Crude oil prices were knocked lower midweek in response to the latest EIA report which showed that US crude inventories rose more than expected.

In the week ending April 26th, US crude stores rose by 9.9 million barrels. Stores hit their highest level since September 2017 at 470.6 million barrels as US crude production surged to fresh record highs.

Gasoline Stocks End 10-Week Build

The 9.9 million barrel increase in crude stocks was well above the 1.5 million barrel increase forecasted. It also comes on the back of an increase in stock levels over the prior week. The data showed that gasoline stocks unexpectedly rose as well, following a ten-week drawdown. Gasoline inventories rose by 917k barrels, in stark contrast to the 1 million barrel decrease forecasted.

The rise in US crude stocks was headlined by a 9.2 million barrel increase in the Gulf Coast region, which saw stocks rising to 244.6 million barrels. This marked the biggest weekly increase in years.

The data also showed US crude imports having risen by 350k barrels per day. Imports rose to 4.8 million barrels per day last week, marking its highest rate since January 2017. Meanwhile, production increased by 100k barrels to 12.3 million barrels per day, marking a fresh record high.

Refining Activity Down

The build-up in crude stocks is clearly explained through a drop in refining activity as well as increased import levels and higher production. However, it took the market firmly by surprise, keeping crude prices capped.

Refinery crude runs were down by 137k barrels per day as utilization rates dropped by 0.9% to 89.2% of total capacity. Distillate stockpiles were also lower. Diesel and heating oil were down by 1.3 million barrels, far lower than the 193k barrel drop forecasted.

OPEC Production Cuts In Focus

The unexpected build in US crude stocks has capped the rally seen so far this year, which has been driven by ongoing OPEC production cuts.

OPEC began cutting production in January this year in a bid to lift ailing oil prices. The production cuts are due to end in June. However, there are expectations that the group is due to announce an extension to these cuts at its next meeting in June.

Trump Blasts OPEC

Last week, oil prices dropped suddenly in response to news that President Trump had contacted OPEC asking the group to step up its production in order to lower prices. US crude production has been surging higher this year, consistently hitting fresh record highs. Meanwhile, Trump has continually criticized OPEC both on Twitter and during official comments for its role in boosting oil prices.

Technical Perspective

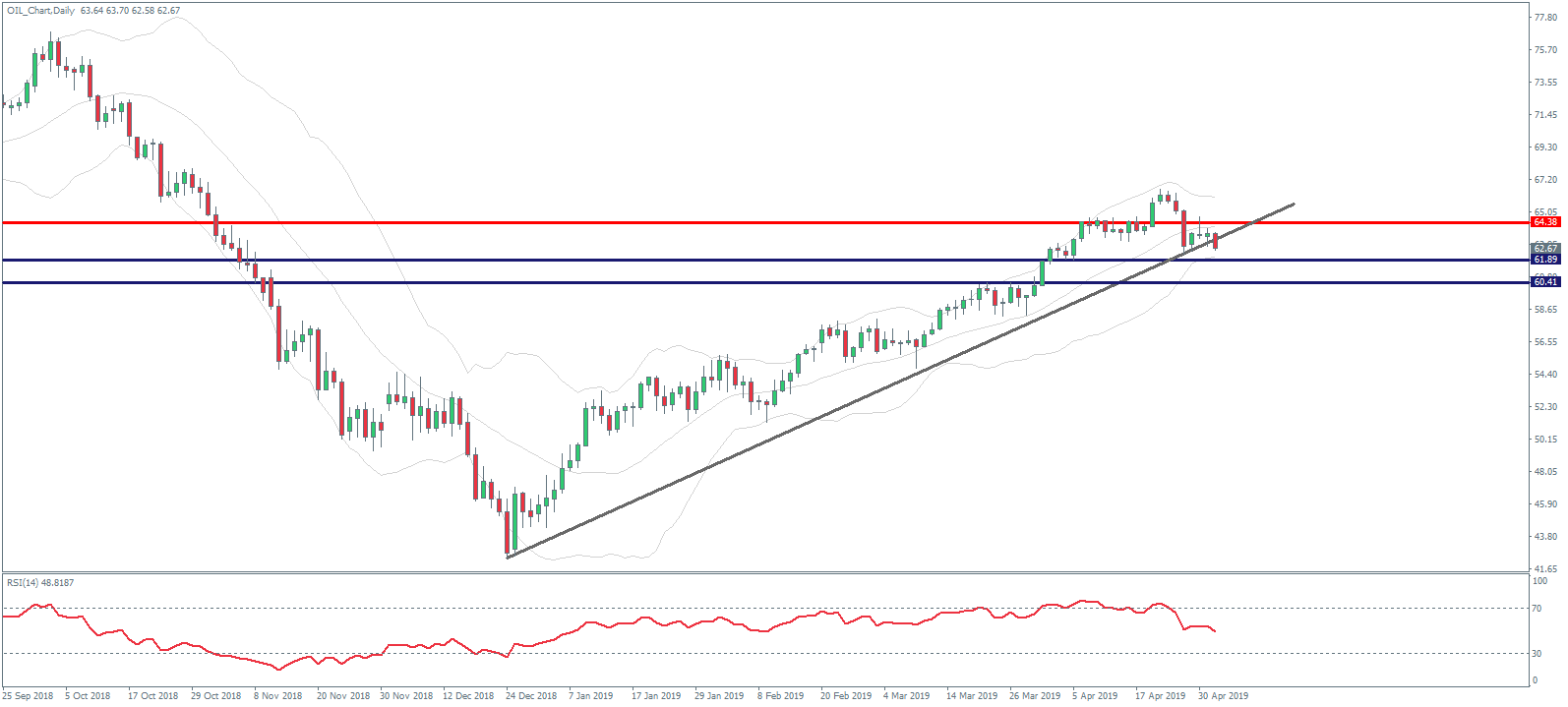

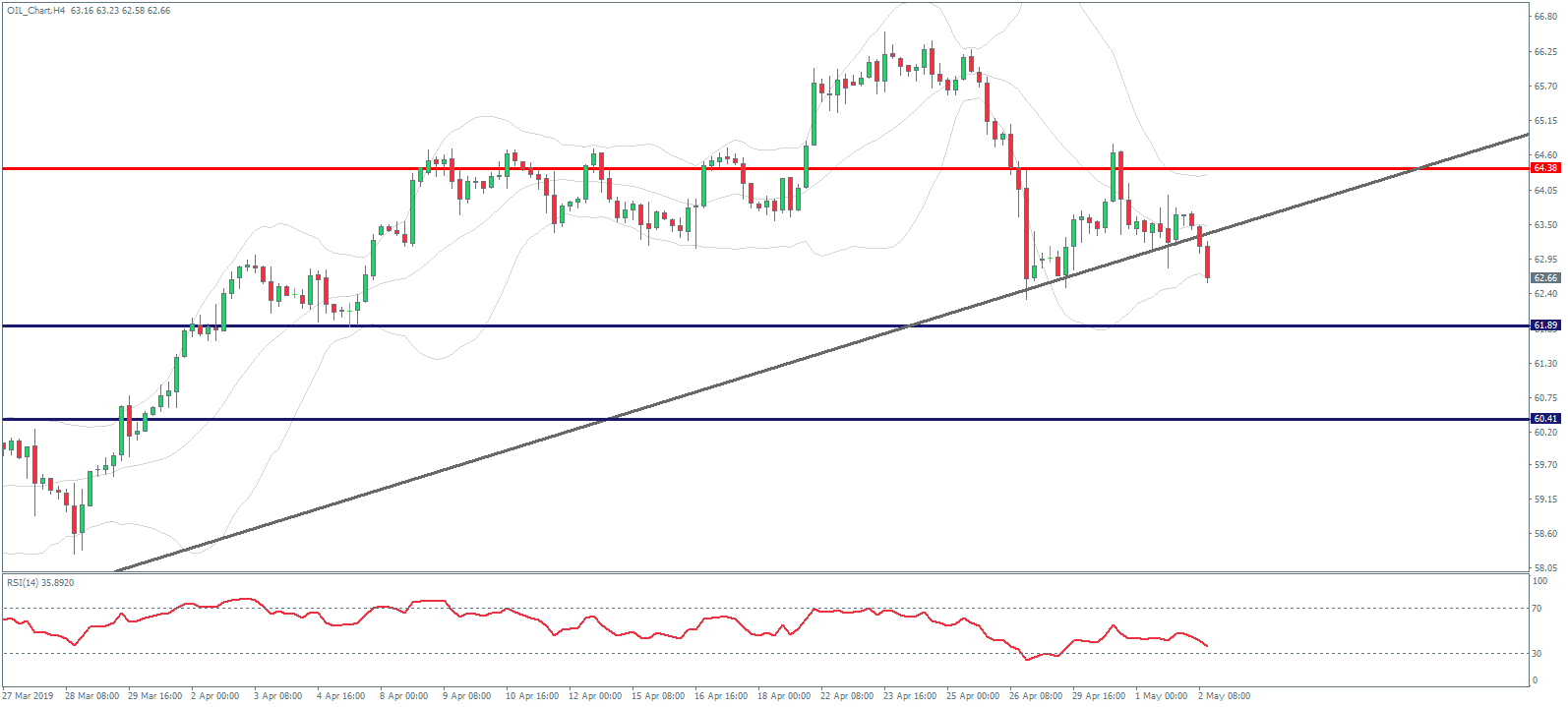

Following a brief move above the 64.38 level oil prices have now fallen back below and have also broken below the rising trend line from last year’s lows. For now, price remains above the 61.89 level which is the next key support. Below there, the 60.41 level is next.

On the lower timeframes, you can see that price is currently challenging last week’s lows. So, while above here, range trading is likely to continue. Though, if we break the lows, we will likely see some momentum players join the market. Longer term, however, we should see support materialize around the 60.41 – 61.89 level keeping focus on further upside.