As oil prices continue to fall, all eyes are once again focused on OPEC and the so called ‘Algiers accord’ of last month, much vaunted as the solution to the problems of oversupply. Since then, markets have remained skeptical and the statement from the Secretary General of OPEC Mohammed Barkindo yesterday, seems to have done little to pause this bearish sentiment. In it he said, ‘we as OPEC remain committed to the Algiers accord that we put together. All OPEC 14 we remain committed to the implementation. We have no price objectives and, God willing, with the implementation of the Algiers accord and cooperation of the non-OPEC member countries, the rebalancing process will be brought forward in 2017." He then went on to say that Russia was on board but would not disclose any of the details.

The next OPEC meeting is scheduled for November 25, followed by a meeting with non OPEC members on the 28 and finally on the November 30, where OPEC oil ministers will meet to discuss and agree on proposals from these meetings. All this is against the backdrop outlined in my post last month of declining demand for oil into 2017, with consumption likely to fall from the current 1.8 million barrels per day to closer to 1.2 million barrels per day, with the concensus view that the current proposed cuts in supply, even if they are agreed and implemented, is seen as too little too late. And waiting in the wings we have the US election, with the potential prospect of a stronger dollar should Hilary Clinton triumph, which will do little to help beleaguered oil prices at present.

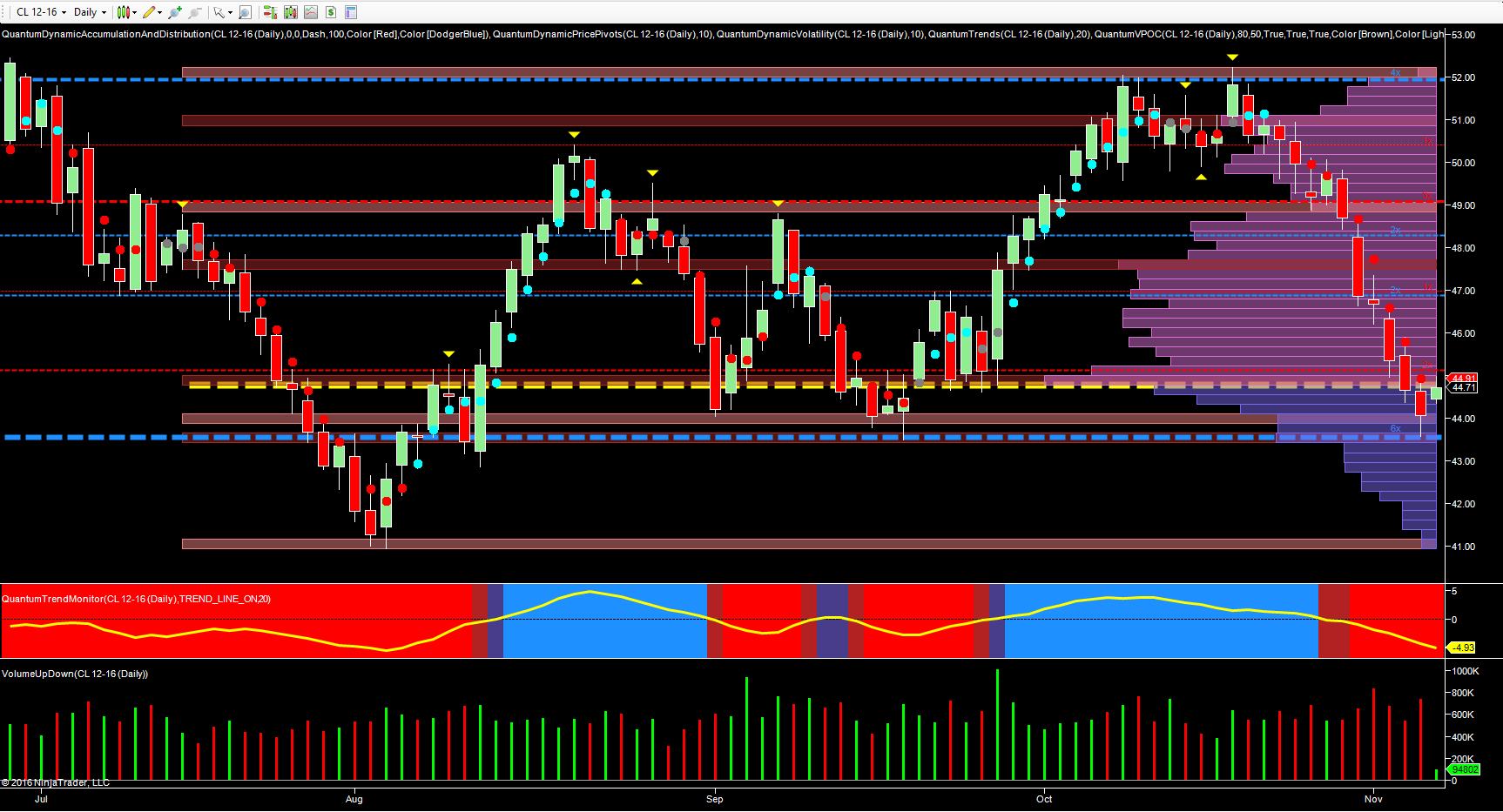

From a technical perspective the various key levels are once again clearly defined on the daily chart. Stiff resistance at $52 per barrel capped the October rally. The floor of potential support was then taken out in early November as oil price moved swiftly through the $49-per-barrel area, before plunging to test much deeper support in the $43.50 per barrel area, which to date has held firm with a minor bounce in early trading following the comments from OPEC. It is also interesting to note that the volume point of control has also moved lower and down from the $47.50-per-barrel region of two weeks ago, confirming the current bearish sentiment. Selling pressure remains high as confirmed with the associated volume of the last two weeks, but with support now building and with the VPOC in attendance, we are likely to see a congestion phase build as the US election and the FED take center stage, with the prospect of a deeper move to the $41 per barrel area in the longer term.

This very bearish tone for commodities is also reflected on the CRB index, which failed to break above the 191 area before reversing lower to test the 182 support area and is currently trading at 182.50. That said, its not all bad news for commodities with coking coal, copper and nickel all showing some stellar gains.