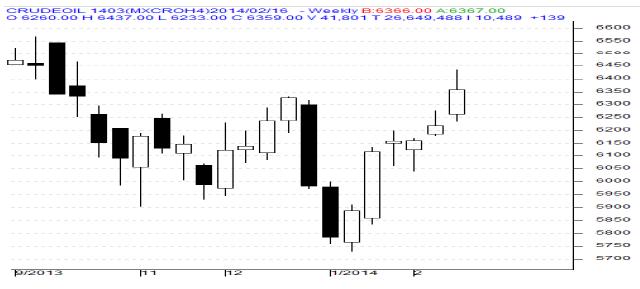

MCX Crude March as seen in the weekly chart above has opened the week at 6260 levels and during this period moved lower and as expected found very good support at 6233 levels. Later prices rallied sharply breaking both the resistance levels towards 6437 levels and finally closed sharply higher from the previous week closing levels.

For the next week we expect Crude prices to find support in the range of 6230 –6200 levels. Trading consistently below 6200 levels would lead towards the strong support at 6050 levels and then finally towards the major support at 5950 levels.

Resistance is now observed in the range of 6550-6600 levels. Trading consistently above 6600 levels would lead the rally towards the strong resistance at 6800 levels, and then finally towards the Major resistance at 7000 levels.

MCX / NYMEX Crude Oil Trading levels for the week

Trend: Up

S1- 6200 $ 100.30 R1-6600 / $ 106.80

S2-6050/ $ 97.90 R2-7000/ $ 112

Weekly Recommendation: Buy MCX Crude March between 6200 - 6250, SL- 6050, Target -6500 / 6600.