-

WTI falls through the bottom end of its trading range

-

Brent rolls from October to November futures

-

Bullish and bearish factors continue to grip the oil market – Inventories and production point higher

Trading crude oil and looking for another significant move to the up or downside had been like watching paint dry since June. The decline to an all-time low in NYMEX WTI futures and the lowest price of this century in Brent futures gave way to a recovery that took the price of the energy commodity to over the $40-per-barrel level. Nearby NYMEX futures first reached $40 in early June. Since then, the market had gone into a volatility coma, but the price settled below the level at the end of last week.

Weekly historical volatility on the WTI futures was around 20% to 25% level at the start of 2020. In May, it rose to over 172%. At the end of last week, the metric was back at 25%.

Bullish and bearish factors are pulling the price of the energy commodity in opposite directions as of Sept. 4. Demand remains a critical concern, but production declines have gone a long way to balance the petroleum market’s fundamental equation. While the trend remains higher, crude oil tends to take the stairs higher and an elevator shaft to the downside over time.

The slide in the U.S. stock market last week was a warning sign for the petroleum market. The United States Oil Fund (NYSE:USO) tracks the NYMEX WTI futures price, while the United States Brent Oil Fund (NYSE:BNO) follows Brent futures on the Intercontinental Exchange (NYSE:ICE).

WTI Falls Through Bottom End Of Its Trading Range

Crude oil took an elevator shaft to the downside earlier this year before recovering to over $40 per barrel. The bullish trend was in question at the end of last week.

The ascent of the energy commodity had been a slow crawl to the upside, but the decline below $40 on the back of weakness in the U.S. stock market led to a test of technical support at $39, the double-bottom low, which failed to hold.

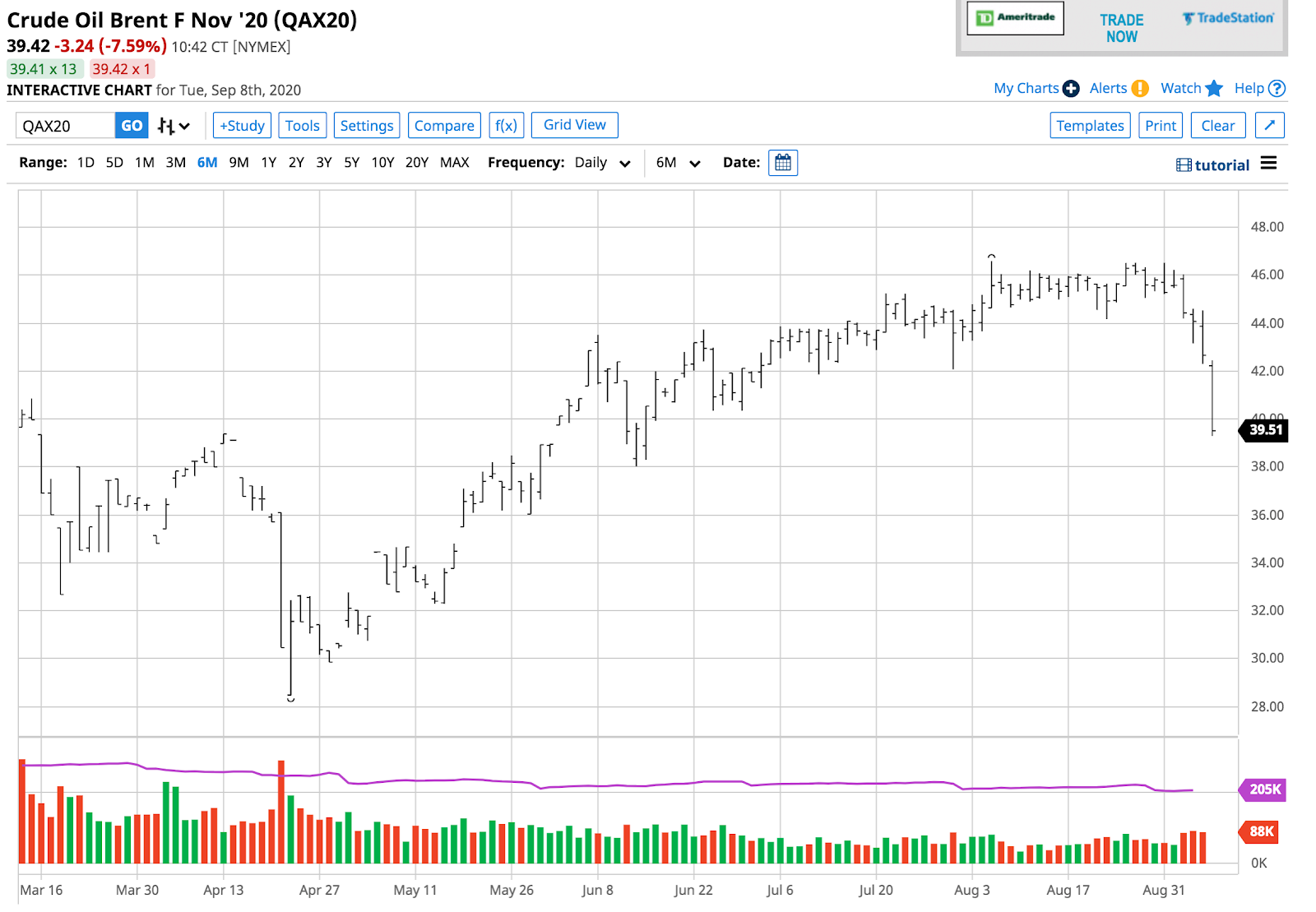

Source: CQG

As the daily chart of NYMEX October crude oil futures highlights, the price settled at the $39.77 per barrel level at the end of last week. On Tuesday, Sept. 8, the price was trading around the $36.30 level. The total number of open long and short positions has been flatlining at around the two million contract level over the past two months. The correction from the Aug. 26 high of $43.78 caused price momentum and relative strength indicators to fall below neutral readings to oversold conditions.

Since June 30, the price range had been from $39.00 to $43.78 per barrel. The $39 low on July 10 and July 30 created a double-bottom formation on the daily chart, which was critical support. The narrow trading range pushed daily historical volatility to 30% at the end of last week. The metric reached a high of over 153.5% in March. On September 8, it was over 47%.

The mid-point over the past two months is at $41.39 per barrel. The price moved below the lows in a short-term technical breakdown in the energy commodity.

Brent Rolls From October To November Futures

On the final day of August, Brent futures on the Intercontinental Exchange rolled from October to November. Brent is the pricing mechanism for approximately two-thirds of the world’s crude oil, including the petroleum from the Middle East. The region is home to over half the world’s crude oil reserves.

Source: Barchart

The chart shows that Brent futures have traded in a range from $40.35 to $46.59 since late June. The trend in the Brent futures was higher, with a midpoint at $43.47. However, at below $40 on Sept. 8, Brent futures fell through the bottom end of the band over the past two months. Brent and WTI futures crawled higher, as fundamentals were supportive of the price. The correction in the stock market caused a return of the elevator ride lower at the start of this week.

Bullish and bearish factors continue to grip the oil market- Inventories and production point higher

Crude oil never away on the upside after reaching the $40 per barrel level. The memory of the price carnage on the downside that led to the April low of a negative price for WTI and the lowest price of this century for Brent continues to weigh on the price action.

Fears that demand could evaporate because of a resurgence of COVID-19 during the winter months is the primary bearish factor hanging over the market. The recent weakness in the stock market weighed on the price of the energy commodity. Meanwhile, the winter months tend to be a bearish seasonal period for the energy commodity.

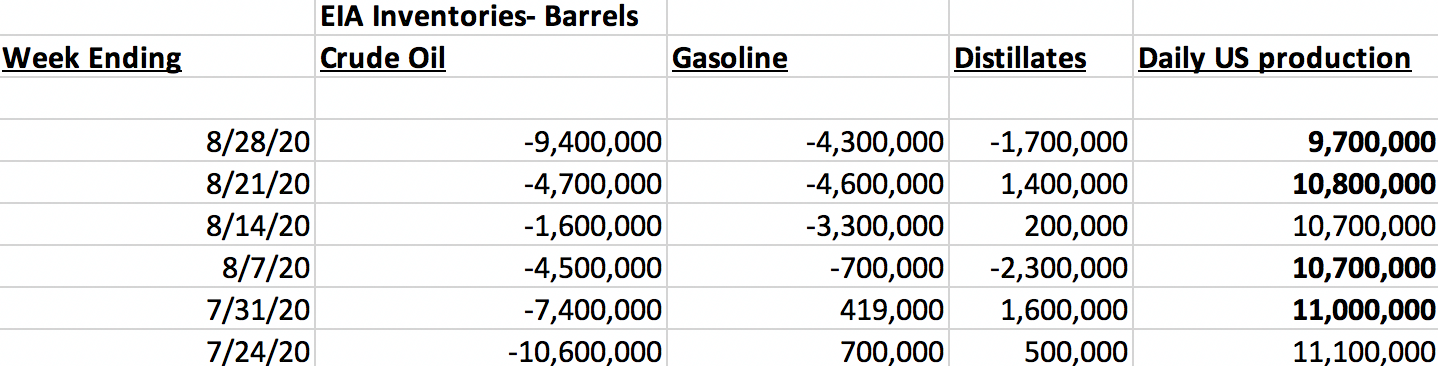

On the bullish side of the oil market, production and inventories have been highly supportive over the past weeks. OPEC, Russia and other producers continue to maintain a 7.7 million barrel per day cut, after tapering the level from 9.7 mbpd in August. U.S. output has dropped, with the Energy Information Administration reporting 9.7 mbpd for the week ending on Aug. 28.

The level of U.S. production declined 26% from record high level in March 2020. In the latest report, the EIA said production fell by 1.1 mbpd. The decline was because of hurricane Laura’s impact on petroleum production in the states on the Gulf of Mexico.

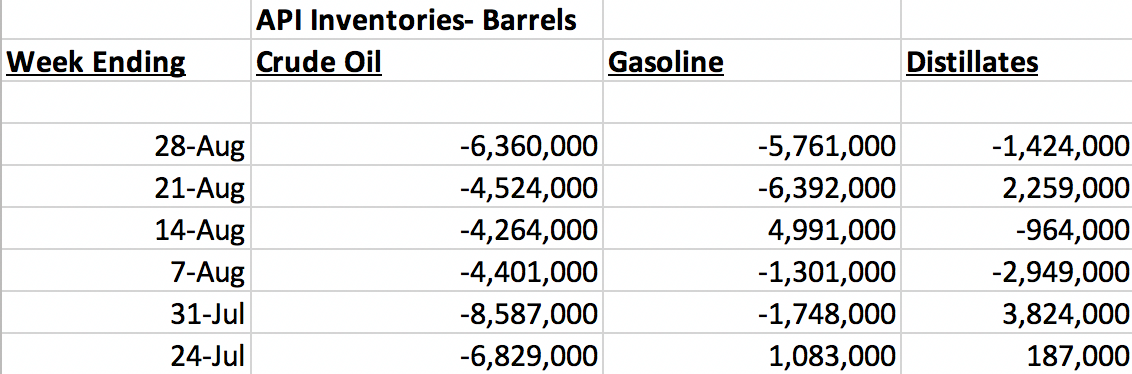

At the same time, the American Petroleum Institute and Energy Information Administration reported the sixth straight week of falling inventories for the week ending on Aug. 28.

Since the week ending July 24, crude oil stocks have dropped by 34.965 million barrels. Gasoline inventories moved 9.128 million barrels lower, and distillate stocks rose by only 0.933 million barrels.

Source: EIA

Over the same period, the EIA reported a decline of 38.2 million barrels of crude oil. Gasoline inventories moved 11.781 million barrels lower, and distillate stocks dropped by 0.300 million barrels.

The inventory data in the U.S. continues to support the price of crude oil futures though they fell below the $40 per barrel at the end of last week on the NYMEX October futures contract. The November Brent futures at under $40 have some support from the decline in OPEC, Russian, and other producers’ output.

Crude oil’s bullish trend turned lower over the recent sessions. The memories of the decline that took prices to lows in April and concerns over demand continue to prevent the price from moving appreciably higher. Crude oil was heading for a test of the mid-June $35.25 per barrel level on October NYMEX futures, the mid-June low. A move below there could open the floodgates on the downside.

The settlement at the lowest price since June 26 on the October WTI futures contract was a warning sign for the energy commodity last week. On Tuesday, it followed through on the downside, rekindling fears that another period of price carnage could be on the horizon.