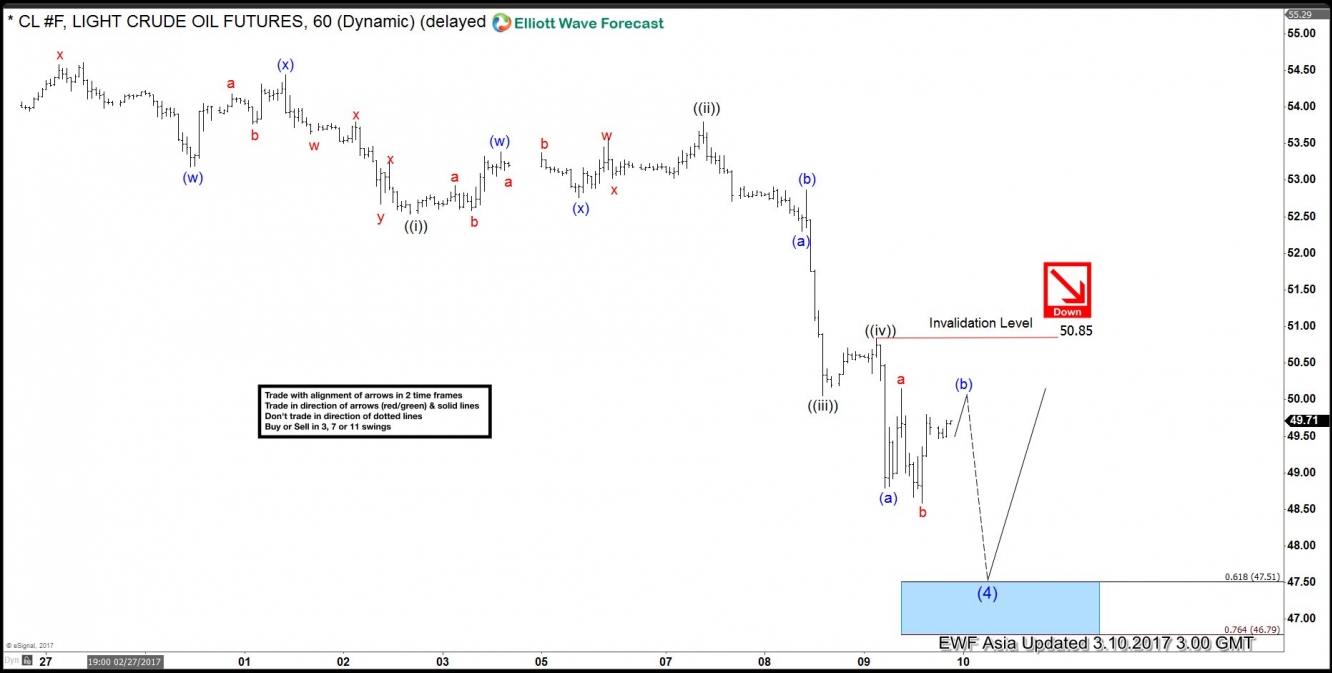

Short term Elliottwave view in Crude Oil suggests that the instrument is currently correcting cycle from 11/14/2016 low (42.21) in 3, 7, or 11 swing before the next leg higher. Revised view suggests the decline starting from 1/3 high (55.24) is unfolding as a flat Elliottwave structure where Minor wave A ended at 50.71 and Minor wave B ended at 54.94. Minor wave C is in progress and subdivided as 5 waves diagonal where Minute wave ((i)) ended at 52.54, Minute wave ((ii)) ended at 53.8, and Minute wave ((iii)) ended at 50.05 and Minute wave ((iv)) ended at 50.85. The current pullback has reached minimum swing and extension to finish cycle from 1/3 high, but while short term bounce fails below 50.85, another leg lower can’t be ruled out towards 46.8 – 47.5 area to end Intermediate wave (4) pullback. Afterwards, look for Crude Oil to resume the rally higher or at least bounce in 3 waves to correct cycle from 1/3 high. We don’t like selling the proposed pullback and expect Crude Oil to find support soon once wave ((v)) of (4) is confirmed complete, provided that pivot at 11/14/2016 (42.21) stays intact.

CL_F 1 Hour Chart