At the start of last week crude oil was trading at less than $36 a barrel. It was down from $43.84 in August and from $41.91 on October 20th. Fortunately, Elliott Wave analysis helped us prepare for this selloff in advance.

So, when the weekly session began, the price of crude oil was down 14% over the past ten trading days. Experts were quick to explain the decline with the subdued demand due to the COVID-19 pandemic. This argument has been used every time crude oil dropped since March. Unfortunately, it is of no use to traders, who need a lot more than a mere after-the-fact explanation.

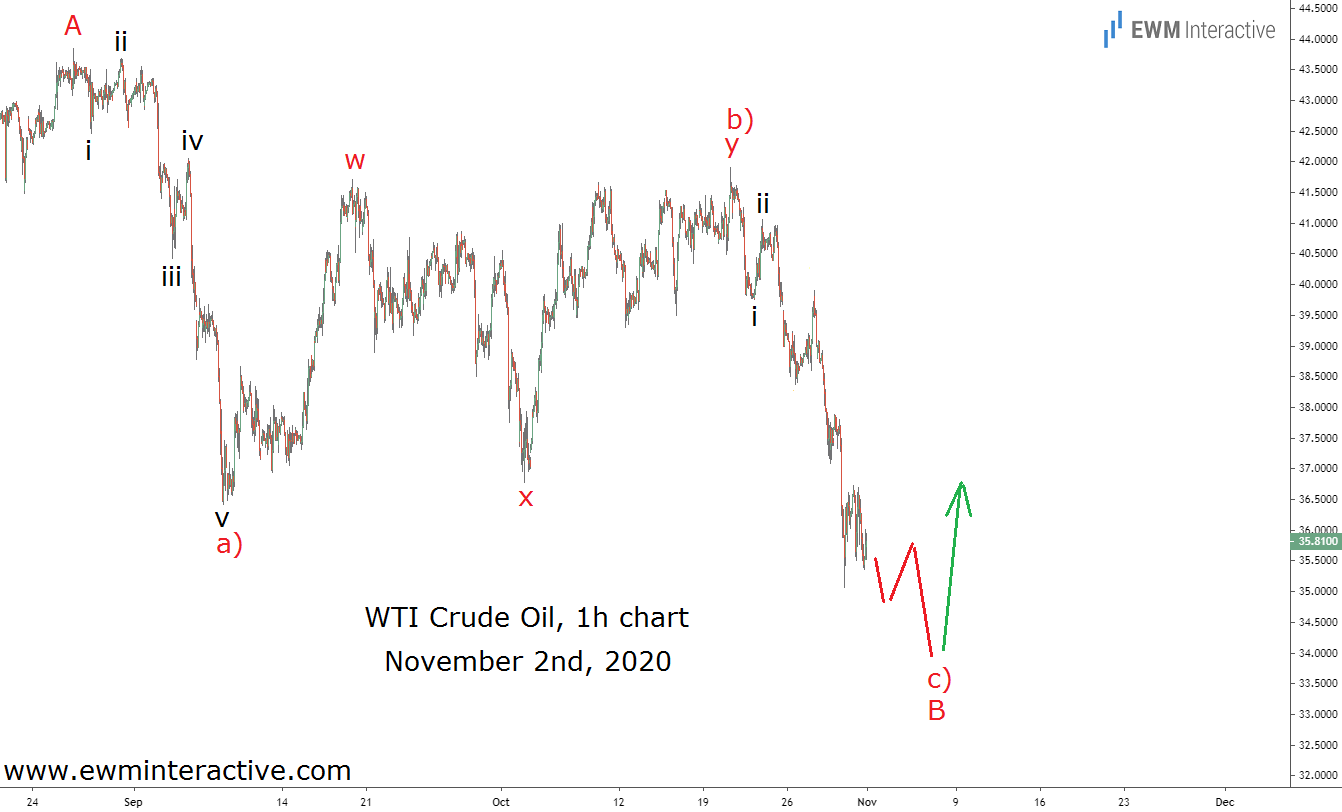

The truth is that by the time the news arrives, the trading opportunity is long gone. Instead of waiting for it, we prefer to rely on Elliott Wave analysis. No trend lasts forever and we knew crude oil’s decline won’t either, regardless of what others were saying. So, before the open on November 2nd, we sent the following chart to our subscribers to prepare them for a bullish reversal.

Putting the recent weakness in the context of the big picture allowed us to see that a three-wave correction has been in progress. The structure from the top at $43.84 looked like an almost complete a)-b)-c) zigzag. According to the theory, once a correction is over, the larger trend resumes.

So instead of extrapolating the past into the future, we thought a bullish reversal should be expected below $34 a barrel. The price had been in an uptrend prior to this three-wave drop and it made sense to expect more upside once wave c) ended. The chart below shows what happened next.

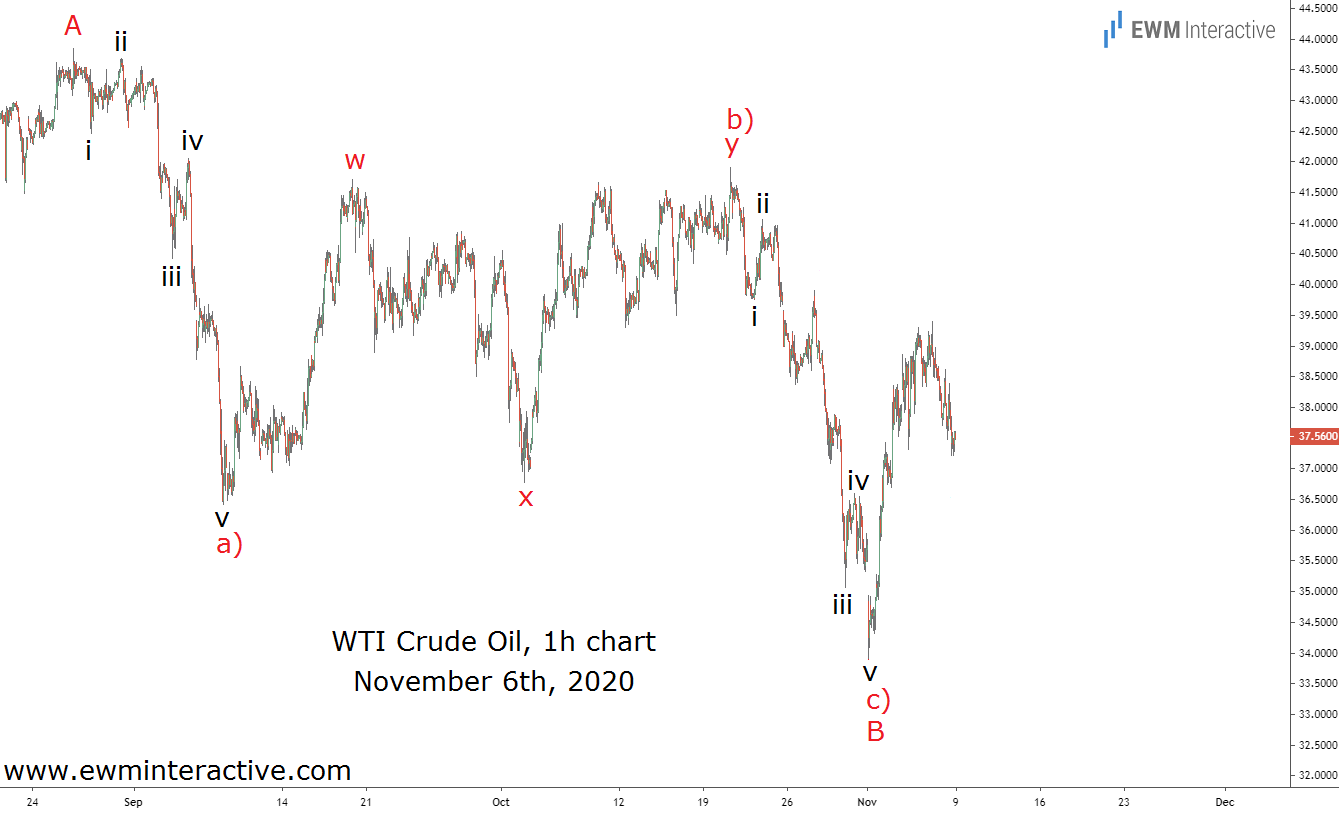

The price of crude oil initially fell to $33.78. On November 5th, it touched $39.53, up 17% in a matter of days. Europe is going into a second lockdown and the coronavirus situation in the US and the rest of the world is hardly improving. From that point of view, WTI‘s surge makes no sense at all. It makes a lot of Elliott Wave sense, however, if one knows what patterns to look for.