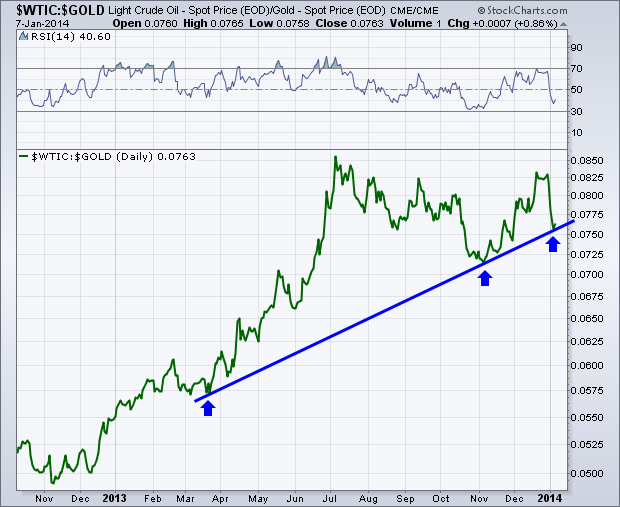

There’s an interesting relationship between crude oil and gold that I like to keep an eye on. When the green line on the chart below is rising we know that crude oil is outperforming (rising more or falling less) than gold. This was the case for much of 2013 as gold dropped for nearly the entire year while oil rose from January until September and then weakened into December.

The ratio between crude and gold is now testing support on the trend line from the March and November lows. If things improve in the relative performance of oil against gold then we should see the Relative Strength Index hold above 35/30 and see the green line bounce off support. I’ll be watching this relationship this week and see if the trend line is able to hold.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer. Connect with Andrew on Google+, Twitter, and StockTwits.