Crude oil opened yesterday’s session with a gap and then decreased only to move even higher. Where have we seen this before?

Technical Indicators at Play

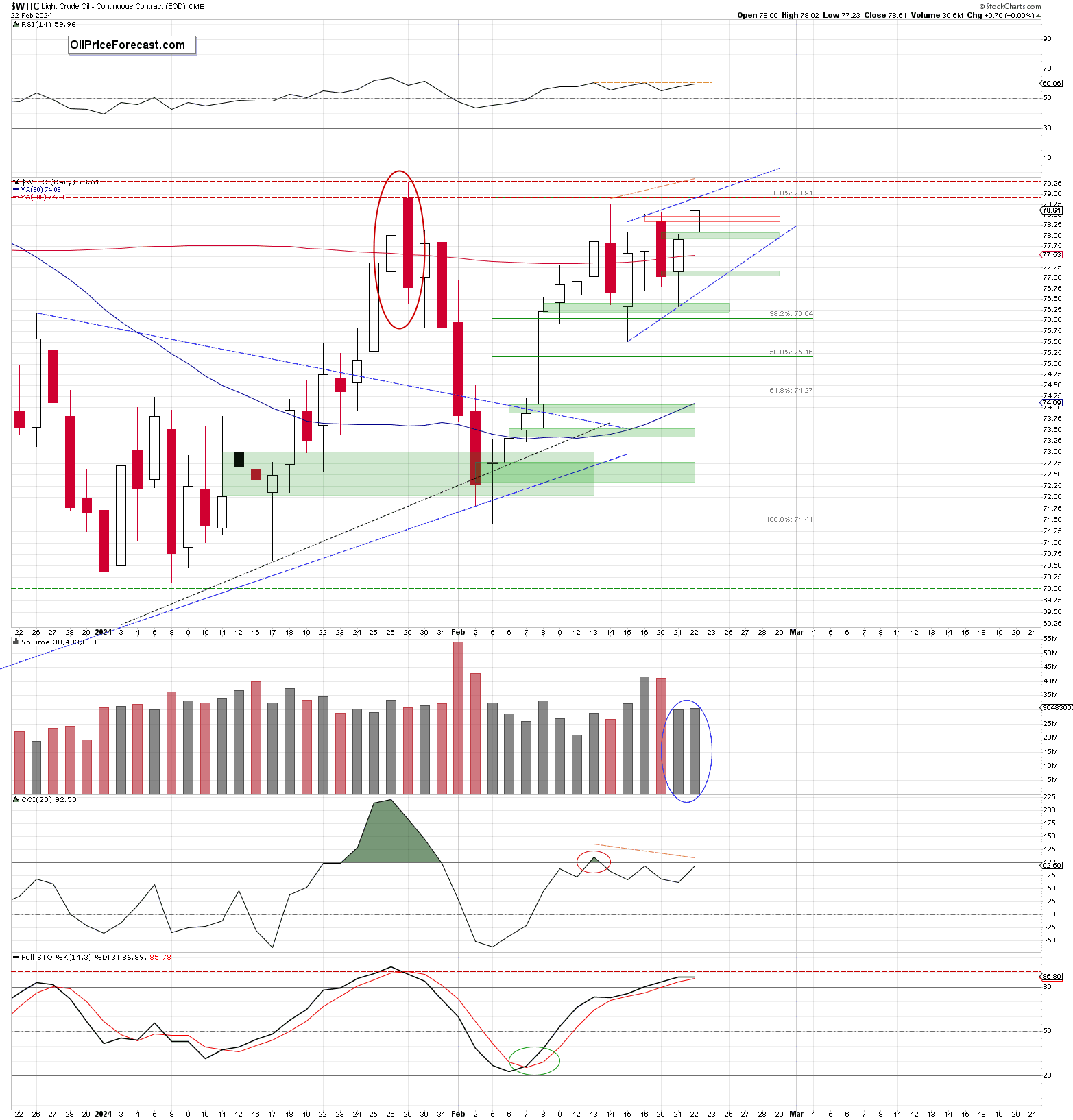

Looking at the daily chart, we see that crude oil opened yesterday’s session with another green gap but then moved lower and tested the previously broken 200-day moving average – just like on last Friday (Feb.16).

Additionally, the commodity extended losses below this support only to reverse and rebound in the following hours – yup, just like on last Friday.

Thanks to yesterday’s price action, market participants left on the chart another white candle with a prolonged lower shadow, which closed the red gap formed on Feb.20 and hit a fresh very short-term local high.

Despite this improvement, the bulls didn’t manage to hold gained levels, which translated into a small pullback that caused a daily closure not only below the resistance area created by the bearish engulfing pattern, but also under the last week’s intraday peak.

Additionally, yesterday’s fresh high materialized on very similar to the previous day volume, which raises doubts about the bulls’ strength – especially when we factor in negative divergences between the price of black gold and the daily indicators (marked on the above chart with orange dashed lines).

Potential for Correction

Taking all the above into account (especially the similarity to the last week’s price action), it seems that we’ll likely see a correction of the recent upswings in the very near future just like on Feb. 20.

If this is the case and crude oil reverses from here, the first target for the sellers would likely be yesterday’s gap ($77.91-$78.09). If this support area is broken, we could see another test of the 200-day moving average or even the green gap formed on Wednesday ($77.04-$77.15).

Summing up, although oil bulls managed to hit a fresh very short-term local peak, yesterday’s price action looks very similar to what we saw at the end of the previous week, which suggests that another downswing may be just around the corner.