Sometimes people look alike, and sometimes patterns look alike.

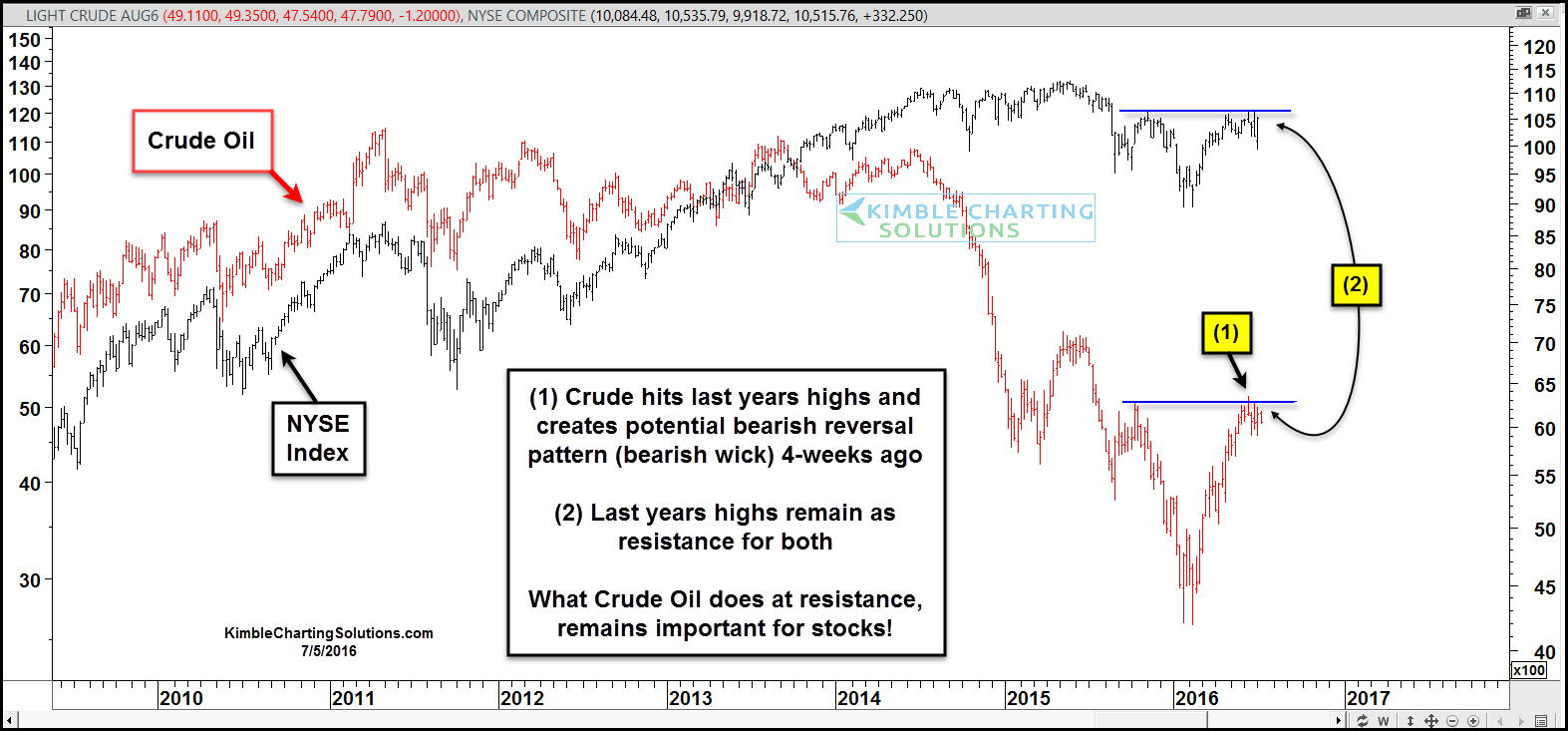

Below looks at the most important commodity on the planet, crude oil, and the NYSE Composite Index.

As the world starts drifting away from the Brexit story, the reality of key leading indicators will come back into focus again. Crude oil remains a big influence over stocks the past couple of years and we humbly feel it will remain doing so, going forward.

Around a month ago, crude oil tested 2015 highs, and so far looks to have created a reversal pattern (bearish wick) at this level (1). Since then, crude oil has been chopping back in forth, just below resistance. The pattern in the NYSE Index has looked very much the same for nearly a year.

Crude and NYSE are both testing the underside of resistance at the same time at (2).

What crude does on the underside of resistance should continue to be a big influence on where stock prices go from here.

Does the risk-on trade in stocks want/need crude oil to break out? We humbly think what crude does here will be very important for stocks going forward.