The threat of sanctions caused a stir in the markets: WTI spiked above $130 and Brent is nearing the $140 mark. Where is crude oil going next?

A possible Western embargo on Russian oil caused oil prices to soar again on Monday, as stock markets feared persistent inflation and a consequent economic slowdown.

On the U.S. dollar side, the continued rally of the greenback has propelled the dollar index towards higher levels, as it is now approaching the three-figure mark ($100), even though it has not had a huge impact on crude oil, other petroleum products, or any other commodities in general. What we rather witness here is the greenback’s safe-haven effect attracting investors, much like gold would tend to act in a “store of value” role.

On the geopolitical scene, Russia-Ukraine peace talks will be resumed today in Brest (Belarus) at 14:00 GMT, while another meeting is already scheduled at the Antalya Diplomacy Forum on Thursday in Turkey. Russian Foreign Minister Sergei Lavrov and his Ukrainian counterpart Dmytro Kuleba will talk in the presence of the Turkish foreign minister. We might, therefore, expect some de-escalation in the Black Sea basin this week if the two parties involved were able to reach an agreement after further negotiations.

Henry Hub Natural Gas (NGJ22) Futures (April contract, daily chart)

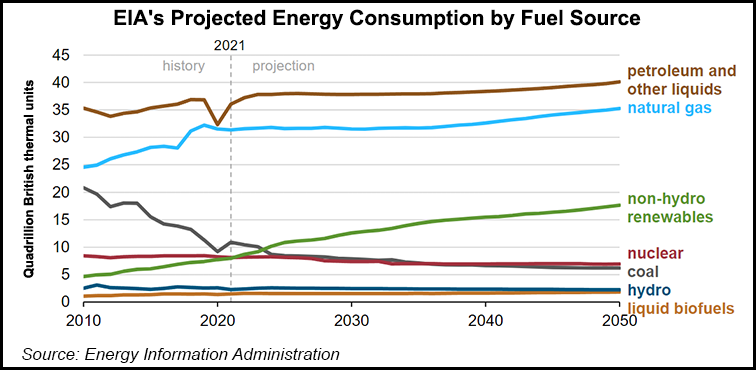

Regarding natural gas, the U.S. Energy Information Administration (EIA) published its Annual Energy Outlook (AEO) 2022 report, suggesting that even with non-hydro renewable sources set to rapidly grow through 2050, oil and gas-derived sources should still remain the top energy sources to fuel most of the United States. The agency is forecasting a rise in the production of Liquified Natural Gas – which mainly comes from shale gas – by at least 35%!

In summary, the threat of sanctions has already wiped out almost all Russian oil – at least 7% of global supply – from the world oil market. In the weeks or months to come, we can see sanctions on Russian oil exports create a boomerang effect on European economies, decreasing world market supply, increasing prices for industry, as well as even more rising expenses, and, thus, cost of living through a ripple effect.