After the market broke during the pandemic panic and crude oil prices fell into negative territory, a quick and sharp surge followed. WTI climbed to $43.84 a barrel in late-August. But the crisis was far from over and the Elliott Wave principle helped us correctly predict the bearish reversal that came next.

Now, crude oil is crashing yet again. It fell to as low as $34.91 yesterday. A decline the media explained with the build-up in U.S. inventories and Libya’s ramped-up output. Unfortunately, the knowledge of these factors would still not help with correctly timing the decline. Elliott Wave analysis, on the other hand, proved to be much more useful for trading purposes.

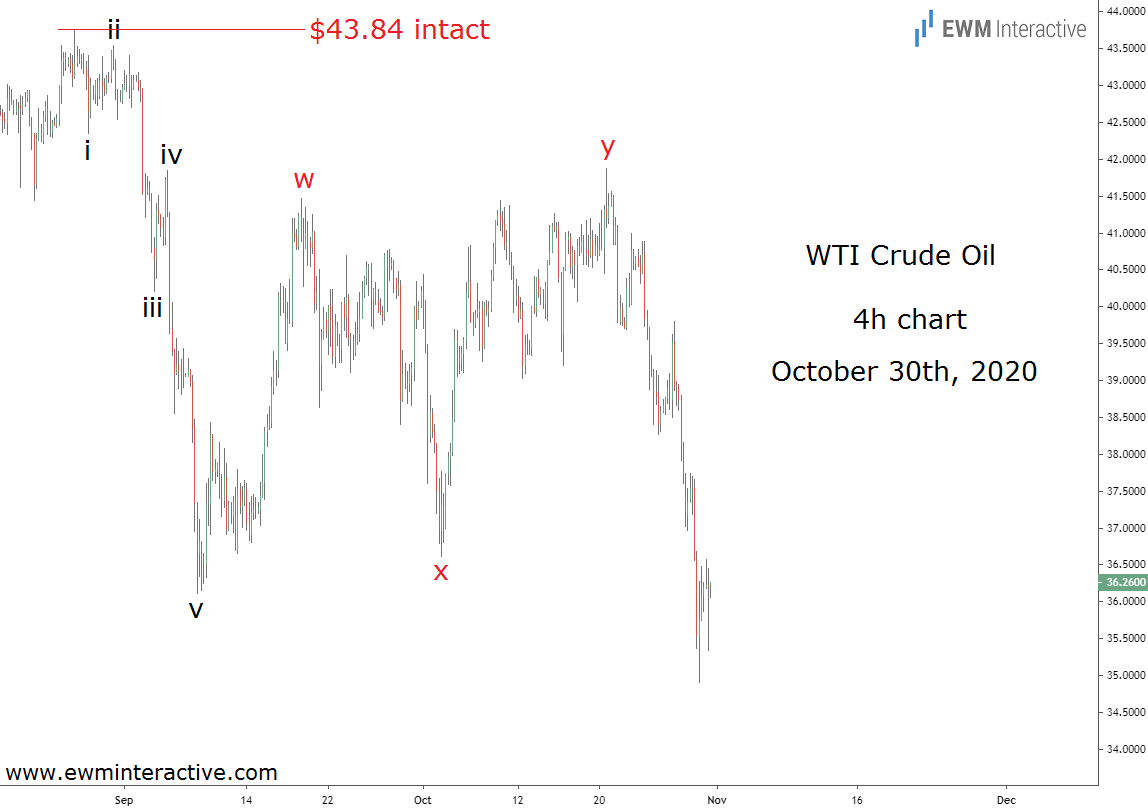

The chart above reveals a complete bearish 5-3 wave cycle from the top at $43.84. There was a five-wave impulse, labeled i-ii-iii-iv-v, down to $36.11. The theory states that every impulse is followed by a three-wave correction in the other direction.

Crude oil ‘s corrective recovery developed as a w-x-y double zigzag up to $41.87 by October 20. We didn’t know if the bears were immediately ready to return at the time, but as long as $43.84 was intact, the count above would remain valid. Nine days later, here is an updated chart of the price of crude oil.

It turned out the bears were ready. The bulls started slowly losing ground before completely giving up over the past couple of days. With crude oil below the bottom of wave ‘v’ at $36.11, they have now officially reached their initial target.

$43.84 was never threatened. And while the macro environment remains more uncertain than ever, the charts are already giving us a hint of what may lie ahead.