Investing.com’s stocks of the week

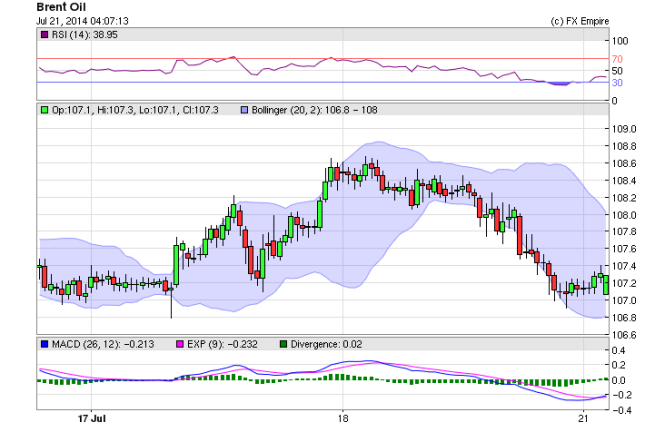

Crude oil eased a bit this morning after its decline late on Friday to trade at 101.91 after touching as high as 103 last week and breaking below the $100 price level. Oil has been erratic as global tensions have been on a roller coaster in oil sensitive zones all week. Brent oil remains low at 107.32 but added 18 cents this morning. Production in Iraq remains constant; Libya oil production is growing as the truce with the rebels seems to be holding in the port areas even though there was an attack at the Tripoli airport. Libya’s El-Feel oilfield has slightly reduced output due to security problems in the capital Tripoli, a spokesman for National Oil Corp said on Friday.

U.S. crude fell in early Asian trade on Monday after last week’s gains, but oil’s risk premium on oil is likely remain intact amid geopolitical risks in Gaza and Ukraine. The trading community is closely watching an intensifying geopolitical crisis between Russia and the West over the downing of a civilian jet in eastern Ukraine last week, which could lead to stricter Western sanctions against Moscow.

Ukraine’s government announced Sunday it was sending in troops to try to quash a pro-Russian insurgency in eastern Ukraine despite warnings from the Kremlin. Markets have been rattled by concern Western sanctions against Moscow might disrupt Russian exports of oil and gas. New U.S. sanctions on Russia last week followed by the downing of the Malaysia Airlines plane over Ukraine, revived geopolitical concerns last week and pumped up global crude oil prices.

But reduced worries over Iraqi oil supplies and weak physical demand from European and Asian refiners struggling with low processing profits have contributed to a more than 7 percent drop in oil prices since a peak above $115 a barrel last month.

Iran faced Western pressure on Saturday to make concessions over its atomic activities after it and six world powers failed to meet a July 20 deadline for a deal to end the decade-old dispute but agreed to extend talks by four months. The U.S. and its partners should make it clear: This extension won’t be open-ended, and it will come with a price: tougher economic sanctions. That’s the best way to ensure that these talks don’t meander for six more months.

There are many unresolved issues on the table, but the key is Iran’s “breakout” capability. That’s a measure of how fast Iran could build a nuclear weapon without drawing the attention of international nuclear inspectors. The more centrifuges Iran spins, the more enriched uranium it produces, the swifter the breakout.

In other signs of heightened tensions in the Middle East, Israeli tanks shelled militant targets in the Gaza Strip on Monday and a woman died in an air strike after the bloodiest day for both sides of a nearly two-week military offensive. Israel and the Gaza Strip have no oil production, but investors often worry that any conflict between the two could spread or escalate to involve key producers.

Natural gas tumbled 64 points to trade at 3.875 hitting a fresh 2014 low as weather continued to remain moderate limiting residential demands. U.S. natural gas ended virtually unchanged on Friday after a selloff the previous day, but traders said they expected more price declines in the coming week if mild weather and heavy stockpile builds continued. For the week, the contract fell 5 percent. For the month, it fell 11.5 percent and for the year, it was off 7 percent.