Plenty to report this morning.

The Japanese, pushed by Shinzo Abe, approved some more stimulus to fight inflation and help cover up for a sales/consumption tax that goes into effect in April.

The Bank of England and the ECB kept rates unchanged (as expected). Mario Draghi continues to hint at other monetary tools at their disposal.

The Euro is rallying -- pushing 137 again, which from a trading standpoint is a level I would consider being SHORT.

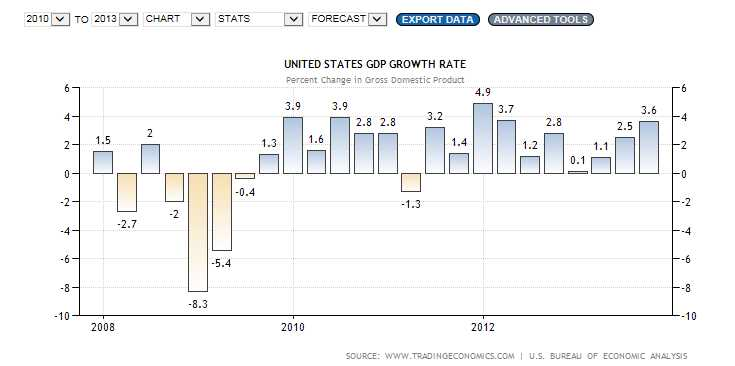

In the US we had 2 strong data points including weekly jobless claims (298,000 v. expectations of 320,000) and Q3 GDP (3.6% v. expectations of 3.1%).

U.S. Growth

We're at the high end of post recession "growth", but 2013 GDP growth has clearly been trending higher. However, when you're point of reference is +0.1% in Q4 2012 and +1.1% in Q1 2013 the bar is set fairly low.

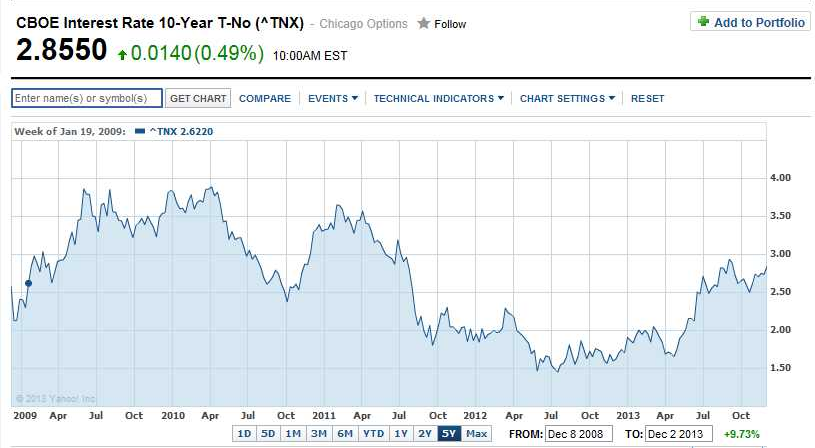

The positive data puts Taper back in play as the Fed remains "data dependent".

The U.S. 10 year yield is very much back at the high end of range going into tomorrow's Nonfarm Payroll number. We haven't been over 3.0% yield since summer of 2011 (euro-zone crisis and US debt downgrade). Watching carefully. For the record, I doubt we go through 3.0% in the near term.

The Metals (both precious and industrial) found support and reversed hard yesterday, but are trading lower by ~2% today.

The Energy markets have been active and volatile. Last week I mentioned the blowout and potential opportunities in the Brent v. WTI spread, the Gasoline crack spread, etc.. WTI has been outperforming Brent and the products all week. (Wooohoooo).

Brent v. WTI (Jan) moved from $19 wide to $14 wide in 4 sessions. $5,000/1 lot spread. Gasoline crack (WTI:RBOB) moved from 21.50 to 16.10 over the same time frame. $5,400/1 lot spread. Heat crack (WTI:HO) moved from 36.50 to 30.50. $6,000/1 lot spread.

I don't expect to sell tops, but hopefully you were able to capitalize on some part of that move.

January CL is RIGHT at the 50-day MA, which may provide resistance.

Last week I also pointed out the potential opportunity as the YEN approached 2013 lows and the Nikkei flirted with 2013 highs. I recommended long deltas in the YEN and shorts in the NIKKEI. I would consider exiting or hedging those going into tomorrow's jobs number.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Crude Oil, Cracks And Central Banks

Published 12/05/2013, 10:32 AM

Updated 07/09/2023, 06:31 AM

Crude Oil, Cracks And Central Banks

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.