Crude oil has experienced a significant decline over the past week which has led some to connect the fall with the events unfolding in Greece. However, the Greek debt crisis has little to do with crude oil’s bearish run as compared to the current global over supply of the commodity. The key to understanding crude oil’s current trend requires an analysis of the fundamental factors of supply.

A recent surge in OPEC production has added to the current supply imbalance, with Iraq crude production reaching record highs at the end of June. This surge in Iraqi production has sought to increase OPEC’s supply to 32.134mb/d. In a strategy designed to drive high cost producers out of the market, OPEC members reached an agreement in June to maintain production above the key 30mb/d mark.

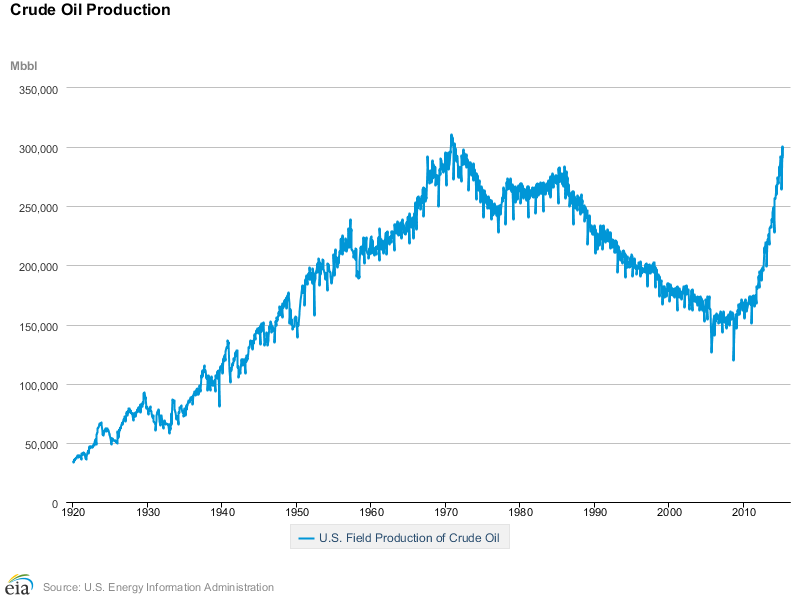

However, US rig count increases are also adding to the growing supply imbalance as the key indicator signals its first rise since December 2014. Last week saw the US rig count increase by 12, including 7 horizontal rigs, in a move that is likely to add pressure to the current oil stockpile at Cushing. The rise in US domestic production is surprising given that the rig count suggests WTI prices near the $60.00/b mark. However, additional efficiencies have been sought during the recent decline in prices and we are now seeing that investment come to fruition. The current rig count predicts domestic oil production levels of 135kb/d across the Rsp Permian (NYSE:RSPP), Eagle Ford, Bakken Energy Corp (OTC:BKEN), and Niobrara shale plays.

Another concerning factor is the diminishing refinery margins which tend to indicate the oil glut is impacting other parts of the supply chain. Despite oil demand exceeding forecasts this year, refinery margins have declined sharply in Singapore. As the current supply imbalance worsens, refinery margins are expected to tighten significantly. In a section of the supply chain where margins are already thin, this is a concerning development.

The final hammer that is likely to further impact the supply imbalance is the re-appearance of Iran as a producer to be reckoned with. Recent news coverage seems to indicate that a potential nuclear deal with Iran is imminent. Although cementing a deal with the Iranians is like walking through a mine field, the risk of a significant increase in heavy crude is real.

The initial response to the lifting of sanctions against Iran would likely be a drawdown of their floating inventory stocks, which amounts to around 30 million barrels of crude. However, Iran’s production will still remain somewhat restricted until significant foreign direct investment occurs within their production fields. The move towards political stability could see this happen sooner rather than later which could lead to significant supply entering the market.

Ultimately, the current crude oil supply imbalance is not going anywhere fast and prices will continue to come under pressure until OPEC chooses to rebalance their output. This is unlikely to happen anytime soon as it appears that the producer cartel is set to test the limits of their strategy to drive out the high cost competitors. However, one has to wonder if this strategy will backfire and open the door to the US removing the current oil export ban. A policy change along this line could irreversibly change the competitive makeup of the global oil industry.