Crude oil remained in rout for the second straight day on the basis of the current inventory build within crude storage facilities. Subsequently, WTI CLF6 futures fell strongly and are currently trading around the $42.50/b level.

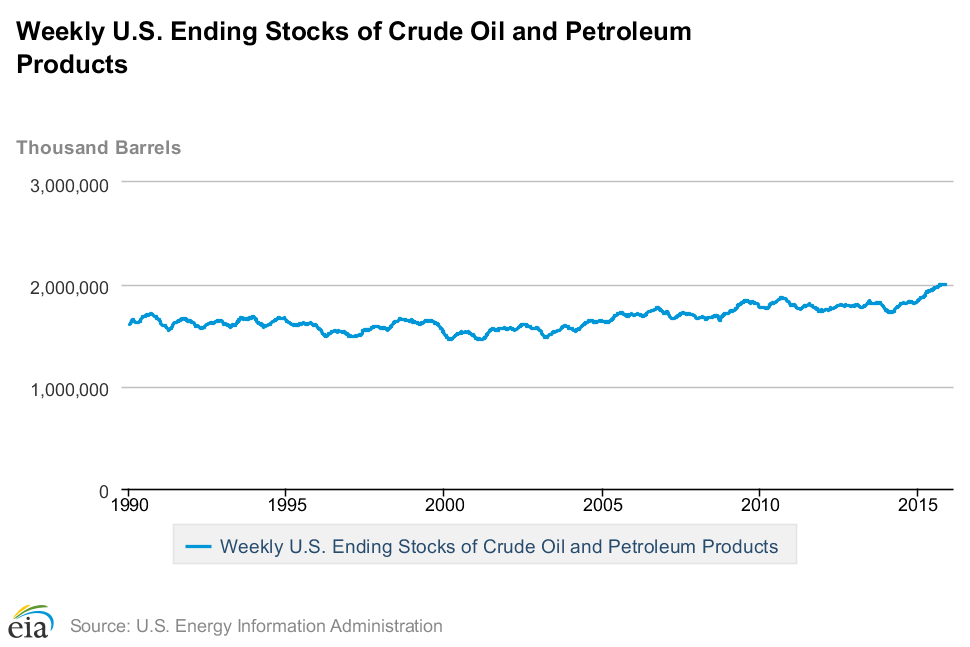

The impetus for the big move was a report by the U.S. Energy Information Administration announcing that Crude Oil Inventories rose by 0.90 million barrels. Forecasts had the initial draw at 1.1 million barrels but the result still remained largely negative for oil traders and sent the commodity falling back towards the key $42.00 level. However, the downside is likely to be limited, at least in the short term, as much of the fall has been abated by long positions being taken around $42.00.

However, the inventory numbers are exceedingly bearish and mirror much of the recent supply pressures within global crude markets. Modelling undertaken earlier in the year by the EIA estimated that oil output would continue to drop by over 160,000kb/d throughout 2016. However, these estimations are in conflict with advanced modelling, developed by the Goldman Sachs commodity team, which forecasts growth of 145,000kb/d throughout the latter part of 2015 and into 2016.

The reality is that there are currently many competing interests amongst oil exporters which are clearly evident when you take into account Iran’s recent announcement that there is no requirement for them to consult with OPEC about increased production levels. Subsequently, the over-supply conundrum is likely to remain in the near term as OPEC countries are increasingly relying upon oil revenues to stump up their ailing foreign currency reserves.

In addition, any subsequent price rally is likely to be short term in nature given the risk of the move becoming self-defeating. Increasing oil prices will simply incentivise producers to clamour back into the market to restart production worsening any potential supply glut. Given the large numbers of rig stand downs and well shuttering that has occurred in 2015, the risk of that productive capacity re-entering the market is real.

Subsequently, until OPEC or the West blinks, and adjusts supply accordingly, low crude oil prices are here to stay for the medium term. Subsequently, we still view our price forecasting for crude as accurate with a price target of $41.00/b towards the end of 2015 and reducing to $37.00-$39.00/b by Q2, 2016.