wave (v), final leg in wave A that should send price down in wave B in the next few sessions and days. An impulsive drop back to $100 would suggests that wave B in already progress.

Oil 4 Hour Analysis