The ratio of Crude Oil to Treasury Bond prices has been trending higher since the middle of 2017. It took a pause in January though and has been consolidating ever since. But with the latest move higher in Oil prices and Treasury yields rising, the ratio seems set to break out of that consolidation and resume higher.

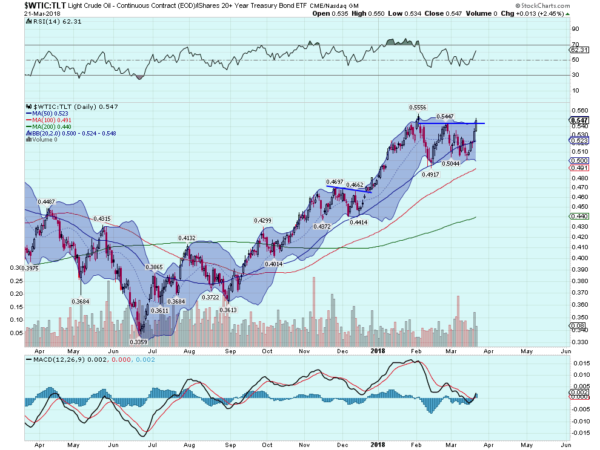

The chart below shows the ratio of Crude Oil to Treasury Bond prices (using the Treasury Bond ETF - iShares 20+ Year Treasury Bond (NASDAQ:TLT)). The stair step rise off on an interim low last June crossed its 200 day SMA in October. It paused and retested the 50 day SMA in December before the last push to the peak in January. When it pulled back with the broad market it again retested the 50 day SMA in February and started the sideways price action.

Wednesday it received a catalyst with the Fed raising short term interest rates. This has pushed the ratio over short term resistance. It also made for a higher high in the RSI and turned the MACD positive. These support further upside in the ratio. The next test is the January high before it can head higher. A Measured Move would then give a target to a ratio of about 0.60, or more than 10% above the current level.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post