The U.S. Dollar rebounded against the euro and British pound as investors are hoping for details on Donald Trump's spending plans. Trump's first speech to Congress on Tuesday will be this week's main risk event with market participants eagerly waiting to get some detail on the still-uncertain fiscal policy of the Trump administration. With less than a 40 percent chance of a March rate hike there has been little consistency in the performance of the greenback and traders do not seem to be convinced that the so-called "Trump trade" could be revived anytime soon, even though firming rate hike bets offered a bit of optimism.

Apart from Trump's address before the congress tomorrow, investors will be watching comments from Fed officials, including Fed Chair Janet Yellen, who speaks at the end of the week. On the economic data front, U.S. GDP figures (Tuesday), Manufacturing ISM (Wednesday) and the Non-Manufacturing ISM report (Friday) will be important to watch.

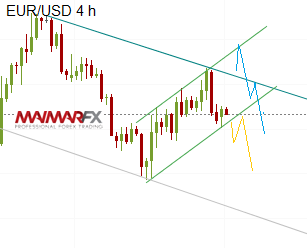

EUR/USD

The euro came under increased pressure as odds of a Marine Le Pen win during the French elections seem to be creeping higher. In short-term time frames we expect the euro to trade between 1.06 and 1.0560. Above 1.0615 it may head for a test of 1.0640/50, while a break below 1.0535 could drive the pair towards 1.0460. However, the risk remains tilted to the downside and we generally expect further losses in this pair.

GBP/USD

The technical picture has not fundamentally changed. The cable reversed after a test of 1.2570 and came under increased pressure after a renewed break below 1.25. We now wait for prices below 1.2380 and further 1.2340 in order to sell sterling towards lower price levels. A current resistance is however seen at 1.2560.

Markets may get off to a quiet start as many investors could remain risk-averse ahead of Trump's speech. The only piece of economic data today will be U.S. Durable Goods Orders due for release at 13:30 UTC.

Here are our daily signal alerts:

EUR/USD

Long at 1.0625 SL 25 TP 17, 40

Short at 1.0535 SL 25 TP 25, 40

GBP/USD

Long at 1.2482 SL 25 TP 20, 50

Short at 1.2390 SL 25 TP 20, 40

We wish you good trades and many pips!

Disclaimer: Any and all liability of the author is excluded.