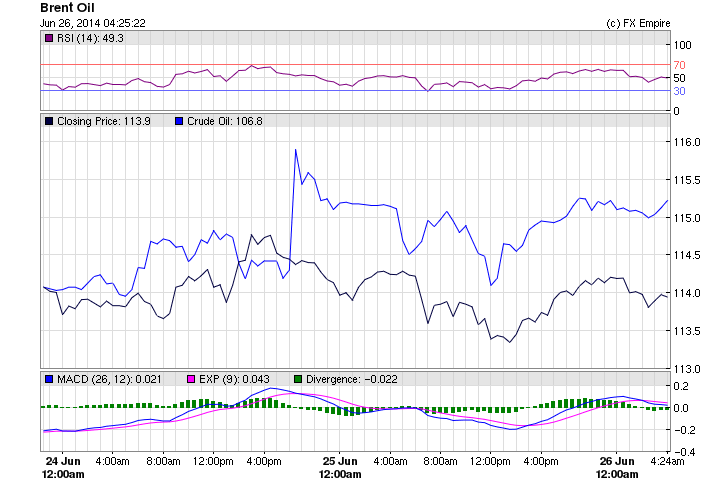

Crude Oil diverged from Brent Oil this morning as WTI gained 17 cents to trade at 106.68 and Brent gave up 14 cents to reach 113.97 as Iraq production and exports continue to climb showing little effect from the war within its borders. U.S. crude futures edged up towards $107 a barrel in early Asian trade on optimism over U.S. oil exports after Washington approved exports of lightly refined oil, although gains were capped by an unexpected rise in crude inventories. U.S. crude inventories unexpectedly grew by 1.7 million barrels last week to 388.1 million barrels. Refinery crude runs rose by 275,000 barrels per day, while U.S. crude imports fell last week by 92,000 barrels per day. The United Nations on Wednesday called for military force to tackle the Sunni insurgency launched by the Islamic State in Iraq and the Levant (ISIL). Western nations warned Russia on Wednesday it faces further sanctions unless it does more to defuse the conflict in eastern Ukraine. The world has saved $3.5 trillion over the last 30 years by maintaining emergency oil stocks to offset supply shocks and curb price surges, the International Energy Agency (IEA) said on Wednesday.

The rally lost some steam after weaker-than-expected data from the U.S. Energy Information Administration (EIA) pointed to a potential dip in demand growth from the world’s largest oil consumer and as traders awaited some clarification of what the condensate ruling would mean for the market.

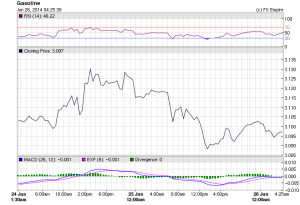

The average price of a gallon of gasoline rose 1.87 cents over the past two weeks, but it could have gone higher had refiners and retailers not absorbed most of the crude oil price increases resulting from the crisis in Iraq. According to the closely-watched Lundberg survey, the average price rose to $3.71 per gallon for regular grade gasoline. Crude oil has risen amid questions over access to Iraq’s oil supply during the Sunni Muslim insurgency. Refiners and retailers did not pass through the $5 to $6 per barrel increase in crude oil prices during the two-week period of the survey. That means their margins have shrunk and they are likely to pass it on soon to customers.

The EIA released its weekly inventories report last night and US crude oil inventories rose by 1.7 million barrels for the week ending on 20th June 2014. Gasoline stocks rose by 0.71 million barrels whereas distillate inventories rose by 1.2 million barrels for the same time period.

Natural Gas gained 26 points ahead of today’s EIA inventory report to trade at 4.594. U.S. natural gas edged higher on Wednesday on forecasts for stronger-than-normal air conditioning demand as the market waited for the government to report what is expected to be another bigger-than-normal storage build. Front-month natural gas futures on the New York Mercantile Exchange closed up 1.8 cents, or 0.4 percent, at $4.553 per million British thermal units.