Talking Points

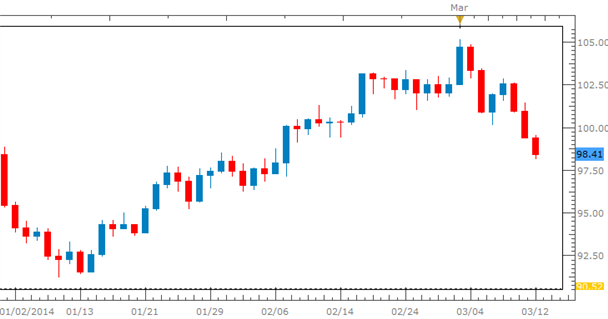

- WTI Crude Oil retreats below $99 following a spike above $105 during the first week of March

- Weekly oil inventories ending March 7th flirt with multi-year highs

- U.S. to release crude from the strategic petroleum reserve (reported by Reuters at 14:18GMT)

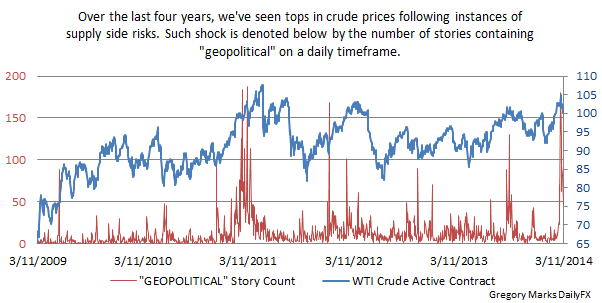

West Texas Intermediate Crude Oil has had a volatile start to the year as the price per barrel saw a run-up to the $105 level on fears of a Ukrainian/Russian tension escalation. We have often seen a spike in prices surrounding such geopolitical tensions, especially in those regions/nations that matter to global supply or supply lines. In 2011 we saw a spike in prices during Arab Spring developments in the Middle East and during reports of chemical attacks in Syria in 2013 we saw WTI Crude Oil hit fresh yearly highs. As we witnessed during the 2011 Arab Spring, fundamental factors can leave energy levels higher across the board for extended periods of time. On the other hand a de-escalation of perceived tensions can help relieve prices in a matter of days and weeks. Price action as of late tells us that market participants are less and less likely to bid up crude oil prices the longer a matter drags on without any substantial developments.

Despite a continuation of tensions- and an arguable escalation- in Ukraine and Russia, Crude prices have come off over the last week amid strong U.S. supply levels and a report from Reuters that the U.S. would release crude oil from the strategic petroleum reserve. For the weeks ahead, market participants may be observant as to what degree policy makers are willing to continue to release reserves and free up excess capacity. It is possible that an escalation of tension with Russia could lead U.S. policy makers to push for reform in energy regulation in order to help supply Europe with natural gas needs.

Source: FXCM Marketscope

Gregory Marks, DailyFX Research Team