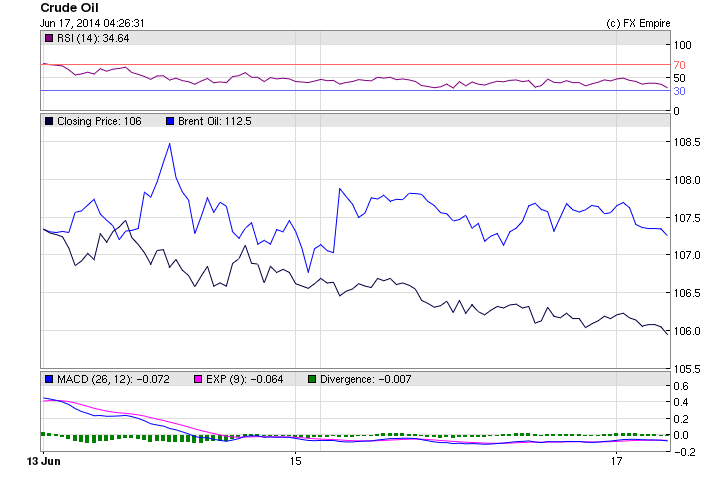

Crude Oil eased by 69 cents to trade at 105.61 after reports showed that the fighting was remaining in the north of Iraq away from the prime production centers located in the southern part of the country. Brent Oil eased by 39 points as traders continued to closely monitor the production levels in Libya.

The oil price edged a bit lower despite the fact that clashes between Iraqi army and members of ISIS continued. The good news from the perspective of oil markets however is that the expansion of ISIS forces towards the south of the country (where the majority of oil facilities is located) slowed down over the past weekend and market impact of conflicts in the north is not that strong given the fact that exports of oil to Mediterranean via Kirkuk-Ceyhan pipeline were subject to disruptions quite often in recent past and the pipeline has been offline since March.

Still, the oil price is seen at elevated levels as markets price in the risk of possible worsening of the conflict. A high appeal of oil as an investment was also confirmed by the latest CFTC and ICE Commitment of Traders data. Money managers’ net positions in case of both Brent and WTI remain in sight of their all-time highs.

FxEmpire provides in-depth analysis for each currency and commodity we review. Fundamental analysis is provided in three components. We provide a detailed monthly analysis and forecast at the beginning of each month. Then we provide more up to the data analysis and information in our weekly reports.