The commodity market started the week with growth. Brent grew to $95.05, despite USD's rally. The fundamental horizon of the oil sector remains saturated. The first event is an OPEC+ meeting planned for today.

The main issue for discussion is the quotas for October. Most probably, production will remain as previously, for various reasons. OPEC+ could revise the quotas if the nuclear agreement between the US and Iran is restored. However, there is no news about it, which means there is no reason to increase the supply.

Previously, G7 members had agreed on the limit of purchase prices for Russian oil. The limits would have been imposed in December. In the market, they say that without the participation of strategic buyers of Russian oil (namely, India and China), the decision will remain purely declarative.

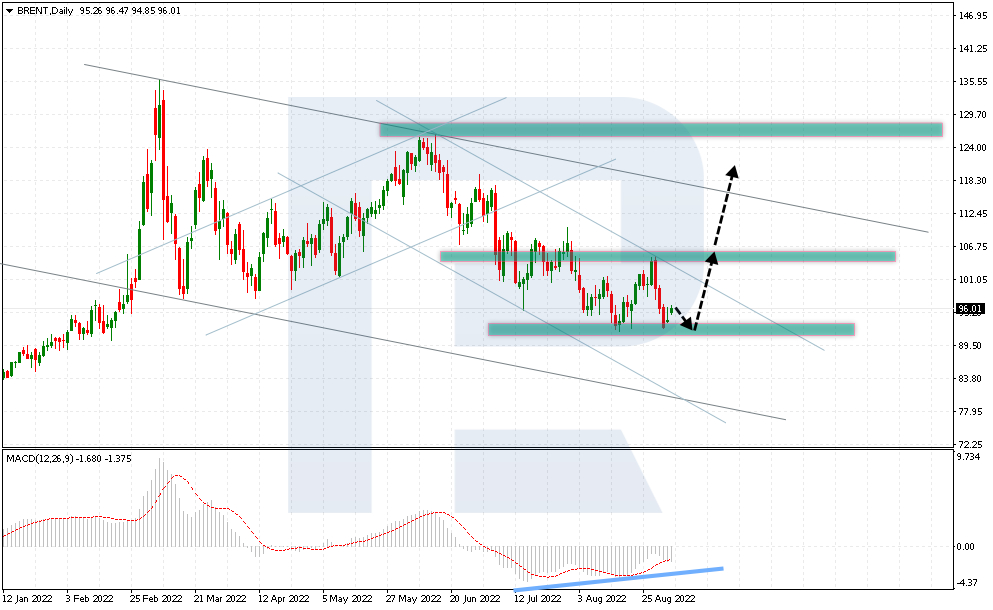

On D1, Brent keeps pushing off the support level of 92.00. On the MACD, a bullish divergence might form, which can become a strong signal supporting an uptrend.

However, the level of 89.00 might be tested before the growth starts. For buyers, it is important to secure above 106.00. If this happens, a Double Bottom reversal pattern will be complete, pushing oil to the potential goal of 119.00.

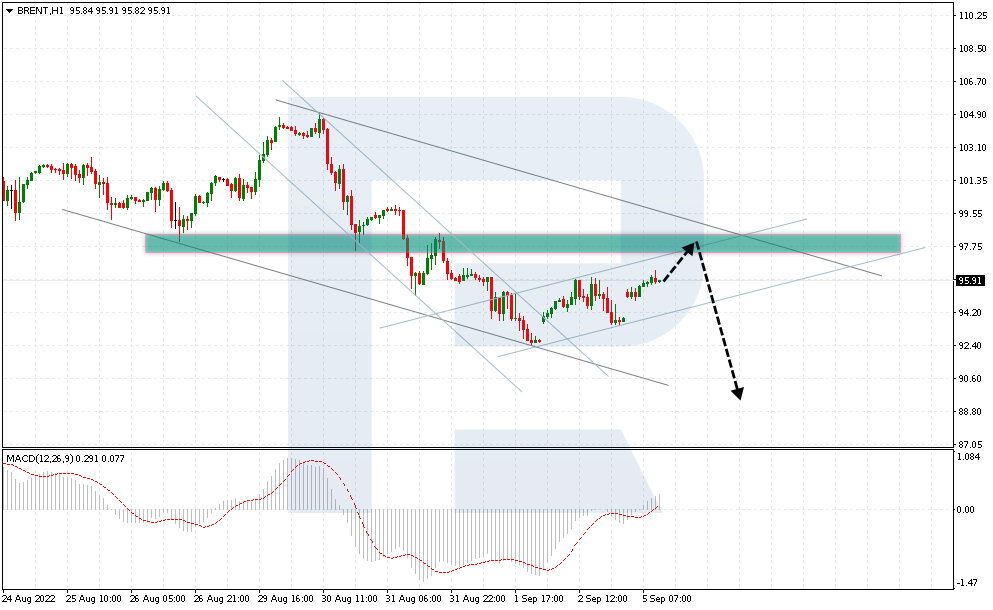

On H1, Brent is correcting inside a descending channel. A bearish 5-0 pattern may still form, meaning price growth to 98.00. After a breakaway off the upper border of the descending channel, a decline to 89.00 might start, going by the pattern.

The decline will be over with a breakaway of the upper border of the descending channel and securing above 99.50. In this case, a bullish trend might recover.

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.