Oil is down 1.3% since the start of the day on Friday and remains on a tight leash around its 200-day moving average. The previous afternoon, oil managed to resist pressure from a strengthening dollar. It failed to make any gains on Friday due to caution in global markets, from currencies and equities to commodities and cryptocurrencies.

Fundamental factors weighing on oil include a weaker-than-expected European economy and a new wave of house price falls in China. The latter reflects the weakness of the real economy, which is negative for commodities despite the measures taken to support the financial market.

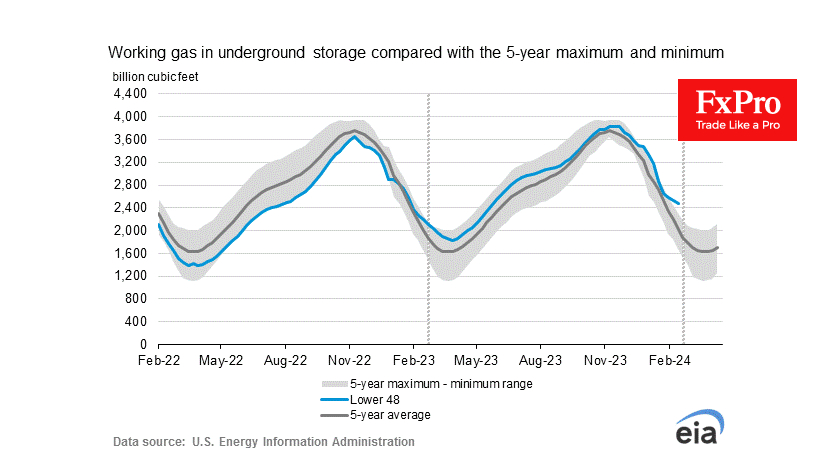

Gas prices in Europe and the US are close to multi-year cyclical lows, easily explained by higher inventories for this time of year. They are above the 5-year range.

At the same time, oil inventories are rising. Last week, commercial oil inventories rose by another 3.5 million, bringing the 4-week increase to 22.3 million. The current stock level of 443 million barrels is 7.5% below the level of a year ago. Stocks in the Strategic Petroleum Reserve increased by 0.75 million over the week, bringing the total to 12.75 million from a 40-year low in July 2023.

Production remains at a record 13.3m bpd. Still, a recent WSJ article noted that further production increases will be difficult as companies focus their financial efforts on buybacks and dividends rather than investing in hydrocarbon exploration.

Oil has been trading near its 200-day moving average for over a week now. The bulls failed to consolidate above this line in late January and last November. In addition, the approach of $79 per barrel for WTI triggered a sharp sell-off.

On the other hand, on the daily timeframe, it is easy to see buying on the dips since the beginning of last week. The intraday fall in oil was likely due to the cautious nature of the markets on Friday.

This means that after a rise above $80, we can state capitulation of the bears and the start of the bull market. If the decline in oil continues for 2-3 days in a row, Crude oil can extend its fall to $72. If this level does not hold, we will see the breakdown of the key 200-week average, which will mark the start of a sell-off on a par with what happened in 2020 or 2014.

The FxPro Analyst Team