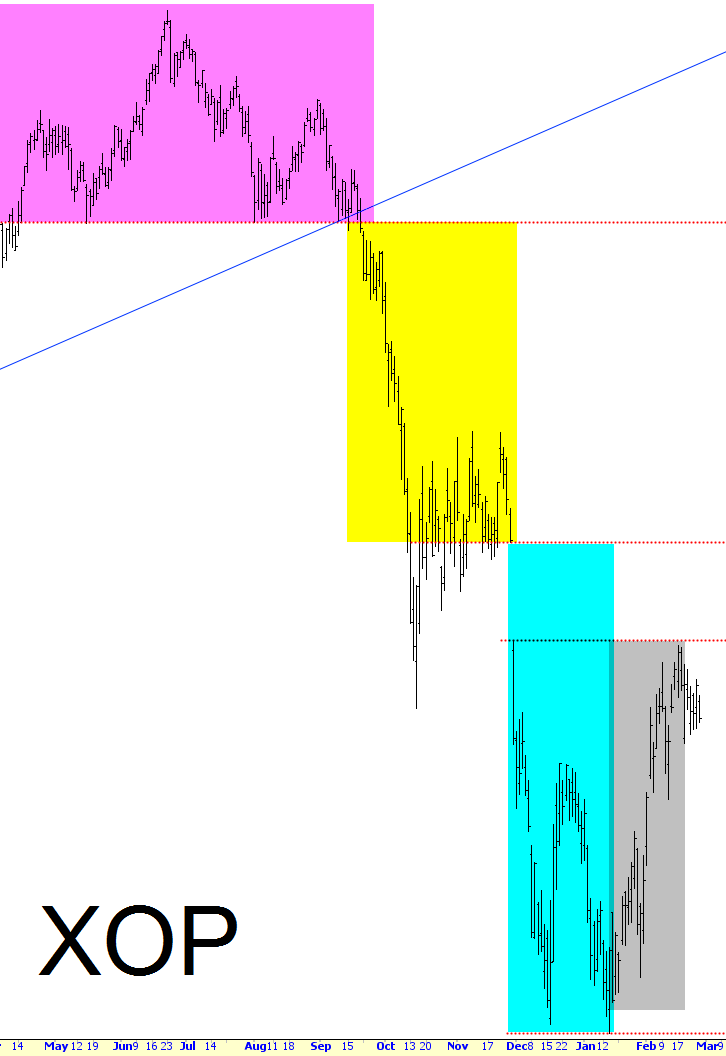

My obsession with crude oil and energy stocks is well-documented. I wanted to talk a bit about this daily chart of the oil & gas explorers ETF, (NYSE:XOP).

I see it going through these phases:

- Magenta – a very well-formed head-and-shoulders top; the bulls didn’t have any idea what was about to happen to them.

- Yellow – the initial plunge, prompted by the magenta pattern, with some stabilization.

- Cyan – after the Saudis said they weren’t going to curtail production, all bets were off. After Thanksgiving, things went into another free-fall, double-bottoming in late December and early January.

- Grey – this is what I’ve been stomaching all month -- a blinkered recovery.

In spite of crude oil weakening quite clearly, the energy stocks seem to be giving me the clod shoulder and not budging. I think they’re going to move sooner or later -- and to the downside. At a minimum, I think they’ll challenge the lows we saw last month.

If deflation really grabs hold, we could conceivably see oil in the 30s this year, with energy stocks following it south.