- Oil prices are sliding due to a stronger US Dollar and concerns about the impact of trade policies on global growth.

- Aramco Chief Nasser expects oil demand to grow by 1.3 million barrels per day in 2025.

- Technical analysis suggests Brent Crude may have found support at the 200-day moving average.

Oil prices struggled today thanks to a stronger US Dollar as well as fears around the impact tariff policies and a trade war may have on global growth and oil demand.

This comes after Aramco Chief Nasser said at Davos that he expects oil demand to grow by 1.3m b/d in 2025, higher than the IEA forecast of 1.05 million barrels.

Trump and US Energy Policy, What Does it Mean?

US energy policy has been an area of focus since President Trump won the election in November. Now we are finally starting to see some of the moves markets envisioned as the Trump administration have revealed at least part of their energy policy.

U.S. President Donald Trump mentioned that his administration will likely stop purchasing oil from Venezuela. The U.S. is the second-largest buyer of Venezuelan oil, after China. Trump also promised to refill the country’s emergency oil reserves, which could increase demand for US oil and potentially raise oil prices.

This follows on from yesterday’s executive order which sought to repeal President Biden’s attempts to stop oil drilling in the Arctic and in big areas off the U.S. coasts.

These moves have no doubt led markets to the belief that excess supply may soon be a regular occurrence which weighed on oil prices.

Aramco (TADAWUL:2222) Chief Positive About China and Oil Demand

Amin Nasser, the CEO of Saudi oil company Aramco, said on Tuesday that he thinks the oil market is doing well and expects demand to increase by 1.3 million barrels per day this year.

Nasser’s comments around China may have caught peoples attention given the struggles experienced by the Chinese Government in stimulating growth and demand. Nasser stated that the Saudi Arabian oil company continues to expect growing Chinese demand for oil even as it transitions toward electric vehicles.

When asked about the effect of US sanctions on Russian oil, Nasser quickly pointed out that Aramco will check if it causes any shortages in the market. The CEO also mentioned that Aramco can increase supply by 3 million barrels a day.

For now though, the longer-term outlook remains uncertain. The Trump administration has pledged to sell US oil and energy around the world which could put it at direct odds with OPEC + and increasing the risk premium moving forward.

The Week Ahead

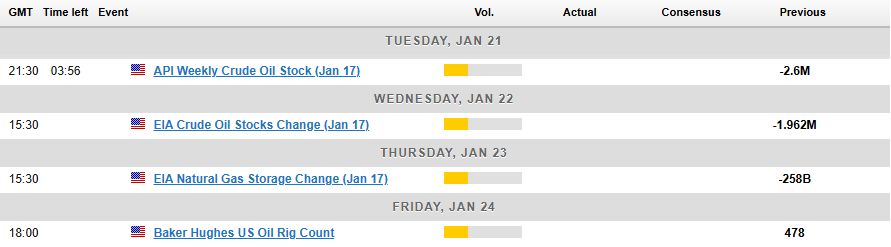

President Trump is likely to remain a key area of focus in the coming days as markets wait for further clarity on tariffs and other moves that may impact markets.

Oil inventories as usual will be out this week and still remains crucial. Given President Trump’s pledge to fill the SPR again, inventories will be watched with even more intrigue than usual.

Technical Analysis

This is a follow-up analysis of my prior report “Brent Crude – Oil Advances on Russian Sanctions. Will the 100-day MA Cap Gains?” published on 13 January 2025. Click here for a recap.

From a technical analysis standpoint, Brent is on course for its fourth successive day of losses but does appear to have found support at the 200-day MA.

The question now will be whether the 200-day MA will be a floor for Brent to kick on and print a fresh high?

Overall, the structure of Brent remains bullish but there is a possibility of a deeper correction.

A potential retest of the trendline breakout (around the 77.00 mark) from January 3 is on the cards if Oil prices push below the 200-day MA.

Below the 77.00 mark, support may be found at 76.35 and 75.00 respectively.

A bounce from current prices will need to gain acceptance above the 80.00 mark before 81.58 and recent highs at 82.82 come into focus.

Brent Crude Oil Daily Chart, January 21, 2025

Source: TradingView

Support

- 78.99

- 77.00

- 76.35

Resistance

- 80.00

- 81.58

- 82.82