Oil has dropped to a 21-year low. Basically, bears are out for blood. The WTI West Texas Crude Oil dropped over 18 percent today and made a low of $14.45, a price level that has surprised traders today. The steep fall in the price is because of the lack of sufficient demand and lack of storage place given the fact that the production cut has failed to address the supply glut. There is a strong possibility that WTI Crude Oil prices can drop to $10. Yes, I mean $10 and here is why:

Since the start of the Coronavirus pandemic, oil’s demand has been crippled. There is little done from the supply side, the CAPEX cut by energy companies aren’t enough, we need organic oil production cut from the U.S.

Critical Factor

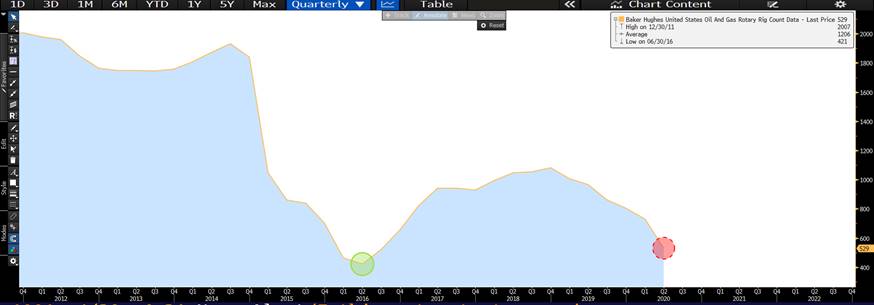

During the 2015 oil supply glut, there has been a massive focus on the U.S. rig count number. As shown in the chart below, the rig count fell to its lowest level in late June 2016. It took a fairly long time for these rig count to touch this level--just under one year.

The same rig count measure has started to fall from its peak level now, but we are still nowhere close enough to find the same level—the level that pushed oil prices higher back in 2016. To put things in perspective, the U.S. total rig count is down (from its December 2018 peak) 51%, but it is still up over 25% from its recent low. The interesting element about rig count is that it doesn’t work like a light switch, meaning they don’t go down or up instantly. It takes time for rigs to go offline due to the complexities in nature of the business such as terms of contracts and rigs’ operation level.

The Estimate

In my estimate, I believe that it is highly likely that it may take another month or two for the rig count number to reach the previous level. In terms of price, unfortunately, it means lower price levels.

Scenario Analysis

In terms of technical price levels, here are some important support and resistance levels based on short-term (4 to7 months) time frame.

If the price falls to $13 to $16 range (which it already has), the upside range could be $20 to $23.

If the price falls to $10 to $13, a likely scenario, the immediate ceiling level could be $15 to $18.

Bottom Line

The bottom line is that there is no doubt that oil prices are way oversold at the current level, but given the circumstances, it is likely that the price may continue to fall further because the rig count hasn’t touched its bottom yet. But for an investor who holds a long term perspective, a time frame of 12 months to 24 months, the current plunge in oil price represents an opportunity.