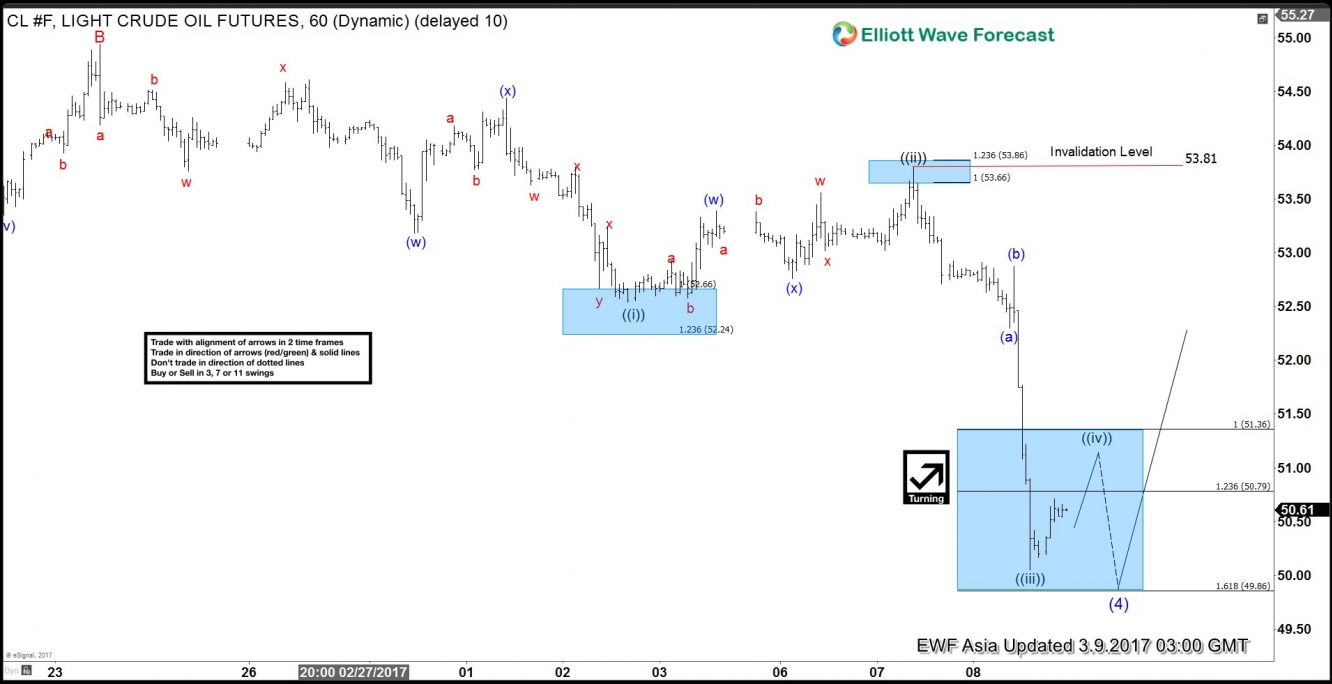

Short term Elliottwave view in Crude Oilsuggests that the instrument is currently correcting cycle from 11/14/2016 low (42.21) in 3, 7, or 11 swing before the next leg higher. Revised view suggests the decline starting from 1/3 high (55.24) is unfolding as a flat Elliottwave structure where Minor wave A ended at 50.71 and Minor wave B ended at 54.94. Minor wave C is in progress and subdivided as 5 waves diagonal where Minute wave ((i)) ended at 52.54, Minute wave ((ii)) ended at 53.8, and Minute wave ((iii)) ended at 50.05. A bounce in Minute wave ((iv)) is expected now followed by another low in Minute wave ((v)) towards 47.6 – 49.34 area to end cycle from 1/3 high. Afterwards, expect Crude Oil to resume the rally higher or at least bounce in 3 waves to correct the cycle from 1/3 high. We don’t like selling the proposed pullback and expect buyers to appear from 47.6 – 49.34 area for at least 3 waves bounce, provided that pivot at 11/14/2016 (42.21) stays intact.