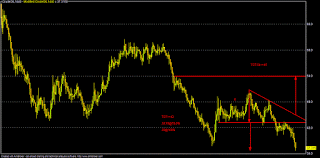

CMP: 36.76

Buy: 36.70-36

TGT: 40-45 (1-3M)

TGT: 60-70 (6-12M)

TSL<35

Note: For crude, 37-35 is very vital technical support zone. Consecutive closing below 35, crude may have further dips to 32-28-25.

Although Saudi Arabia is adamant not to cut any production immediately, geo-political factors may keep the falling price trend in check despite huge supply demand mismatch. Also growing pressure for falling crude oil prices on the oil producing economies including Saudi Arabia itself, may force OPEC to cut production at some point of time in early 2016.

Another point is that crude oil producing companies may be shoring its futures against their huge inventory build up as hedge. Its a crowded short trade in crude and any positive news can cause sharp rally (short covering).

Looking ahead, we may see better oil demand on the back of incremental growing vehicle sales in China and India. Also, China may add a significant amount of crude oil in its SPR in 2016. If crude falls more, together with that improving economic outlook in EU/US/India, we may see crude bottoming out around 32-25$ as worst global recession including China slowdown may be over.

Analytical Charts: