Wednesday proved to be a busy day for oil traders, but the bears emerged as winners at the end of the day. Following WTI oil, which surrendered a tactically important position, Brent is showing more and more signs of a bear market.

Brent and WTI traded up almost 3% after reports that OPEC is likely to raise output quotas by 100kbpd in September, as market participants anticipated a more significant rise in quotas in response to a call from the US. Cartel participants, however, cited previous weak investment in the industry, which has now prevented a more aggressive production increase.

We also note that the cartel's actual production has been falling further behind the allowable quotas month on month, which is also working to overheat the market.

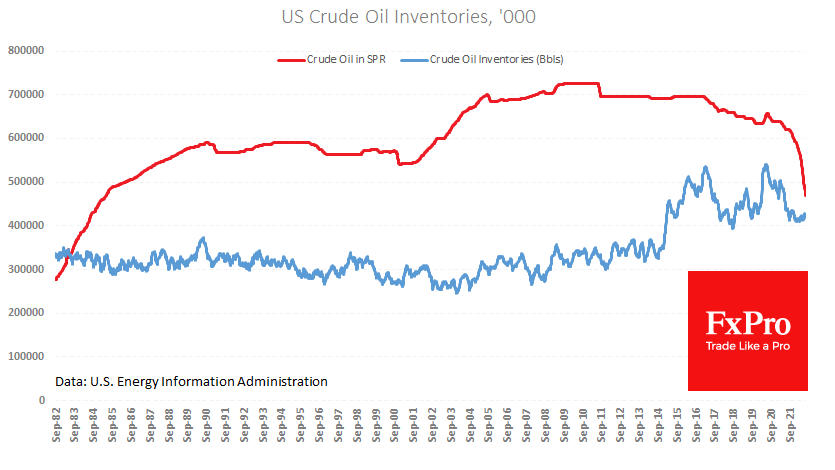

Nevertheless, the bulls' situational victory was short-lived. By the start of active trading in the USA, oil prices turned sharply to the downside, exacerbated by the release of weekly inventory data. Commercial crude inventories rose 4.5Mb compared to a 1.4Mb decline last week.

Signs that sales from reserves are allowing commercial inventories to build up added pressure on the oil price, which closed the day at its lowest level since Feb. 18. WTI lost 5.7% from Wednesday's peak and almost 8% from the start of the week and month.

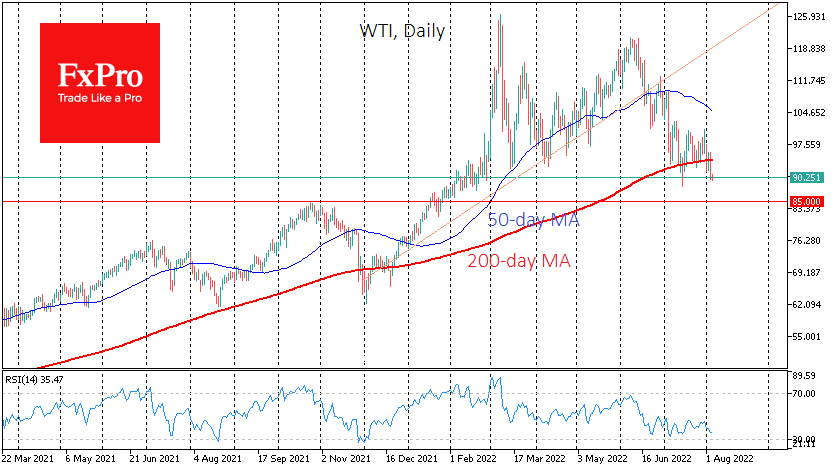

WTI was testing the $90 mark early Thursday, a psychologically significant level from which buyers have been pushing back since the start of hostilities in Ukraine. The market has staged a strong sell-off near the 200-day moving average, which is an important bearish signal.

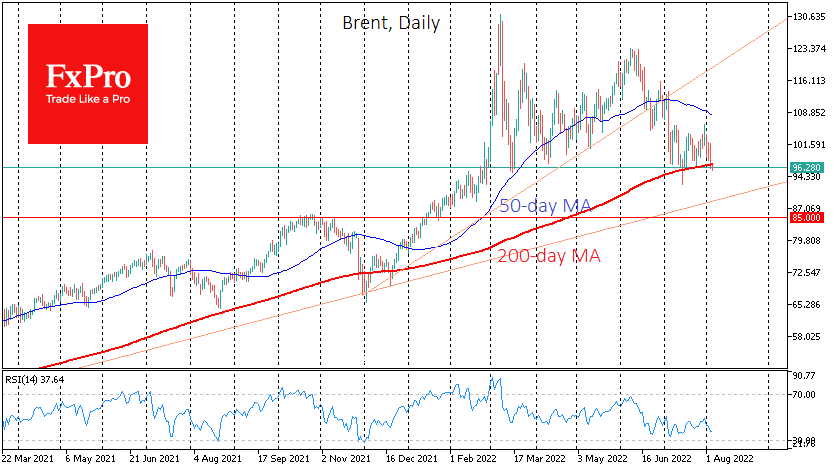

Brent is currently testing its 200-day average and last month's support area. However, with American WTI surrendering critical levels one by one while Brent plunges below $100, it is not easy to be on the bulls' side right now.

Having returned to the area of the July lows and zeroed in on the rally since late February, oil is potentially facing an abyss. If we break that downward slide down into phases, the nearest next stop on the way down could be the area of $85 per barrel for Brent and $80 for WTI.