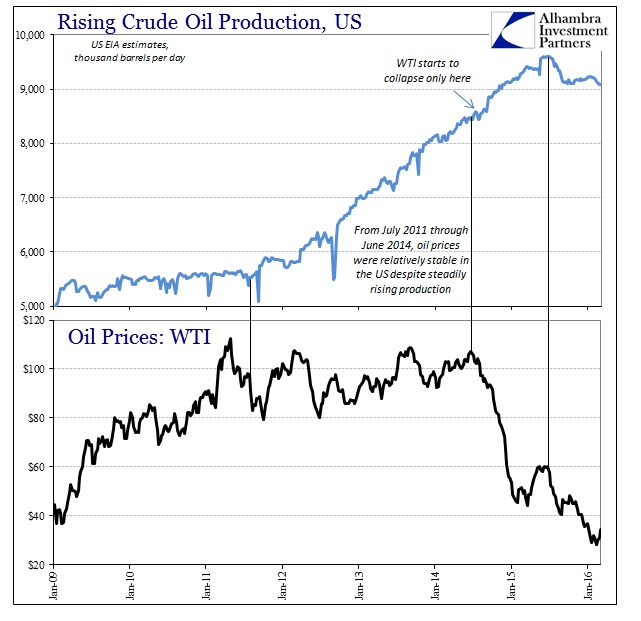

Crude oil prices in the US have jumped back up to above $38 again, leading various financial correlations toward much less depressing interpretations (chiefly stocks). That in turn has allowed the proliferation of the “it’s all over” narrative despite fundamental accounts that continue to suggest otherwise. Being the sharpest rally in WTI since really last April, these reflections appear to be this year’s equivalent to “transitory.”

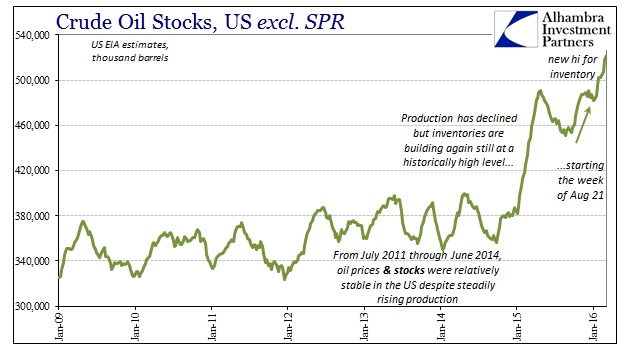

The rally has continued despite almost every immediate factor in oil suggesting the contrary. Crude oil inventory hit yet another record in the latest US EIA weekly estimates, significantly above last year’s “transitory” storage build. Worse, the rise has been nearly unbroken since last August when so many other economic accounts suggested a similarly depressive turn in economic circumstances.

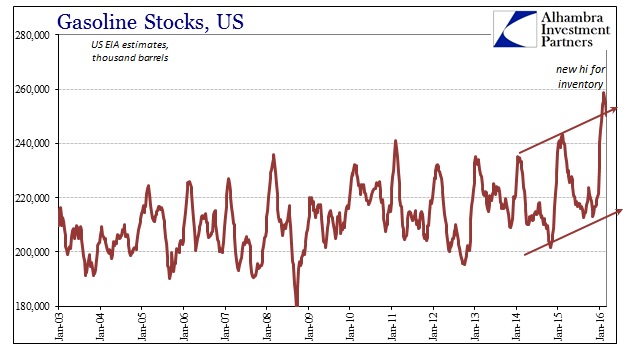

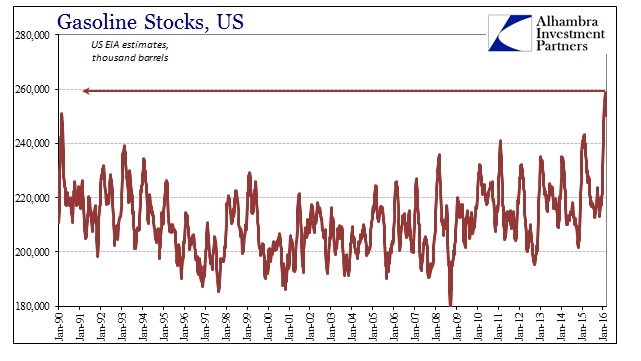

The buildup in physical crude inventories has ominously extended to gasoline. Gasoline inventory in the US continues to be near record highs (set the week of February 12) with the shift in the physical balance of gasoline appearing during December and January. Reaching 260mm barrels (equivalent), the inventory over the past month is significantly greater than anything in the data series dating back 26 years, suggesting “something” also shifted in physical fundamentals here.

Oil production in the US has declined again, but the adjustment was very slight and not really something that would suggest an $11, nearly 40% move in crude prices. By and large, the production side has once again settled into a quite predictable pattern sideways not unlike when it was rising in almost the same straight line. Production levels have been around 9.1 – 9.2 mbpd since September, meaning that while production was declining somewhat compared to early 2015, crude inventory was still surging in this latest bulge.

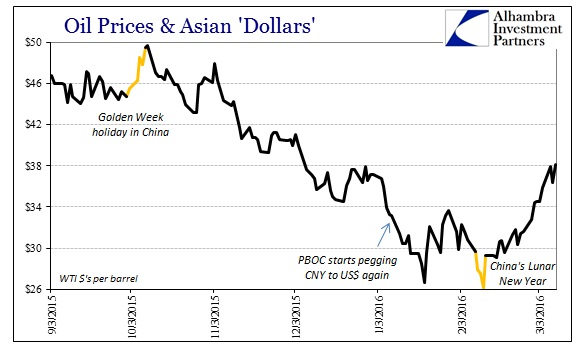

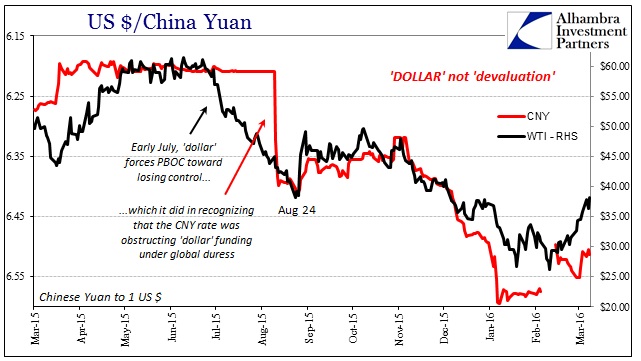

That leaves funding conditions as the primary culprit in “allowing” crude oil to spring back much the same as last April (or August). The rough correlation between WTI and CNY exchange remains intact, with crude having surged since China’s Lunar New Year holiday (and the PBOC “liquidity” efforts that went into it).

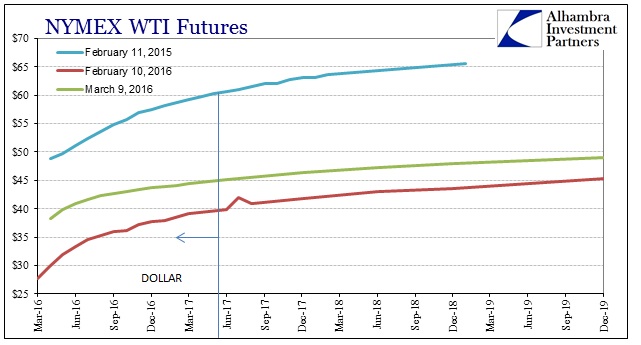

This funding behavior manifests in the futures curve for WTI as much sharper volatility at the front end. In liquidations, the front months (and sometimes only the first few months) get pushed down much farther and faster than the rest of the curve – the tell-tale sign of “dollar” influence is the contango in those shortest calendar/maturity distances. As “dollar” pressure relents, the front end likewise, symmetrically reacts more than the rest of the curve. On February 10, for example, the contango between the front month (March) and August 2016 was an enormous $7.55; today, the contango between the front month (April) and September 2016 is just over $3 less at $4.54.

Where the front month price is today more than $11 above what it was on February 11, the change at December 2017 isn’t even $5. Instead, the “dollar” works on variability in the front end while the fundamentals reflect the more stolid and stubbornly persistent physical imbalances shown above. That suggests, as August, what the next “leg” might be or even when it might become most apparent.

We know the PBOC has been extremely busy with wholesale intervention since January 8, as that was the date the CNY exchange hit 6.60 and triggered whatever central bank “dollar” response. Reported “reserves” in February declined “only” $28.95 billion compared to the much larger (and less interfered with) $99.5 billion drop in January. This was the same pattern of behavior as we saw August 2015 into September (and then October), where August’s fall in “reserves” was “shocking” at a then-record $93.9 billion (into the bottom of a “devaluation” wave that was really the “dollar” run) followed by a more pleasing $43.3 billion the month after that convinced economists and some markets the worst was over.

Here is the Wall Street Journal two days ago:

China’s foreign-exchange reserves fell to the lowest level in more than four years in February, as the central bank continued to tap into its stockpile of foreign currencies to shore up the yuan.

But the reserves fell at a slower pace last month, helped by Beijing’s latest efforts to restore confidence in the yuan.

Here is the Journal in early November after China’s reported forex reserves actually rose in October:

China’s massive foreign-exchange hoard rose in October, snapping a five-month streak of capital outflows in a development that could help Beijing shore up the value of its currency.

The rise reported by the central bank on Saturday follows five consecutive monthly declines. It indicates weakening investor expectations of a depreciating yuan and Beijing’s successes in stemming the outflow of illegal money transfers out of the country.

That last paragraph is how mainstream commentary looks upon these kinds of figures, missing the whole point. To it, China was “selling” heavily in August but then less so in September and then back to buying UST’s by October – all was well and good again. Just two days after that Journal story was written, however, the yuan lurched into another hugely destructive “devaluation” that wasn’t devaluation at all (the media seems to have finally caught on to that part) due in full to what was really taking place behind those reported reserve numbers. “Capital outflows” and “expectations of a depreciating currency” aren’t the issue; the problem is the imperfect manner by which the PBOC is forced to deal with a “dollar” menace far beyond its reach.

The monetary textbook says that you use any and all means at your disposal aiming only at the short run (Keynes, after all). These waves of “devaluation” at almost perfectly regular intervals show that such effort is completely wasted where the problem is not itself short-term. Instead, by placing wholesale effort into that textbook approach to “buy time” for calm to prevail, they are only making it worse when it swings around again. The reserve pattern shows, as does the pegging of the CNY exchange, that the PBOC in January only restarted that clock. In other words, the PBOC has been again “supplying dollars” only in a format different than the reported “selling UST’s”; these forwards and swaps come with an expiration and unless the “dollar” problem is fixed those expirations should likely be met with the same forceful regret, early April the next target.

The PBOC “bought” its calm again off the books, as oil prices suggest, but we don’t yet know the full cost of that small, temporary window.